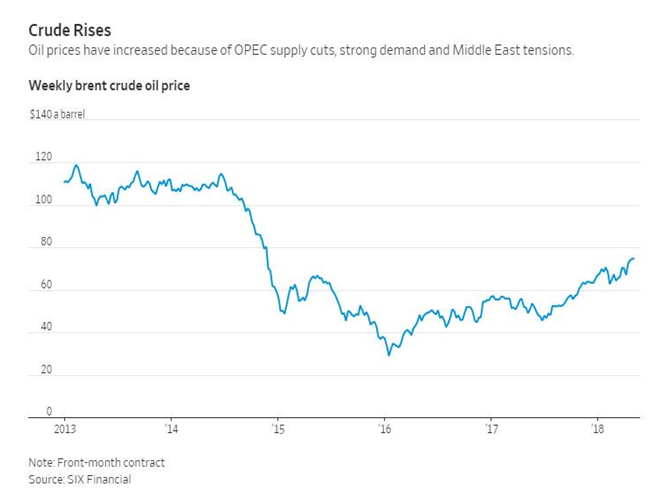

Oil prices—both WTI and Brent—have been on a tear in recent months, with traders attributing the move higher to a number of bullish factors, including ongoing efforts by major global crude producers to reduce a supply glut as well as the Trump administration's looming decision, which could be announced as early as Tuesday afternoon eastern, on whether to pull the United States out of a 2015 international accord to curb Iran’s nuclear program and restore sanctions on one of the world's biggest oil producers.

Geopolitical and sector activity notwithstanding, one can argue that the real driver behind the recent surge in oil prices has been none other than Saudi Arabia, which, for now, is shifting away from its long-time role as a stabilizing force in global energy markets.

“Saudi Arabia is now the main price hawk,” said a high-level OPEC source recently. According to senior Saudi officials, 32-year-old Crown Prince Mohammed bin Salman (often referred to as MBS), the country’s day-to-day ruler, is behind the break in policy.

Saudi Oil Policy – Pre MBS

Brent crude, the global benchmark, breached the $75-level last week, its highest point since the Organization of Petroleum Exporting Countries (OPEC) on November 27, 2014 turned its back on curbing output to support prices, a move that triggered a battle for market share and helped deepen a collapse to around $25 in early 2016. At the time, then Saudi Energy Minister Ali Al-Naimi argued that the oil market should be left to rebalance itself competitively at lower price levels, underscoring the Saudi's stance of strategically rebuilding OPEC's long-term market share by ending the profitability of high-cost U.S. shale oil production.

But as OPEC members grew weary of lower prices, diminishing returns and shrinking financial reserves, in 2016 the cartel discussed a return to market management with the help of Russia and other non-members. The deal to cut oil output by 1.8 million barrels a day (bpd) was initially adopted in November 2016 by OPEC, Russia and nine other global producers, sparking a price recovery to the $50-level by the end of that year.

The agreement has already been extended twice, the first time in May 2017 for a period of nine months. In December 2017, Russia and OPEC agreed to extend the production cuts a second time, currently taking it all the way through the end of 2018.

When making that decision, the world's largest oil producers also signaled a possible early exit from the pact should the market overheat and prices rise high enough that OPEC's main rivals, U.S. shale producers, start ramping production. Fast forward to now—May 2018. The supply cuts have virtually achieved their stated goal of reducing global inventories to their five-year average, while U.S. output has ramped up to its highest level on record. However the Saudis, OPEC's de-facto leader, have shown little sign yet of wanting to wind down the deal.

Saudi Oil Policy – Post MBS

So what has changed that has contributed to this seismic shift in oil market dynamics? The short answer: the upcoming Saudi Aramco initial public offering (IPO), the kingdom's crown jewel.

The IPO—billed as the largest ever public offering, with an expectation of approximately $100 billion worth of shares entering circulation via the kingdom's Tadawul exchange—was initially set to happen in the second half of this year. However, it has since been delayed until 2019 due to a desire to push up oil prices before the offering in order to maximize the valuation of Aramco ahead of the listing.

Saudi officials said they hope to sell just a 5% stake in the oil giant, valuing the company at more than $2 trillion.

High oil prices are also necessary for the economic reforms Crown Prince Mohammed bin Salman has planned as part of his "Vision 2030" agenda. The kingdom has also been involved in a costly war on its southern border with Yemeni rebels.

Prices have already risen some 60% since June 21, 2017 - the day MBS was appointed as the Saudi crown prince - taking prices from around $45 to $75.

For every dollar that oil prices gain, Saudi Arabia gets about $3.1 billion a year in additional revenue, according to Rapidan Energy Group, a Washington consultancy.

“There is no intention whatsoever from Saudi Arabia to do anything to stop the rally” in oil prices, said a senior Saudi government official. “It is exactly what the kingdom wants.”

In fact, if MBS gets his way, oil prices will rise even further in the second half of the year and test the key $100-per-barrel-level, as the Saudis shrug off losing market share on the global stage and turn a blind eye to soaring U.S. shale output. Recent news reports have suggested that Saudi Arabia would like oil prices to rise further, fueling speculation that the kingdom could oppose any changes to the output limits when OPEC meets in June.

Current Saudi Energy Minister Khalid al-Falih has already gone on record to say that OPEC members would need to continue coordinating with Russia and other non-OPEC oil-producing countries on supply curbs into 2019.

MBS has also been very critical of Iran and the 2015 nuclear deal it signed with global powers, calling it a “flawed agreement.” It is no secret that the Saudis would be happy to see sanctions reimposed on Iran and its oil, which could drive prices up further.

While the Saudis have worked to cool off oil prices in the past, as they heated up in 2008 and 2011, Riyadh’s stance has shifted tremendously from its role of urging restraint and seeking to convince fellow members that prices rising too fast benefited alternative energy providers, namely U.S. shale producers. “We have come full circle,” a high-level industry source recently said of the change in Saudi thinking. “I would not be surprised if Saudi Arabia wanted oil at $100 until this (Aramco) IPO is out of the way.”

Right now, it's the Iranians and the Russians who have been more cautious about pushing for higher prices, highlighting just how drastically the dynamics in the oil market have changed.

Ironically, perhaps this new paradigm's biggest winner has been the U.S. shale industry, which has reaped the benefits of higher oil prices. U.S. drillers added nine oil rigs in the week to May 4, bringing the total count to 834, the highest number since March 2015.

Indeed, domestic oil production—driven by shale extraction—rose to an all-time high of 10.62 million bpd last week, above Saudi output levels. Only Russia currently produces more, at around 11 million bpd.

That has led to a bump in U.S. oil exports. In April, U.S. supplies to Europe reached an all-time high of roughly 550,000 bpd, according to the Thomson Reuters Eikon trade flows monitor. In 2017, Europe took roughly 7% of U.S. crude exports, Reuters data showed, but the proportion has already risen to roughly 12% so far this year.

Trade sources said U.S. flows to Europe would keep rising, with U.S. barrels increasingly finding homes in foreign refineries, often at the expense of oil from OPEC or Russia. That's a development that was unheard of up until a few years ago.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.