FX Brief:

- China’s GDP hit a fresh multi-decade low, expanding ‘just’ 6% YoY and below expectations of 6.1% (down from 6.2% prior). Taking the edge off-of weak growth, industrial output expanded at 5.8%, above 5% consensus whilst retail sales also beat at 7.8% YoY versus 7.5% forecast. So, whilst growth was a disappointment, the rest average it out, hence the muted market reaction from the likes of AUD and NZD.

- RBA’s Governor Philip Lowe thinks that negative rates are “extraordinarily unlikely” and that low rates along are not likely to stimulate investment. “In my view, we’re clearly in the world of diminishing returns to monetary easing…" which could be taken to mean RBA will favor QE of negative rates.

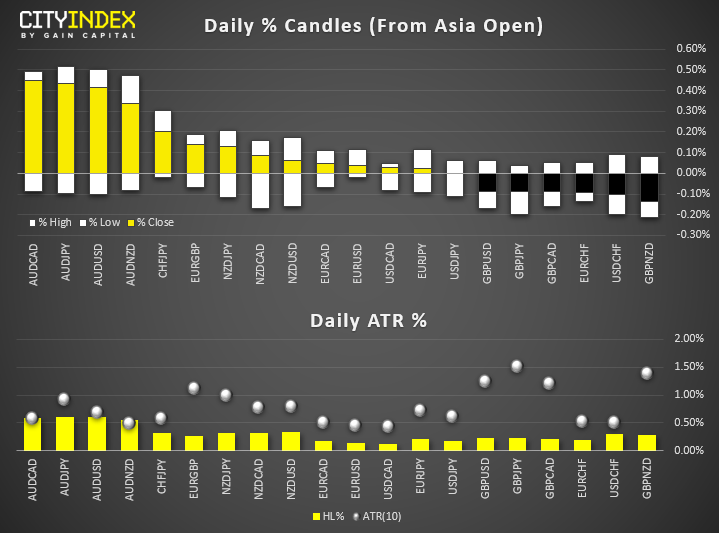

- Razor-thin ranges for the majors. USD/JPY is consolidating in a small range above the pivotal level if 108.50. EUR/USD is brimming at its highs after closing above 1.1100 yesterday. GBP/USD is treading water around 1.2850. NZD I the strongest major (as seen with its dominating strength on the FX dashboard). GBP/NZD has fallen -0.8% but, given high levels of volatility, it has pushed the ATR up, hence it ‘only’ covering 50% of its ATR.

- AUD/NZD is the only pair to be near its ATR and, with little news flow expected to impact the cross direction, the move could be done for the day and could be prone to mean reversion.

Equity Brief:

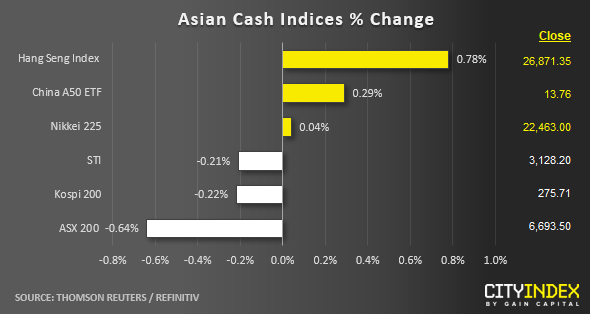

- Some profit-taking activities can be seen in several Asian stock markets in today’s Asian session on the backdrop of mixed economic data from China. China Q3 GDP growth has slowed to 6.0% y/y (below consensus of 6.1% y/y), its lowest growth rate since Q1 1992 while Industrial Production has managed to beat expectations with a growth rate at 5.8% y/y in Sep (5.0% y/y consensus).

- Despite EU and U.K has agreed to a Brexit deal and the ball now is back in the U.K for a parliamentary vote scheduled this Sat. Thus, some unwinding of “risk-on “positions can be justified as we head into the weekend with the possibility that U.K PM Boris Johnson may not be able to gather enough votes in the parliament as the Northern Ireland DUP, which the government relies on for support in key votes has reiterated no support on the latest deal.

- The ASX 200 has continued to decline for the 2nd consecutive day, where it has shed -0.63% led by major healthcare-related stocks that have offshore operations where revenue can be dented due to a weaker USD seen in the past week. Share prices of CSL and Cochlear have declined by -1.1% and -0.8%, respectively.

- Japan’s Nikkei 225 has managed to inch out a modest gain of 0.20% led by several major technology stocks reinforced by upbeat earnings from Taiwan’s TSMC, the world’s largest contract chipmaker. Murata Manufacturing, Fanuc, and Keyence have recorded gains between 1.3% to 2.4%.

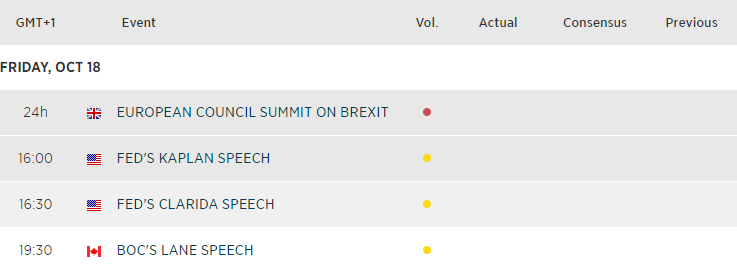

Up Next

- No major economic data points today, so it’s all about Brexit as we head towards the weekend.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."