Wall Street Went Up Yesterday

Thursday has been a positive day for the US stock market.

All three major US indexes reported profits.

The S&P 500 finished at +1.96%, the Nasdaq ended the trading session at +2.43% and the Dow Jones closed at +1.57%.

The positive movement has been driven by the strong earnings reports of the big tech companies, including Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL).

After the earnings reports, Meta (NASDAQ:META) stocks gained 14% yesterday and were the best performer.

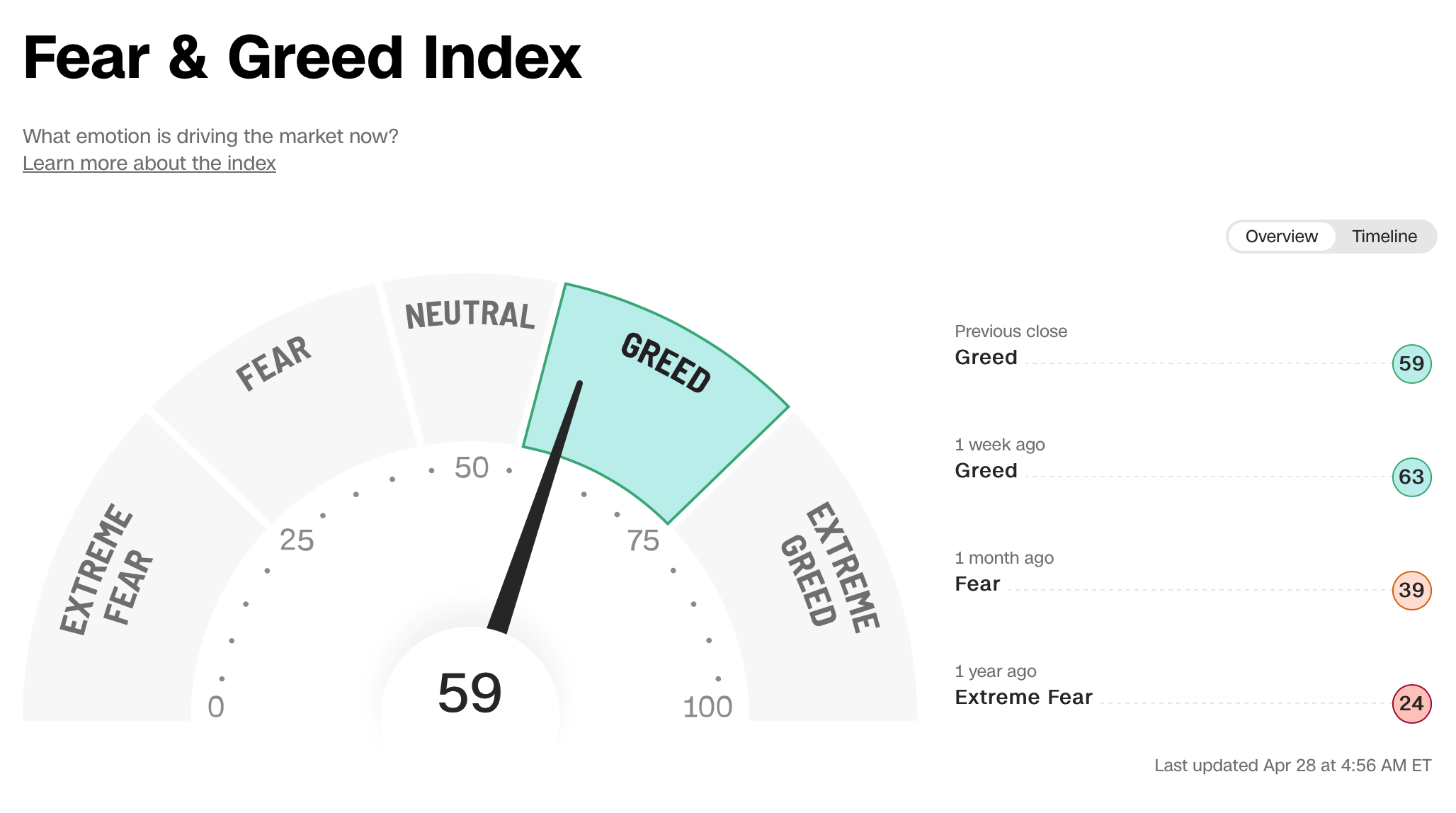

The investors' sentiment is Greed, as indicated in the graph below:

Sentiment Indicator - Fear & Greed Index

The market sentiment is 59, in “Greed” mode, but it is less than the data registered one week ago.

No Recession in the US (For Now)

The US Commerce Department on Thursday published the latest gross domestic product which grew at a 1.1% annual rate in Q1.

The data released yesterday is lower than expected and lower than the previous reading, which was 2.6% in Q4.

Even though there is an evident economic slowdown in the US, the report is still solid and the recession that many investors were expecting in the first months of 2023 has not happened and most probably it will not happen this year at all.

The fact that the GDP is slowing down is not a surprise because the Federal Reserve is implementing a restrictive monetary policy to cool inflation with the attention of not causing a recession.

What to Watch Today

The Core Personal Consumption Expenditure (PCE) Price Index will be published today at 13:30 GMT.

Core PCI is forecasted to be 0.3% month over month and 4.5% year over year.

This is the most important inflation index for the Fed that is working to bring down the actual 4.6% of inflation to its target of 2%.

The next Fed gathering will be on 3 May, and most of the investors (87.4%) are betting on a rate increase of 0,25%.

The stock market could be volatile.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!