Nokia (HE:NOKIA) may be a company that’s best-loved for the role it’s played in the formative years of mobile phones, but the Finnish communications giant has its sights firmly set on a future driven by the development of 5G technology. For a stock that’s recently become a meme favourite among Reddit-based retail investors, there could be plenty of growth on the horizon for Nokia.

2021 has been an excellent year for Nokia’s share price. Although the stock is regarded as a meme by many retail investors due to its prolonged popularity within Reddit forums like r/WallStreetBets, the company’s fundamentals are far stronger than many of the other meme stocks that have become retail favourites.

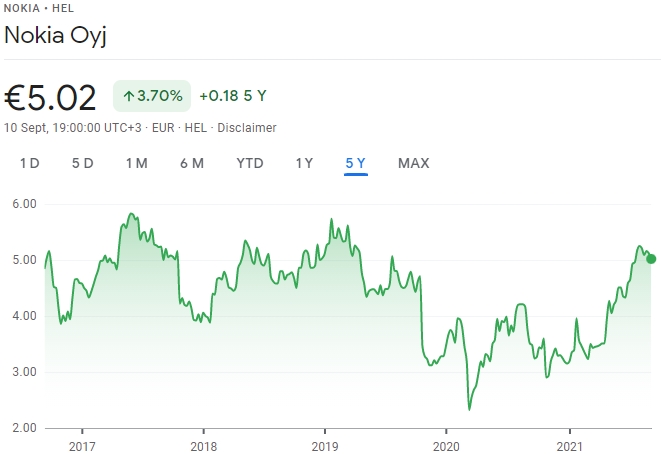

As we can see from Nokia’s 2021 so far, the company’s share price is up some 58.8% at the time of writing, paving the way for a market capitalisation of around €28.74 billion.

As we can see from the chart, there’s clear evidence of meme investing taking place, with Nokia’s stock spiking at the beginning of the year, owing to the short squeeze frenzy that was sparked by the GameStop (NYSE:GME) rally of late January.

Zooming out five years, we can see that Nokia’s stocks are dissimilar to that of other popular meme stocks, like that of GameStop and AMC Entertainment (NYSE:AMC). While the aforementioned companies are based heavily within industries that have struggled in the age of cloud technology and streaming services, and thus faced steady price declines prior to their respective squeezes, Nokia’s efforts to continue embracing emerging technologies has led to a more erratic price history in recent years.

As Nokia looks to embrace 5G technology as a key driver of growth over the coming months and years, is it time to stop regarding Nokia as a nostalgia-based meme stock and to begin recognising it as a forward-facing innovative communications firm?

Embracing an Optimistic Outlook

In mid-July, Nokia shares climbed further after the company announced to investors that it was set to lift its financial outlook for 2021.

The company noted that its business had continued to gain strength across Q2 of the year, which has helped to brighten its prospects for the rest of 2021 - with net sales among the range of revised metrics.

As a result, Nokia shares on the New York Stock Exchange climbed 7.8% prior to opening and popped by a peak of 9% to a total of $5.87. There’s little doubting that the company’s status as a favoured meme-stock bolstered Nokia’s outlook for the year, with Reddit and social media users opting to collaborate in buying and holding shares in the firm as hedge funds showed intent to short the stock whilst anticipating an upcoming decline.

"Our first-half performance has shown evidence of this in good cost control and also benefited from strength in a number of our end markets. We continue to expect some headwinds in the second half as we have previously highlighted but our performance in the first half provides a good foundation for the full year," noted Pekka Lundmark, president and CEO of Nokia.

Blue Skies Forecast as Nokia Targets 5G Adoption

Nokia’s intent towards embracing 5G technology has contributed to some market volatility in recent months. In late 2019, the company announced that it was pausing dividend payouts in a bid to raise investments for 5G. The risky move caused shares to fall some 21%, with the act of embracing the emerging technology causing a significant drop in the company’s bottom line.

However, since the troubling end to 2019, Nokia has been efficient in embracing emerging technologies - such as becoming a vocal supporter of O-RAN 5G architecture.

Nokia has also since launched its own 5G AirScale Cloud RAN solution that’s been built on vRAN2.0. The company also brokered a €400m 5G deal with Taiwan Mobile as a means of boosting its 5G adoption efforts.

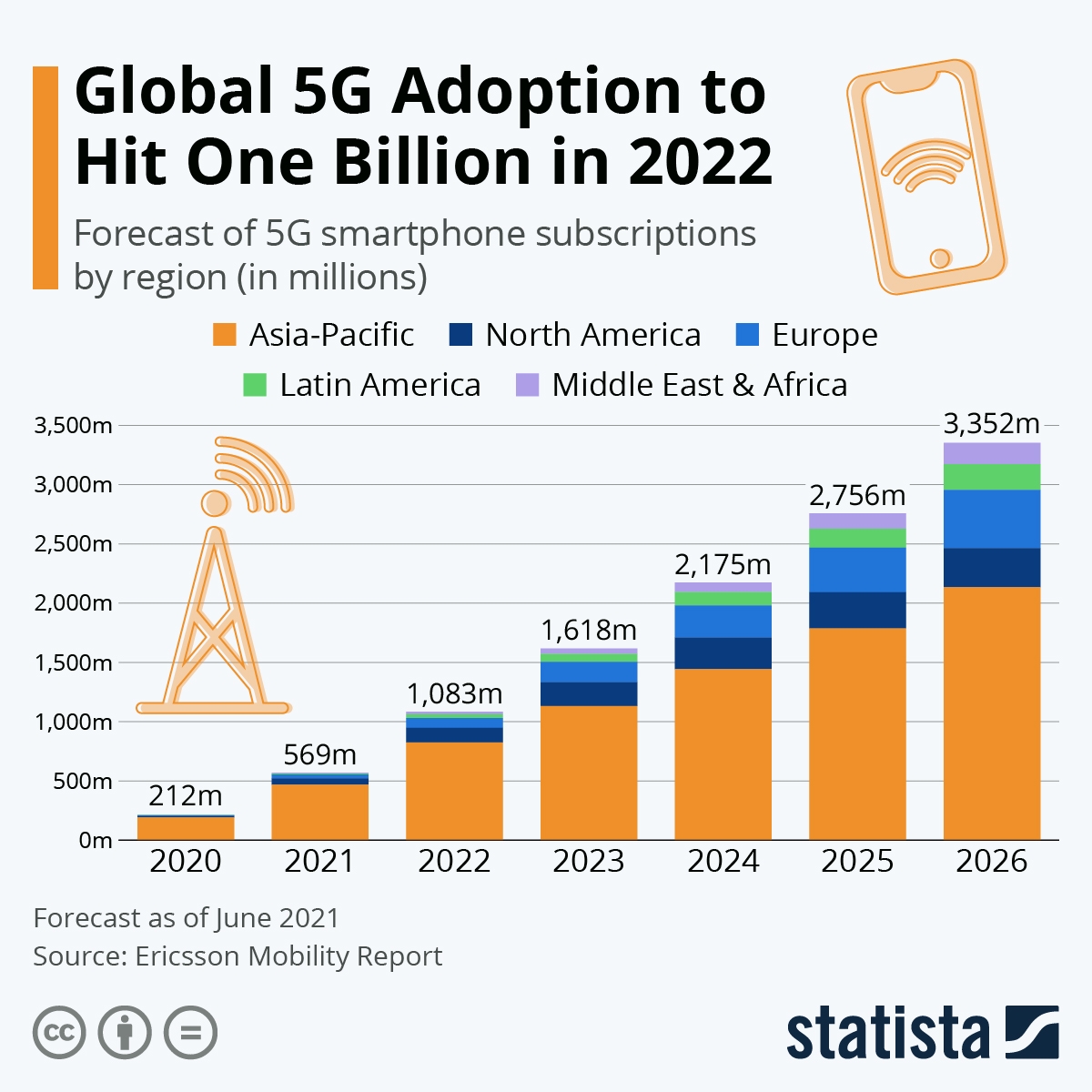

(Image: Statista)

Nokia’s movement into the 5G market is set to become highly lucrative as the decade progresses, with adoption set to grow to over 3.3 billion users by 2026.

Such market potential has led to Nasdaq-listed online brokerage, Freedom Finance Europe, highlighting recently that it has projected Nokia to yield 31.1% in investment value over the course of the coming three-to-six months.

The investment firm highlighted Nokia’s streamlining of operations in order to embrace 5G in a more sustainable manner as a key driving force behind the positive outlook for the company.

In the meantime, social media sentiment surrounding Nokia is still heavily nostalgia-based among Reddit communities of retail investors. The company’s strong fundamentals have been bolstered by collective reminiscing of an age where Nokia’s 3310 ruled global communications.

However, it’s become clear that the Finnish company has no intention of dwelling in the past, and as the company continues its strategic growth into the 5G market, its dedicated following of retail investors may yet see a just reward for their faith in the company.