Focus on growth with shareholder returns

Aside from H1 results that demonstrated strong operational execution in the UK and reiteration of US rate filing prospects, National Grid (L:NG) has announced the intended sale of a majority stake in its UK gas business. The prospect of shareholder returns and long-term stronger growth outlook from the deal underpins the attraction of the company’s combination of growth and yield. The deal also lifts the bottom of our valuation range. Our new valuation range is 874-1,067p per share.

Strong results

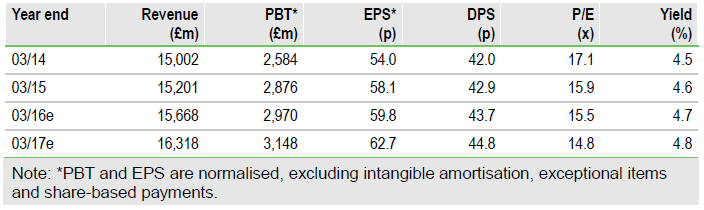

National Grid has reported strong H1 results with operating profit of £1,836m, PBT of £1,371m, EPS of 28.4p and DPS of 15p. Net debt stood at £24.6bn. The UKregulated business delivered performance in line with expectations, while other activities, chiefly property and the French Interconnector, drove an 8% outperformance against consensus operating profit. We have made small adjustments to our forecasts to reflect the stronger prospects of these businesses but, given their size, the overall impact on our group earnings forecast is minimal.

To Read the Entire Report Please Click on the pdf File Below