- Fundamentals evolving toward a looser supply/demand situation

- Despite colder outlook, gas futures leaped some 8% in last two days

- No signs yet of storms that usually add to supply fears

- The potential for storm-related power loss should a large hurricane make a beeline toward a densely populated area of the United States. This season looks to be heavily slated toward storms taking aim at the Eastern Seaboard.

- If a hurricane develops in the Gulf of Mexico and threatens operations of coastal LNG export facilities, it would also have a bearish impact on the Henry Hub. However, at this point in time, it doesn’t appear that the market has factored in any demand destruction risk into gas futures.

If it’s becoming increasingly evident that the fundamentals in natural gas are evolving toward looser supply/demand, then why does the Henry Hub remain so elevated?

Despite a much cooler temperature outlook for a large swathe of the United States, the hub’s front-month leaped some 8% over the past two days of trading, recovering all it lost in three prior sessions as bulls in the space sensed a buying opportunity at mid-$7 lows.

In Thursday’s pre-New York trade, the front-month hovered at above $8.25 for each million metric British thermal unit for a more modest weekly gain of about 3% following this week’s volatility.

From the summer demand perspective, the seasonal calendar is on the downside of the bell curve of summer heat. In support of this outlook, the major weather forecast models—namely the Global Forecast System (GFS) and the European Centre for Medium-Range Weather Forecasts (ECMWF)—have flipped to a much cooler temperature profile for the bulk of the United States over the next couple of weeks.

The GFS and the ECMWF represent the industry’s gold standard of forecast models and they even have Texas—the largest US gas-consuming state—in their outlook.

All summer long, gas bulls have used record hot temperatures as a primary reason to keep Henry Hub futures underpinned on the higher end of pricing.

In an email on Wednesday, analysts at Houston-based gas markets consultancy Gelber & Associates prodded their clients with a question they seemed to be asking themselves:

“Could it be that gas market bulls are so biased by their large long positions that they are ignoring the reality of advancing bearish drivers?”

Technical charts for Henry Hub’s front-month suggested the run-up could continue, says Sunil Kumar Dixit of SKCharting.com, adding:

“A sustained break above $8.50 will help Gas to reach $8.82 and test $9.42.”

Most gas bulls think Henry Hub pricing can go to $9 and above once the Atlantic hurricane season gets underway, with a steady stream of storms adding to supply concerns.

But in the tropics, overall action is still rather quiet, with some activity starting to percolate with a handful of disturbances in the cue. This includes the development of Invest 97L, which is located in the deep Atlantic southwest of the Cabo Verde Islands.

While at this point in time, there is nothing that could be construed as a meaningful concern, it does appear that the cap is about to come off the tropical season, which will open the door to a flurry of activity.

For natural gas, this creates 2 areas of risk:

Wednesday’s rebound on the Henry Hub gas came on the back of a twist in the Freeport LNG crisis—a saga dubbed by now in the market as the 'F-word.'

Under the headline F-Word Rattles Natural Gas Futures Again Despite No Change to Operations Plans, industry portal naturalgasintel.com remarked:

“It appears every time someone utters the word ‘Freeport’, the natural gas market gets itself into a tizzy. This time, though, the latest development in the wake of the LNG terminal’s explosion earlier this summer did nothing to alter its planned restart and thus should have had little influence over prices.”

What Freeport did say is that it has dropped the force majeure declaration it adopted after the June 8 explosion that idled about 2 billion cubic feet (bcf) of daily demand at the Texas-based liquefied natural gas plant. Gas futures lost an epic 33% in June over the Freeport saga, touching a bottom of just under $5.36 before recovering all of that and more by July.

According to Freeport’s original repair schedule, the plant should be out of commission at least until October. Wednesday’s removal of the force majeure did not provide any update on the start-up date. Yet, Henry Hub’s front-month jumped almost 37 cents on the day.

Naturalgasintel also cited a bullish development the market had missed:

“For example, wind generation has fallen to ‘very low’ levels as heat continues in the South Central United States. Power burns … spiked to 47-48 bcf on Tuesday, with wind generation expected to remain low through next week.”

The cooler weather pattern combined with rising dry gas production volumes—which continue to wobble around the 98 bcf per day area—is a recipe for weekly gas storage injections to come in larger than average over the next few weeks.

That brings us to the next big question of what the US Energy Information Administration is likely to report later for gas storage levels for the week ended August 5.

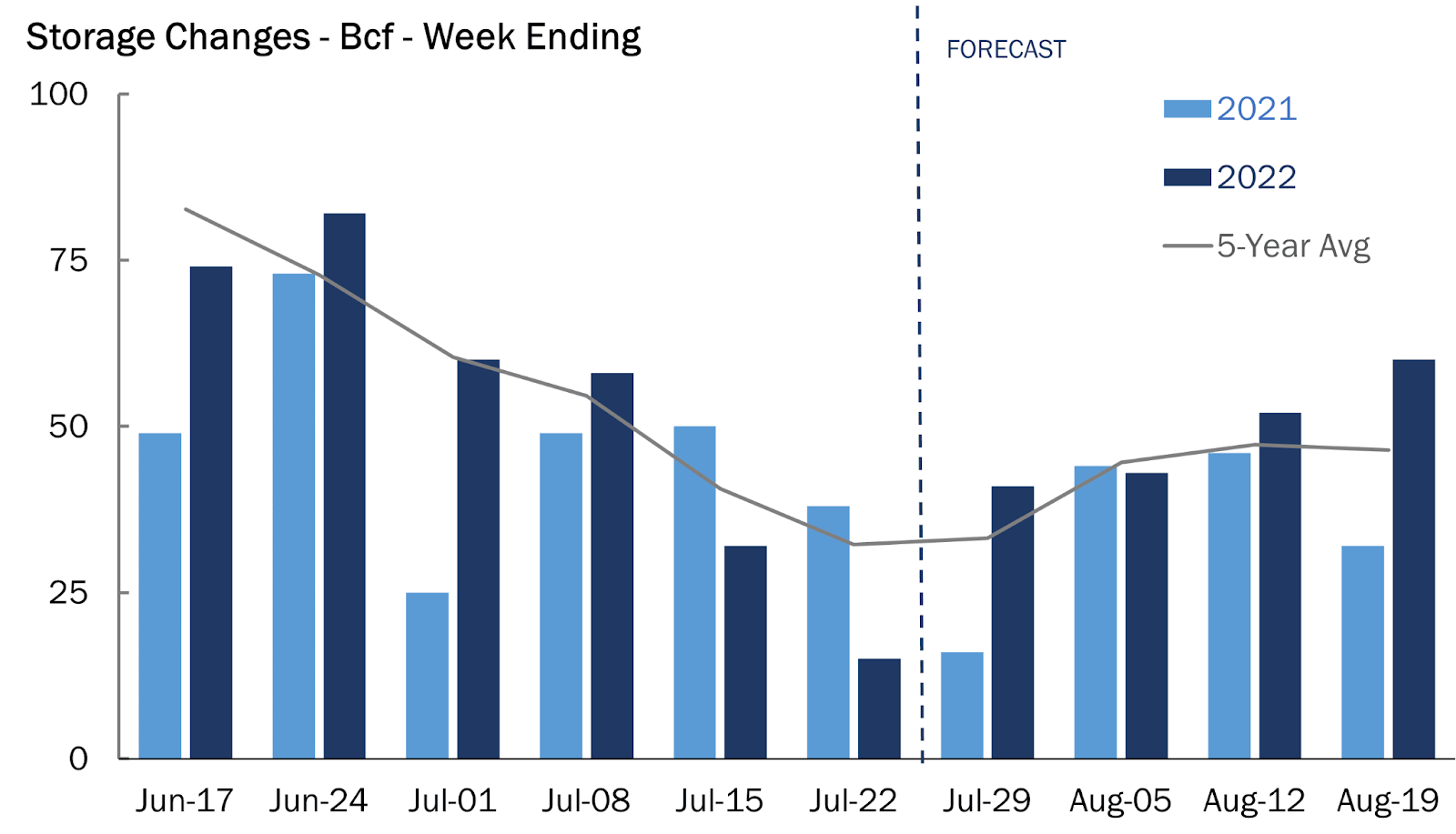

Source: Gelber & Associates

According to a consensus of analysts tracked by Investing.com, U.S. utilities likely added a smaller-than-usual 39 billion cubic feet (bcf) of natural gas to storage as hot weather boosted the amount of gas power companies burned to meet last week’s air conditioning use, a Reuters poll showed on Wednesday.

That injection, for the week ending Aug 5, compares with a build of 44 bcf during the same week a year ago and a five-year (2017-2021) average injection of 45 bcf.

In the week ended July 29, utilities added 41 bcf of gas to storage.

The injection analysts forecast for the week ended August 5 would lift stockpiles to 2.496 trillion cubic feet (tcf), about 12.1% below the five-year average and 9.9% below the same week a year ago.

According to Reuters-associated data provider Refinitiv, there were around 107 cooling degree days (CDDs) last week, which was much more than the 30-year normal of 88 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 C).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.