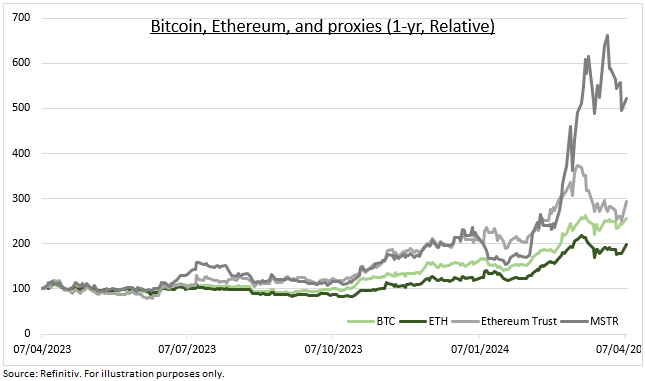

ASSET: Crypto is by-far the best performing asset class this year. Trouncing other hard-assets like gold. Its $2.7 trillion market cap is the smallest, youngest, and most retail of all assets. Bitcoin set the pace and optimism is high. With a classic supply-and-demand squeeze of ETF inflows and the imminent halving. Ethereum (ETH) lagged and its depressed sentiment ahead of next month’ spot ETF decision is a possible opportunity. Crypto also has longer term catalysts of Fed rate cuts and company accounting and bank regs changes. Whilst ecosystem venture capital (VC) inflows were up by a third last quarter and institutional tokenisation projects are building.

ETHEREUM: ETH has lagged Bitcoin the most in two years. Its 25% below its all-time-high. And its ‘dominance’, or proportion of crypto market cap, is only 16%. Even after April’ Dencun upgrade that cut transaction fees and boosted scalability. And with more tokenisation uses, like BlackRock’s (BLK) digital liquidity fund. And ahead of the May 23rd US SEC first final deadline to decide on a spot Ethereum ETF. Where it just opened a 3-wk public comment period. Approval skepticism is the main underperformance driver. Proxied by the Ethereum Trust NAV discount widening to 26%. With ETH maybe seen as a security and on a different legal footing to Bitcoin.

BITCOIN: The largest crypto asset has found support after profit taking from its recent new all-time-high. It’s being driven by a classic supply-and-demand squeeze. As new spot ETFs see an average $200 million net inflows daily, and now hold 4% of all BTC. Whilst adoption spreads to more fund platforms, and new products – like levered versions – are launched. Also, the four-yearly halving event is just two weeks away and will cut the growth rate of the 7% of Bitcoin still to be mined. The 2x NAV premium of equity proxy MicroStrategy (MSTR) speaks to the optimism, even as competition from higher bond yields and delayed Fed rate cuts has mounted.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Messages from crypto and its proxies

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.