- Microsoft is down 30% YTD despite continued signs of resilience in face of recession

- Office Suite, Azure, and cybersecurity record organic growth as companies prove reluctant to cut mission-critical software

- Microsoft is showing initiative through new growth areas and consolidating its already-dominant position

Microsoft (NASDAQ:) has lost close to 30% of its value this year. With its Q123 earnings just released, maybe it’s time to give it another look. The latest numbers revealed no surprises but given the challenging operating and macro circumstances, the double beat provides some respite. It is clear that is going to be much more than “temporary,” with further Fed hikes still on the way and strong signs of an upcoming recession. Yet, Microsoft's consistent advances in cloud computing and gaming, the resilience of its core business, and a substantially discounted relative valuation indicate that Microsoft is on the right track to a strong recovery.

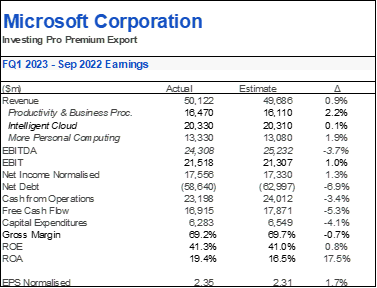

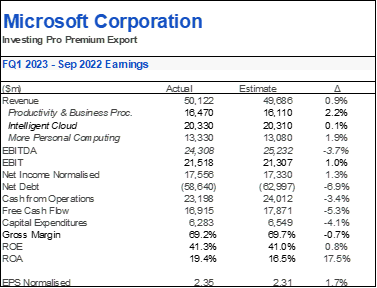

Source: Investing Pro

Q1 23 Earnings And Guidance

Source: InvestingPro

The earnings for the tech giant offer no particular surprises as Microsoft on the top and bottom lines. Revenue came in at $50.12b, an 11% YoY increase, and EPS sat at $2.35, down 13% YoY but better than estimates.

The last two quarters have seen sales growth slow to the lowest level in years, hovering at low double digits. Cash flow margins and yet-to-be-recognized revenue have also slowed. This is a reasonable consequence of the post-Covid slowdown and perhaps an indication of turbulent times ahead.

One detail is that there could be problems affecting cloud margins – management discussed how the cost of providing cloud services is increasing as a result of rising energy prices: “gross margin percentage decreased roughly 3 points driven by […] lower margins in Azure and other cloud services, primarily due to higher energy costs.” This could cost the company $800m this fiscal year.

The guidance for the second quarter was more interesting, with most numbers lower than expected. More Personal Computing revenue showed the most weakness in the current business environment, with sales projected between $14.5-$14.9 billion, compared to the expected $17.2b. The Productivity & Business Processes segment projects $16.6-$16.9 billion in sales, versus the $17.2b analysts were predicting.

The Intelligent Cloud segment surprised analysts the most, with sales projected at $21.55b, lower than the expected $21.8b. Microsoft’s Azure cloud computing business is the company's most valuable, and analysts expected 41% YoY growth instead of the 37% growth rate implied by the forecast.

The downward pressure on the stock following the release was probably due more to Google's (NASDAQ:) (NASDAQ:) miss than to Microsoft’s own results. Despite the bleak macro environment, Microsoft’s business is proving to be far more resilient than others and shows signs of opportunity.

The Growth Story: Gaming & Metaverse

Following the proposed Activision Blizzard (NASDAQ:) acquisition, which is set to go through in 2023, Microsoft will join Sony (NYSE:) as one of the world’s biggest game providers, making the gaming segment more important than ever for the company.

Among its main competitors in this area is the Chinese Tencent (OTC:), a top-5 game provider with $13.9b in revenue and growing at a 27% 5-year CAGR. This massive growth is in part due to Tencent’s perfecting of AI recommendations, which suggest a game to users based on social media profiles and similar data. These AI and metaverse algorithms require very sophisticated servers – Tencent Cloud uses Nvidia’s GPU chips.

The renewed tension between the U.S. and China has brought the US Department of Commerce to limit exports of Nvidia’s chips to China. Denying AI GPU chips to Tencent could severely impact its business model, allowing Microsoft to gain market share. Together with these political tailwinds, Microsoft seems increasingly well positioned to synergize its cloud AI with the gaming and metaverse ecosystems.

Mission-Critical Software

Microsoft’s Q1 results reveal the strength of the company’s competitive moat in the mission-critical software segment. Productivity and Business Processes revenues grew 9% YoY and 1% QoQ. Despite the slowing jobs market and hiring freezes, Microsoft 365 sales grew 11% YoY. This inelasticity to price changes and continued (though decelerating) growth can serve as a float in a slowing economy.

Microsoft has also clearly benefited from the shift in working and teaming habits that followed the pandemic, doubling down on its cloud-based productivity software. Microsoft Teams is now the undisputed leader among cloud-based collaboration tools, with 91% of Fortune 100 companies subscribed to the system. The company has also partnered with rival Cisco (NASDAQ:) to enable Teams compatibility on all Cisco platforms. New efforts to dominate the business communications segment include the launch of Teams Premium, with capabilities such as summarizing meetings with recap notes.

Perhaps Microsoft’s biggest push into the cloud-based productivity space is Microsoft Places. As companies transition between a physical and a connected workplace, Microsoft Places aims to create a “connected workplace” that takes office utilization information online, addressing a potential >$80b technological gap.

The improved offers are anticipated to attract businesses that are scrambling to find methods to adapt to the new standard of "location-agnostic" working arrangements. Once again, Microsoft is ahead of the curve and plans to stay ahead.

Cloud & Security Services

Despite the slight slowdown in revenue growth and minimal compression of margins due to energy prices, Microsoft’s Azure continues to be promising. The cloud computing service continues to win deals worth over $100m and past $1b, keeping Amazon Web Services (AWS) (NASDAQ:) on its toes.

Azure is also in a good position to capitalize on the rising need for cybersecurity solutions. The commercial sector is constantly emphasizing cloud security as offices move from legacy IT infrastructures to the cloud. In addition to its strong growth prospects, security software is very resilient in times of economic uncertainty, as executives are reluctant to cut spending in this area. Though already strong before, these trends simply reinforce Azure’s growth story.

Risks

Demand Slowdown

The latest numbers on personal computer shipments confirm a rapid decline in demand due to the pandemic's accelerated demand and declining consumer confidence amid rising inflation. Shipments fell 20% YoY in Q322, with analysts expecting even worse from the last quarter of the year. Microsoft’s more macro-sensitive businesses such as Windows and Bing are sure to suffer from the downturn.

FX

The continues to be a short-term headwind for big tech Microsoft, as more than 50% of the company’s consolidated revenues are generated from operations outside the U.S. Despite many believing the dollar to have peaked, these FX headwinds are far from over as the Fed continues to hike rates. No matter its resilience in a downturn, Microsoft’s fundamentals will suffer.

Activision Blizzard

Although it remains a marginal tail risk, there is a chance that Microsoft’s proposed $69b acquisition of Activision Blizzard may fall apart. Most analysts see the deal closing by Q223, yet it remains at the discretion of the Competition and Markets Authority (UK) and European Commission. A negative outcome would likely put downward pressure on the stock.

Valuation

Despite the stock's continued growth possibilities, Microsoft is currently trading at a considerable discount to both its own multi-year average and its large-cap peers.

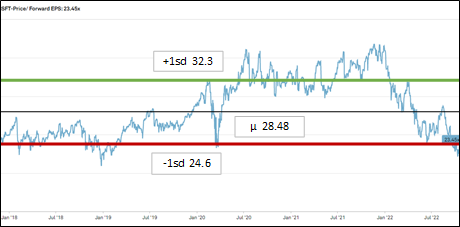

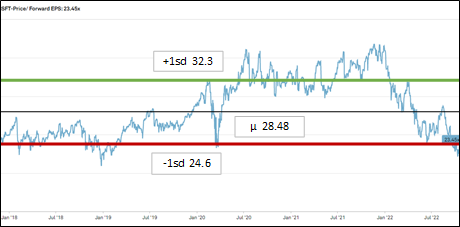

*5Y Historical Price/Forward EPS. Source: CIQ*

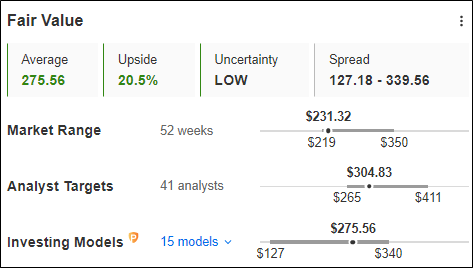

At 23.5x Price/Forward EPS, Microsoft is trading one standard deviation below its 5-year average multiple. Even in the event of a serious downturn, it would be difficult to imagine multiple compression beyond 21x. The downside is limited. The upside potential, however, is quite significant as Microsoft has plenty of room for multiple expansion. The average target price is $275, making for a 20% upside. For long-term growth investors, there won’t be many other opportunities to buy a high-quality asset like Microsoft at this price.

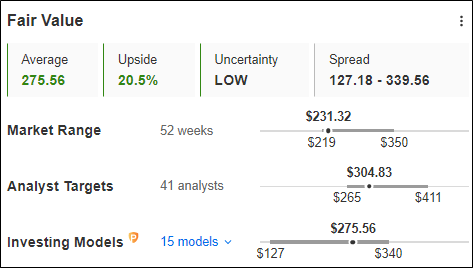

*Fair Value. Source: InvestingPro*

Conclusion

Like many others, Microsoft stock has been battered this year in light of FX headwinds and a market downturn. Yet, the company clearly remains among the world’s greatest with core competencies that underpin its possibilities for sustained longer-term success. Despite the sell-off after Q1 earnings, the report points to a fundamental resilience in Microsoft's diversified product portfolio. The company also continues to show off its ability to capitalize on its existing user base to seize market share, increase its addressable market, and explore new growth areas. With multiples near 5-year lows, now may be the time to get in on one of NASDAQ’s gems.

Microsoft Corporation (NASDAQ:)

Title: ‘Microsoft: Earnings Hint At Downturn Resilience’

Date: 27.10.22

- Microsoft is down 30% YTD despite continued signs of resilience in face of recession

- Office Suite, Azure, and cybersecurity record organic growth as companies prove reluctant to cut mission-critical software

- Microsoft is showing initiative through new growth areas (e.g. Microsoft Places) while consolidating its already-dominant position in existing businesses such as cloud-based productivity software and gaming

Intro

Microsoft has lost close to 30% of its value this year. With its 1Q23 earnings just released, maybe it’s time to give it another look. The latest numbers revealed no surprises but given the challenging operating and macro circumstances in the three months leading up to September, the double beat provides some respite.

It is clear that inflation is going to be much more than “temporary,” with further FED hikes still on the way and strong signs of an upcoming recession, pointing to additional macroeconomic challenges for the rest of the year.

Yet, the consistent advancement on the cloud computing and gaming fronts, the resilience of its core business, along with a substantially discounted relative valuation indicate that Microsoft is on the right track to a strong recovery.

*Stock Performance graph. Source: Investing Pro*

Latest Earnings & Guidance

1Q23 Earnings

*FQ1 22 Earnings. Source: InvestingPro*

The earnings for the tech giant offer no particular surprises as Microsoft slightly beat on the top- and bottom-lines. Revenue came in at $50.12b, an 11% YoY increase, and EPS sat at $2.35, down 13% YoY but better than estimates.

The last two quarters have seen sales growth slow to the lowest level in years, hovering at low double digits. Cash flow margins and yet-to-be-recognized revenue have also slowed. This is a reasonable consequence of the post-Covid slowdown and perhaps and indication of turbulent times ahead.

One detail is that there could be problems affecting cloud margins – management discussed how the cost of providing cloud services is increasing as a result of rising energy prices. As mentioned in the presentation, “gross margin percentage decreased roughly 3 points driven by […] lower margins in Azure and other cloud services, primarily due to higher energy costs,” which could cost the company $800m this fiscal year.

These two small indications aside, Microsoft earnings were fairly stale.

2Q23 Guidance

The guidance for the second quarter was more interesting, with most indications lower than expected. More Personal Computing revenue showed the most weakness in the current business environment, with sales projected between $14.5-$14.9 billion, comparted to the expected $17.2b. The Productivity & Business Processes segment projects $16.6-$16.9 billion in sales, versus the $17.2b analysts were predicting. CFO Amy Hood mentioned that the “materially weaker PC demand from September will continue” in their consumer business.

The Intelligent Cloud segment surprised analysts the most, with sales projected at $21.55b, lower than the expected $21.8b. The 37% growth rate implied by the forecast is below the 41% analysts wanted to see – Microsoft’s Azure cloud computing business is the company's most valuable.

The slight downward pressure on the stock following the release was probably due more to Google’s miss than to Microsoft’s own results. Despite the bleak macro environment, Microsoft’s business is proving to be far more resilient than others and shows signs of opportunity.

Growth Story

Gaming & Metaverse

Following the proposed Activision Blizzard acquisition, which is set to go through by next year, Microsoft will join Sony as one of the world’s biggest game providers, making the gaming segment more important than ever for the company.

Among its main competitors in this area is the Chinese Tencent, a top-5 game provider with $13.9b in revenue and growing at a 27% 5-year CAGR. This massive growth is in part due to Tencent’s perfecting of AI recommendations, which suggest a game to users based on social media profiles and similar data. These AI and metaverse algorithms require very sophisticated servers – Tencent Cloud uses Nvidia’s GPU chips.

The renewed tension between the US and China has brought the US Department of Commerce to limit exports of Nvidia’s chips to China. Denying AI GPU chips to Tencent could severely impact its business model, allowing Microsoft to gain market share. Together with these political tailwinds, Microsoft seems increasingly well positioned to synergize its cloud AI with the gaming and metaverse ecosystems.

Mission-Critical Software

Microsoft’s results this last quarter reveal the strength of the company’s competitive moat in the mission-critical software segment. Productivity and Business Processes revenues were up 9% YoY and 1% QoQ, at $16b, showing just how much businesses and individuals rely on the Microsoft Suite. Despite the slowing jobs market and hiring freezes, Microsoft 365 sales grew 11% YoY. This inelasticity to price changes and continued (though decelerating) growth can serve as a float in a slowing economy.

Microsoft has also clearly benefited from the shift in working and teaming habits that followed the pandemic, doubling down on its cloud-based productivity software. Microsoft Teams is now the undisputed leader among cloud-based collaboration tools, with 91% of Fortune 100 companies subscribed to the system. The company has also partnered with rival Cisco to enable Teams compatibility on all Cisco platforms. New efforts to dominate the business communications segment include the launch of Teams Premium, with capabilities such as summarizing meetings with recap notes. The $10/month add-on will be accessible in December.

Perhaps Microsoft’s biggest push into the cloud-based productivity space is Microsoft Places. As companies transition between a physical and a connected workplace, Microsoft Places aims to create a “connected workplace” that takes office utilization information online, addressing a potential >$80b technological gap.

The improved offers are anticipated to attract businesses who are scrambling to find methods to adapt to the new standard of "location-agnostic" working arrangements. Once again, Microsoft is ahead of the curve and plans to stay ahead.

Cloud & Security Services

Despite the slight slowdown in revenue growth and minimal compression of margins due to energy prices, Microsoft’s Azure continues be promising. The cloud computing service continues to win deals worth over $100m and past $1b, keeping Amazon Web Services (AWS) on its toes.

Azure is also in a good position to capitalize on the rising need for cybersecurity solutions. The commercial sector is constantly emphasizing cloud security as offices move from legacy IT infrastructures to the cloud. In addition to its strong growth prospects, security software is very resilient in times of economic uncertainty, as executives are reluctant to cut spending in this area. Though already strong before, these trends simply reinforce Azure’s growth story.

Risks

Demand Slowdown

The latest numbers on personal computer shipments confirm a rapid decline in demand due to the pandemic's accelerated demand and declining consumer confidence amid rising inflation. Shipments fell 20% YoY in 3Q22, with analysts expecting even worse from the last quarter of the year. Microsoft’s more macro-sensitive businesses such as Windows and Bing are sure to suffer from the downturn.

FX

The strong USD continues to be a short-term headwind for big tech Microsoft, as more than 50% of the company’s consolidated revenues are generated from operations outside the US. Despite many believing the dollar to have peaked, these FX headwinds are far from over as the FED continues to hike rates. No matter its resilience in a downturn, Microsoft’s fundamentals will suffer.

Activision Blizzard

Although it remains a marginal tail risk, there is a chance that Microsoft’s proposed $69b acquisition of Activision Blizzard may fall apart. Most analysts see the deal closing by 2Q23, yet it remains at the discretion of the Competition and Markets Authority (UK) and European Commission. A negative outcome would likely put downward pressure on the stock.

Valuation

Despite the stock's continued growth possibilities, Microsoft is currently trading at a considerable discount to both its own multi-year average and its large-cap peers.

*5Y Historical Price/Forward EPS. Source: CIQ*

At 23.5x Price/Forward EPS, Microsoft is trading one standard deviation below its 5-year average multiple. Even in the event of a serious downturn, it would be difficult to imagine a multiple compression beyond 21x. Also, with this fiscal year’s EPS estimated at 9.54 and current share price of $231, much of the EPS contraction is already priced in. The downside is limited. The upside potential, instead, is quite significant as Microsoft has plenty of room for multiple expansion. The average target price is $275, making for a 20% upside. For long-term growth investors, there won’t be many other opportunities to buy the high-quality equity asset which is Microsoft at this price.

*Fair Value. Source: InvestingPro*

Conclusion

Like many others, Microsoft stock has been battered this year in light of FX headwinds and a market downturn. Yet, the company clearly remains among the world’s greatest with core competencies that underpin its possibilities for sustained longer-term success. Despite the latest earnings being quite flat, there are details that point to a certain resilience within areas of Microsoft’s diversified product portfolio, such as the Office Suite and its cybersecurity services. The company also continues to show off its ability to capitalize on its existing user base to seize market share, increase its addressable market, and explore new growth areas. With multiples near 5-year lows, now may be the time to get in on one of NASDAQ’s gems.