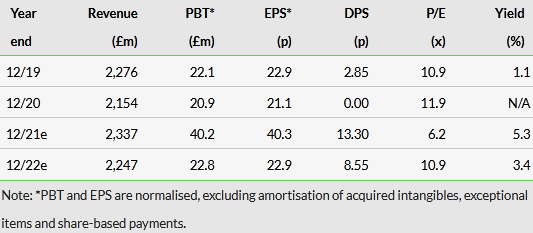

The strong used car market has enabled Marshall Motor Holdings (LON:MMHM) to deliver an exceptional H121 performance that should drive record FY21 underlying PBT of not less than £40m as indicated last week. However, the uncertainty surrounding the market outlook continues. Vehicle supply issues are likely to result in lower volumes for both new and used cars in H221 and H122 affecting dealership profitability. We have upgraded FY21 to reflect guidance but our FY22 estimates are unchanged with a more normal level of profit. The resumption of dividends is welcome with an exceptional FY21 payment to reflect the strong current year financial performance.

Share price performance

Business description

Marshall Motor Holdings is the seventh largest UK motor retailer, operating 116 franchises spread across 22 brands in 29 counties. It is one of six UK dealership groups that represent each of the top five volume and premium brands. The group has a strong presence in eastern and southern England.

Outperformance in an exceptional market

Market conditions were exceptionally favourable during H121, with MMH outperforming both new and used car segments once more. Record underlying PBT of £38.4m (H120 loss £11.8m) was more than double the £15.2m achieved in H119. Against a weak H120, l-f-l new unit sales rose 46.1% (market +39.2%), used unit sales increased by 51.7% (market +31.1%) and aftersales by 34.8%. Second-hand prices also increased at unprecedented rates, especially in Q221, driving H121 used car gross margin up 246bp to a best-ever 8.6% including a £2.8m (45bp) stock provision release. Group gross margin was up 117bp at 11.8%, also a record level with both new and aftersales increasing margins. The balance sheet remains robust with £57.2m of adjusted net cash (excluding lease liabilities) at H121 after continuing to invest £17.2m in both organic and acquired growth, including the addition of two new businesses.

Supply constraints expected to prove disruptive

The supply shortages caused primarily by the global chip shortage are increasing in severity, with production affected at many manufacturers. To date, the availability of stock has helped to offset the shortfall. However, inventory levels of new and used cars are now low, with extended lead times on new cars further reducing vehicle returns from financial agreements, which restricts quality used car availability. While demand remains strong, the inability to complete sales will hurt the top line in both segments and reduce dealership profits in H221, and most probably in H122. Nevertheless, MMH remains well placed to pursue its growths strategy.

Valuation: Dividends a welcome return

The exceptional interim dividend payment of 8.86p provides attractive immediate income and should lead to a FY21 yield of 5.3%. The dividend should be restored to a level with 2.5–3.5x cover in FY22, still a healthy level of yield support. The recent share price rise represents a significant multiple expansion for FY22, although a P/E of 10.9x may not look demanding if growth resumes in FY23.

H121 record driven by used car performance

H121 has seen positive supply and demand dynamics across both new and used cars despite the third national lockdown, which was only lifted in early April. Compared to H120, which saw the UK new car market fall 48.5% below H119, the availability in H121 of click and collect and extended use of remote and online communications allowed a more consistent level of trading during the showroom closures in Q121. However, the shortage of semiconductor chips led to disruption in the supply of new vehicles from manufacturers and increasing demand for quality used cars as an alternative. As stocks had been held in part due to Brexit concerns, these became available in a very positive pricing environment, which saw an unprecedented 14.7% increase in used car values in Q221 as stock levels fell.

MMH outperformed the market in both the retail and fleet new car segments, as well as in the used segment. The favourable market dynamics and tight operational control led to a record level of first-half profitability and very strong cash flows. The key financial highlights are shown in Exhibit 1 below, with comparison provided to H119, which we feel is more meaningful than compared to the heavily pandemic-affected H120.

Click on the PDF below to read the full report