Author: Blake Heimann

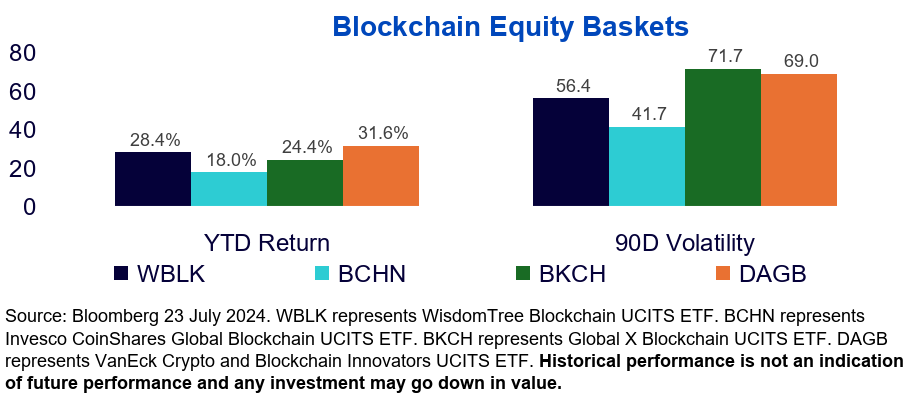

The digital asset ecosystem has experienced significant price performance and volatility in the first half of 2024, driven by notable developments in the institutionalisation of the crypto asset class. Regulated digital asset products are becoming more widely available on exchanges, benefiting firms directly engaged in the blockchain ecosystem. Consequently, we've observed strong performance within the blockchain ETP landscape. However, not all blockchain equity ETPs are created equal; different portfolio construction approaches have resulted in divergent performance and volatility profiles.

The approaches to blockchain equity portfolio construction

In emerging technology themes, many pure-play firms are small cap with lower liquidity and higher volatility. This is especially true in the blockchain ecosystem and poses trade-offs for creating an equity fund within the narrow space of publicly listed blockchain companies.

The broad and diversified approach

BCHN, the most established fund, adopts a broad and diversified strategy. By including exposures to mega cap tech companies and auxiliary sectors like semiconductors, BCHN aims to mitigate volatility and liquidity risks. As shown in Figure 1, the approach results in lower volatility but has led to lower performance at the start of the year.

Concentrated pure-play exposures

In contrast, BKCH and DAGB focus exclusively on firms directly operating within the blockchain ecosystem – more ‘pure play’ than the diversified approach. While these strategies offer more direct exposure to the blockchain theme, they also come with the challenge of managing liquidity and volatility. When the ecosystem performs well, these funds most effectively capture the performance of the blockchain theme but are also subject to higher volatility and potentially more liquidity concerns, given investment concentrations in small firms.

WisdomTree: Striking a balance

WisdomTree seeks to balance these factors, providing pure-play exposure that optimises volatility, liquidity and purity of exposure. Our strategy ensures sufficient liquidity and reduced volatility without overlapping other equity exposures in your portfolio (e.g., Nasdaq). Year-to-date, WisdomTree has successfully captured most of the positive returns of the purest baskets with lower volatility.

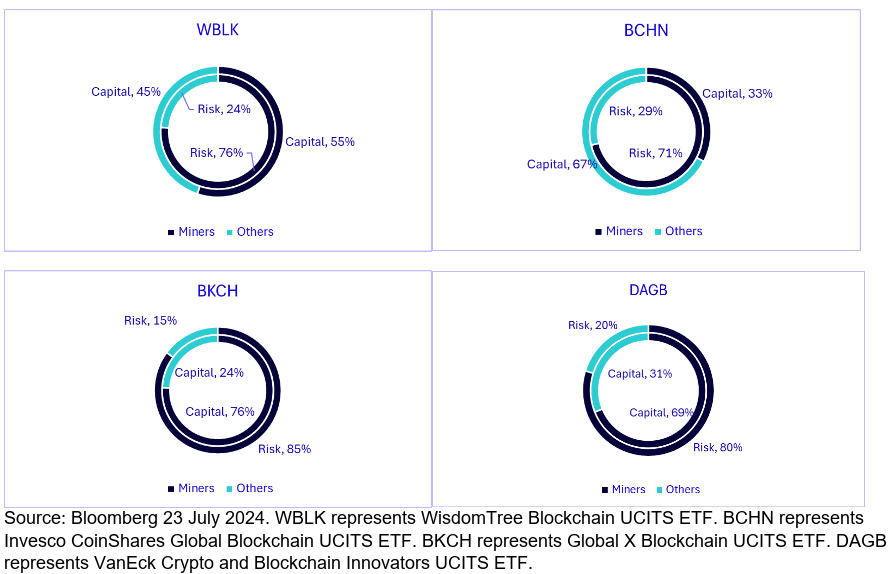

Mining exposure matters: The role of digital asset miners

One of the critical components in these funds is the allocation to digital asset miners, which are notoriously volatile and highly correlated with the price of bitcoin. The bitcoin halving event in April of this year has exacerbated this volatility and led to a significant dispersion in performance amongst the mining firms, resulting in some price discrepancies across funds. If we look at the allocations to miners, we find very different approaches to capital allocation, with most of the portfolio risk (i.e. volatility) being contributed by the miners.

Capping allocation to miners to manage risk

For all the funds shown, at least two-thirds of each fund’s overall volatility is sourced from these mining exposures. To manage this volatility, WisdomTree caps the allocation to digital asset miners. However, since our last rebalance in May, this weight has surged to 55% due to the strong performance of specific holdings. We anticipate reducing this exposure to align with target limits in our August rebalance.

Conclusion

The blockchain equity ETP landscape is complex and varied, with different approaches leading to varying performance and volatility profiles. At WisdomTree, we strive to provide a balanced approach that offers direct exposure to the digital asset ecosystem while managing risks through strategic allocation and diversification. We aim to ensure that our investors benefit from the growth and innovation within the blockchain space while maintaining sufficient liquidity and diversification to optimize portfolio risk and returns.

_____________________________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

This document contains a comparison of financial products contained within the relevant prospectus and/or based on publicly available information, some of which has been prepared by third parties. While such sources are believed to be accurate as at their date of publication, WisdomTree does not warrant, guarantee or otherwise confirm the accuracy or correctness of any information contained herein and any information or opinions related to the products detailed herein may change over time. Any third parties used to source the information in this document make no warranties or claims of any kind relating to such data. Investors should read the prospectus and other applicable offering documents for each product and consider the investment objectives, risks, charges and expenses carefully before investing.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.