Metro Bank (LON:MTRO) (Metro) has published a trading update that shows that it returned to profitability in October. This is consistent with previous guidance of a return to profitability during Q424 and the bank has reiterated its guidance for a mid- to upper single-digit FY25 return on tangible equity (RoTE). The October net interest margin of 2.48% also points to faster improvement than we had anticipated.

Separately, the bank reported that it has resolved Financial Conduct Authority (FCA) enquiries into legacy transactions monitoring systems and control. The £16.7m financial penalty is non-recurring and equivalent to c 2.5p of tangible book value per share. At this stage, we have not adjusted the forecasts set out in our recent initiation note and will review these with the full year results.

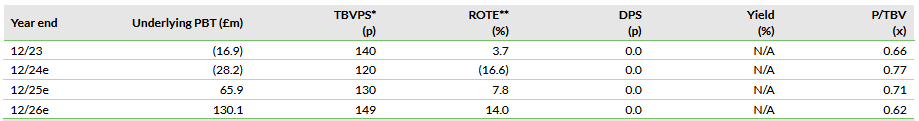

Note: *Tangible book value per share. **Return on tangible equity

With its interim results in late July, Metro substantially upgraded its financial guidance for the next three years and beyond. Based on its current expectations for the UK economy and interest rate progression, as well as competitive dynamics in the market, it expects a mid- to-upper-teens RoTE by 2027 and beyond, driven by net interest margin (NIM) expansion, capital optimisation and cost efficiencies. Metro expects a significant expansion in NIM over the period, from 1.64% in H124 to approaching 4% in FY26. The NIM increase to 2.48% in October indicates significant progress towards the bank’s expectations and reflects the run-off of relatively high-cost deposits, the sale of lower-margin retail mortgages and early repayment of base-rate linked Bank of England TFSME funding. The sale of a lower-margin £2.5bn book of retail mortgages, completed in late September, is reflected in the 22% decline in Q3 lending to £9.1bn, supporting Metro’s strategic repositioning of its balance sheet towards higher-yielding SME, commercial, corporate and specialist mortgages. Q3 deposits reduced by £0.6bn, or 4%, to £15.1bn and are now down £1.4bn from the February peak, primarily reflecting the focus on lower-cost core deposits.

The financial penalty levied by the FCA relates to its enquiry into the bank’s historical transaction monitoring systems and controls. The enquiry began in 2016, was remediated in 2020, and the issue has now been brought to a close.

Metro shares and bonds have risen strongly since the interim results but do not reflect the improvements in RoTE that Metro guides to. We see upside potential as confidence in the bank’s strategy builds. Based on a medium-term mid- to high-teens RoTE, even a modest c 0.7x FY28e P/TBVPS, discounted at conservative 15% pa underpins the current share price. While it is too early to predict the outcome and impact of the recently launched Bank of England consultation on the setting of minimum requirements for own funds and eligible liabilities (MREL), any softening of Metro’s requirement would lend further support to RoTE. The bank’s existing £525m MREL bonds pay a coupon of 12% pa.