- Reports Q4 2021 results on Thursday, Jan. 20, after the market close

- Revenue Expectation: $7.71 billion

- EPS Expectation: $0.8454

While video streaming giants are struggling to attract new subscribers after the pandemic-driven surge, Netflix's (NASDAQ:NFLX) superior content could separate it from the crowd.

Fueled by an “unprecedented” slate of new shows after its global hit Squid Game made waves during the third quarter, the world’s largest paid streaming service forecast the addition of 8.5 million customers in the final three months of 2021. If that holds, it will help Netflix stock recover from a disappointing start to the year.

The service added just 5.5 million customers in the first six months of 2021, the least since 2013. But following its Squid Game success last quarter, new seasons of La Casa de Papel and Sex Education might have helped reverse that trend in the fourth quarter.

Still, the impressive content roster has failed to help Netflix stock this year. Shares of the California-based company have fallen about 16% in the first three weeks of trading at a time when surging bond yields are reducing the investment appeal of high-growth tech stocks.

Netflix shares closed on Wednesday at $515.86, down about 26.5% from their record high in November. That weakness, however, is a buying opportunity, according to many analysts. Wall Street’s optimism hinges on Netflix’s ability to attract new subscribers with best-in-class content, boosting margins and cash flow along the way.

30% Potential Upside

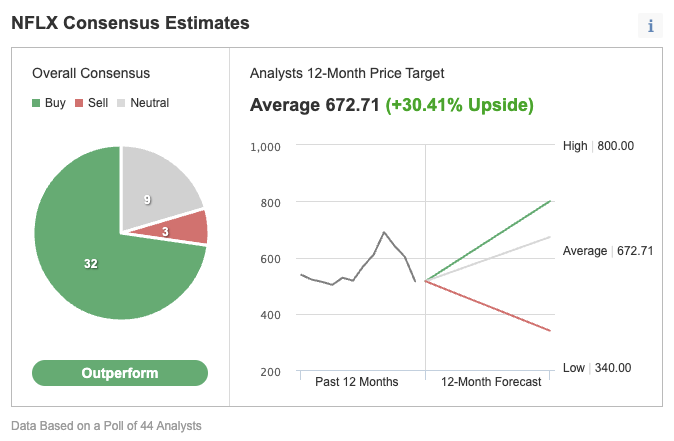

The 12-month average analyst price target for Netflix stock comes in at $672.71, which implies about a 30% jump from Wednesday’s closing price, according to an Investing.com poll of 44 analysts.

Chart: Investing.com

Bank of America kept its buy rating on the stock ahead of the streaming giant’s earnings report later today. The bank said 2022 should be a better year for the company. Its note added:

“We continue to see Netflix’s ability to grow as its global content investment strengthens its value proposition.”

Wells Fargo Securities analyst Steven Cahall is among those who expect Netflix’s rally to continue, projecting that the stock will reach $800 by the end of the year. Popular content, subscriber growth, and margin expansion—the longstanding yardsticks for the company—will remain the catalysts for shares. In a Bloomberg report he said:

“The content is the majority of their costs. And so their ability to spend on content and generate new content is really what drives these business models.”

Netflix’s first price increase since October 2020 is another indication that the company is in a solid position to fund aggressive content creation. The company’s standard plan is now $1.50 higher, costing $15.49 in the US.

Bottom Line

Netflix has solidified its cash and market position after the pandemic windfall. In addition, the company’s latest popular shows reveal that it is in a strong place from which to compete in a crowded streaming market and maintain its lead. Today’s earnings report could very well prove that point.