- China vowed to retaliate after the US House voted to pass the human rights bill, which effectively provides support to pro-democracy protesters in Hong Kong. Risk came off a little with E-mini futures dropping slightly and JPY gaining inflows, making it today’s most robust major. Although we’ll need to see if the Senate passes the bill for it to have any meaningful impact.

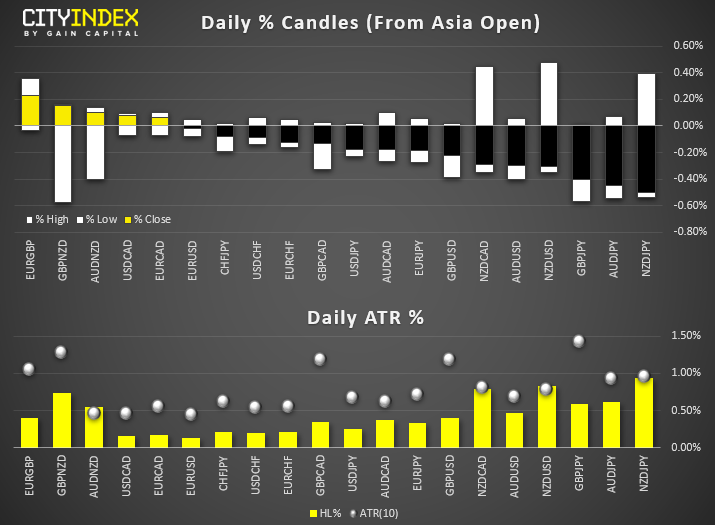

New Zealand CPI slowed to 1.5% YoY from 1.7% prior, yet shortly after RBNZ said their measure of CPI remained at 1.7%. Still, RBNZ suggested further cuts may be needed and that they continue to undertake prep work on ‘less conventional’ (QE) tools should they be required. NZD and AUD are currently the weakest majors on the session, which are also being weighed down by the pro-democratic bill voted by the US House of Representatives. - The British pound wavered as doubts again grew whether a Brexit deal could be reached, seeing GBP retrace a tad after its best 4-day rally since 2016. With yen taking inflows, GBP/JPY was the third biggest mover, while NZD/JPY was the only pair to reach its typical daily range and is today’s biggest mover (so perhaps the move is overdone?)

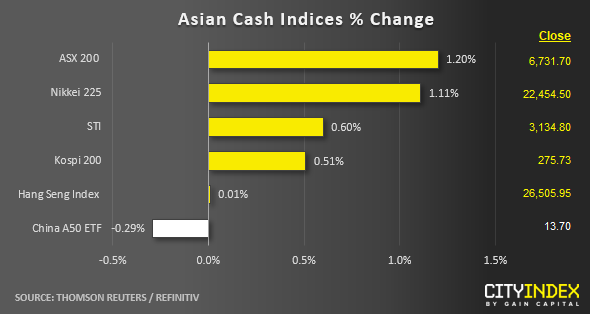

Equity Brief:

- Most Asian stock markets have continued to solidify their gains since the start of the week, taking the cue from the U.S. stock market where both the S&P 500 and Nasdaq 100 have rallied by 1.00% and 1.28% respectively on the backdrop of Q3 earnings optimism.

- China and Hong Kong’s stock markets do not manage to sail along with the “bullish wave.” The political situation in Hong Kong has become the latest flashpoint between the U.S. and China on top of an ongoing trade war. The U.S. House of Representatives has just passed a bill that offers support to pro-democracy protestors in Hong Kong. A similar statement is now in front of the Senate (the upper house of the U.S. Congress) for voting. China has threatened to retaliate if U.S. Congress passes the bill that can complicate the on-going negotiation talks to put “Phase 1 of the U.S.-China trade deal” in writing.

- The Japan stock market has continued to shine, where the Nikkei 225 is upped by 1.19% for a second consecutive session. It also rallied to a 10-month high at 22615 led by semiconductor-related stocks reinforced by the positive sentiment seen in the U.S. Philadelphia Semiconductor Index that has surged to a fresh all-time high in terms of closing level yesterday. Tokyo Electron and Advantest have outpaced the Nikkei 225 with gains of 1.8% and 3.7%, respectively.

- The S&P 500 E-Mini futures have continued to a pull-back in today’s Asian session after a test on the 3000 psychological levels in yesterday's U.S. session. It has dropped by -0.30% to print a current intraday low of 2986.

Up Next

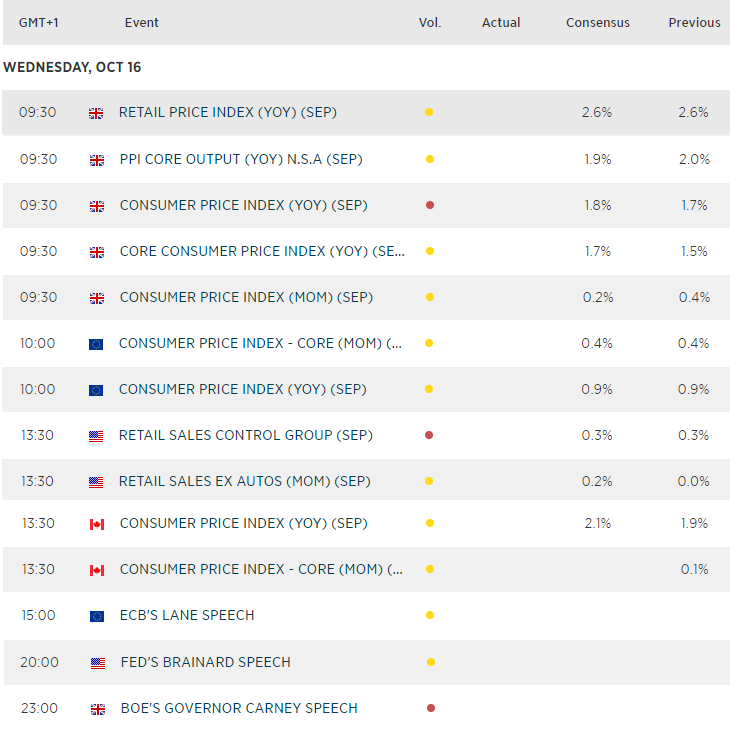

- UK inflation, producer and retail prices make up the balk of UK data, with prices mostly being expected to soften. Still, it’s more likely Brexit headlines that could make a material impact on GBP crosses over the next couple of days.

- US retail sales provide a feel for consumer spending, which is expected to rise by 0.2% from 0% prior.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."