musicMagpie's (LON:MMAG) (MMAG) maiden interim results following its admission to AIM demonstrated underlying revenue growth with expanding gross margins. There are encouraging results from new initiatives that aim to generate incremental revenue streams in new markets including recurring telephony subscriptions (versus historical one-off revenues), and new sources of product including corporate recycling and SMARTDrop kiosks. These have the potential to become important contributors to MMAG’s growth prospects.

H121 results: In line with management’s expectations

MMAG’s H121 results included positive contributions from all product categories to revenue growth (3.7% in constant currency) and the impressive gross margin progression (+570bp y-o-y). The UK reported strong revenue growth (+6.6% y-o-y) while, as expected, the US declined (-22.5% y-o-y) due to the change in focus to higher-margin consumer revenue from B2B. COVID-19 has provided a tailwind, primarily to disc media and books, and current trading confirms management’s expectations of normalisation as the economy emerges from the pandemic. Current trading is in line with management’s expectations, leading to a reiteration of guidance for FY21 adjusted EBITDA, including gross margin consistent with FY20. Net cash at end H121 was £6.4m following gross primary IPO proceeds of £15m.

Encouraging signs from new initiatives

MMAG has seen strong acceptance of its UK smartphone subscription service (£1.2m rental stream at end H121), which dampens current revenue in favour of higher recurring subscription revenue in the future. Management’s trial with SMARTDrop kiosks in ASDA, which aims to stimulate consumer interest in recycling, has produced encouraging results for both MMAG (attracting new ‘recyclers’ with higher-than-average unit values) and ASDA (footfall and enhancing environmental credentials), and will therefore be expanded to near-national coverage. The recently launched corporate recycling programme in the UK has been well received, presenting the opportunity to source products from the non-consumer facing market, and potential to establish new revenue from telephony rentals. MMAG’s US brand (Decluttr) has traditionally suffered from a lack of awareness and inbound volumes, and management therefore expects new trade-in partnerships to provide more favourable growth.

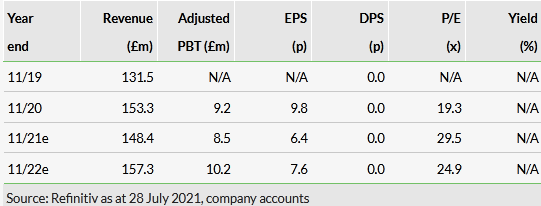

Valuation: 29.5x P/E for FY21e

Consensus estimates imply a P/E ratio of 29.5x for FY21e, while online peers trade at a wide range of multiples reflecting different levels of growth and profitability.

Consensus estimates

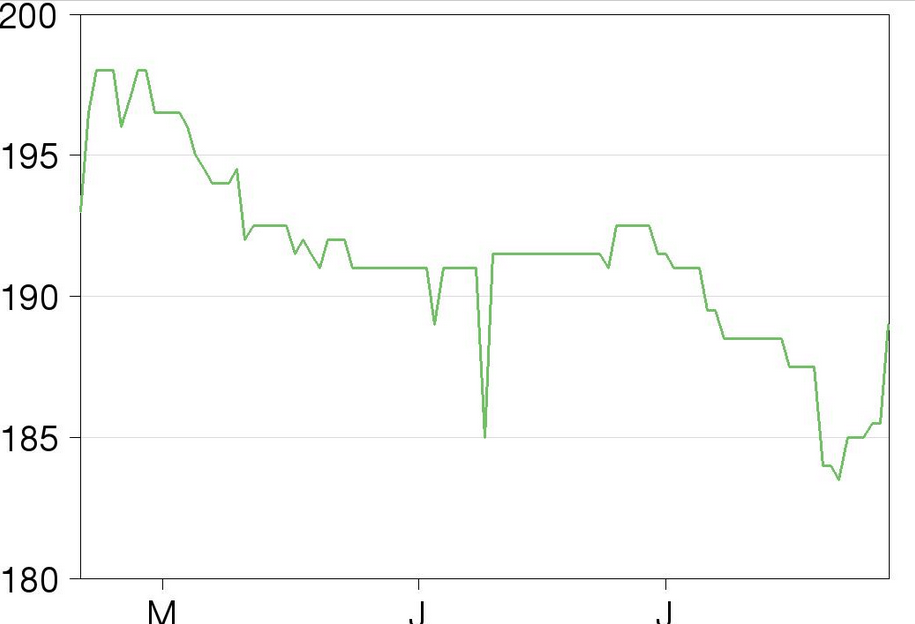

Share Price Graph

Bull

- Market supported by tailwinds of increasing consumer acceptance of circular economy, rising prices and slower rates of innovation of consumer technology products.

- Increasing penetration of rentals increases recurring revenue and quality of earnings.

- Entrance to corporate recycling market enhances sourcing and growth opportunities from its traditional consumer focus.

Bear

- The market for disc media is expected to decline due to the shift to digital and streaming media.

- Competitors include online re-commerce specialists and marketplaces.

- Dividends not expected in the near term as cash flow will be invested in developing and expanding the businesses.