FX Brief:

- Global growth bears have more to cheer about on the back of weak data from Asia.

- South Korean exports hit a 4-year low and contracted for an 11th consecutive month at -14.7% YoY. CPI was stagnant at 0% YoY, although above last month’s 30-year low of -0.3%.

- Japan's final manufacturing PMI was lowered to 45.4 from 48.5 prior (below 50 denotes contraction) whilst Austrian manufacturing slowed to 51.6 from 54.7 prior. Producer prices were also lower, coming in at 1.6% YoY vs. 2% prior.

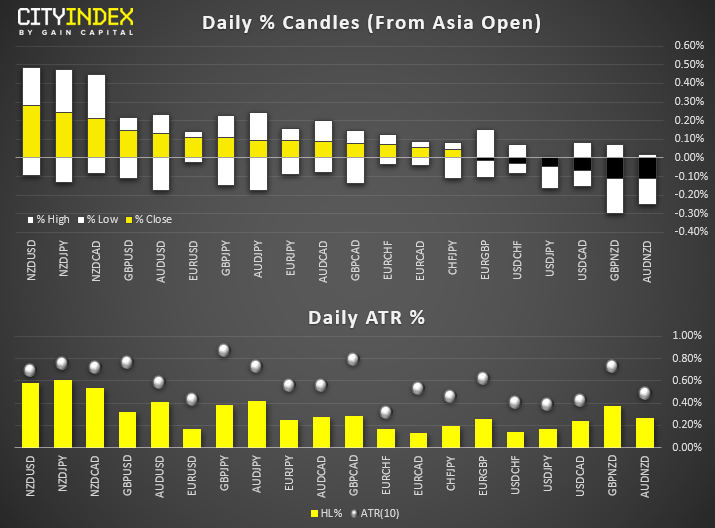

- The USD remained under pressure for a third session and is weaker against its peers. NZD, GBP, and AUD are the strongest majors. NZD/USD hit a marginal 7-week high, and USD/CHF and USD/JPY teased yesterday’s lows.

- Volatility remains contained, with all 20 pairs monitored remaining within their 10-day ATR. Although the average range of ATR is 50%, so above the usual 30% we’ve become accustomed to in recent sessions.

Equity Brief:

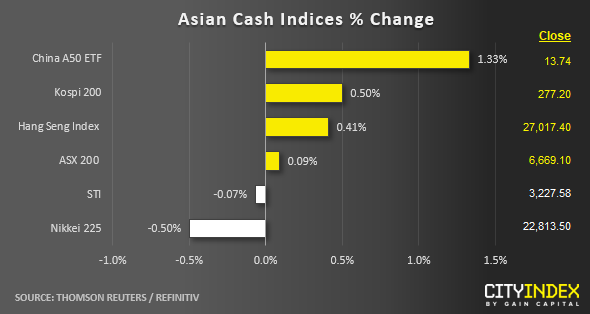

- A better than expected Caixin China Manufacturing PMI for Oct (51.7 versus the consensus estimate of 51.0) has helped to offset a negative trade-related news flow reported yesterday that cited unnamed Chinese officials airing doubts whether a comprehensive long-term U.S-China trade deal is possible. The latest reading of the Caixin PMI has pointed to the strongest pace of expansion in the manufacturing sector since Feb 2017.

- China A50 has rallied by 1.33% to hit a 5-day high follow by South Korea’s Kospi 200 and Hong Kong’s Hang Seng Index that have gained by 0.51% and 0.41%, respectively.

- Hong Kong stocks have shrugged off the negative impact caused by the 5-month long street protests that saw its economy entered a technical recession for the first time since 2009. Flash estimates for Q3 GDP shrank by -3.2% q/q from -0.5 q/q recorded in Q2. Also, China government has vowed to bolster Hong Kong’s national security laws to clamp down on the on-going street protests that may backfire as such actions may incite more defiance behavior from the protestors.

- Japan’s Nikkei 225 is not showing much optimism today as it has shed by -0.50% dragged down by a stronger JPY where the USD/JPY has dropped to a 3-week low of 107.90 in today’s Asia session. The underperformers are export-oriented and cyclical sectors; Automaker Subaru declined by -1.0% while electronic device maker Kyocera and optical equipment maker Olympus tumbled by around 3%.

- The S&P 500 E-mini futures have inched higher from yesterday’s U.S. session low of 3020 to record a modest gain of 0.28% and printed a current intraday high of 3044 in today’s Asia session.

Up Next:

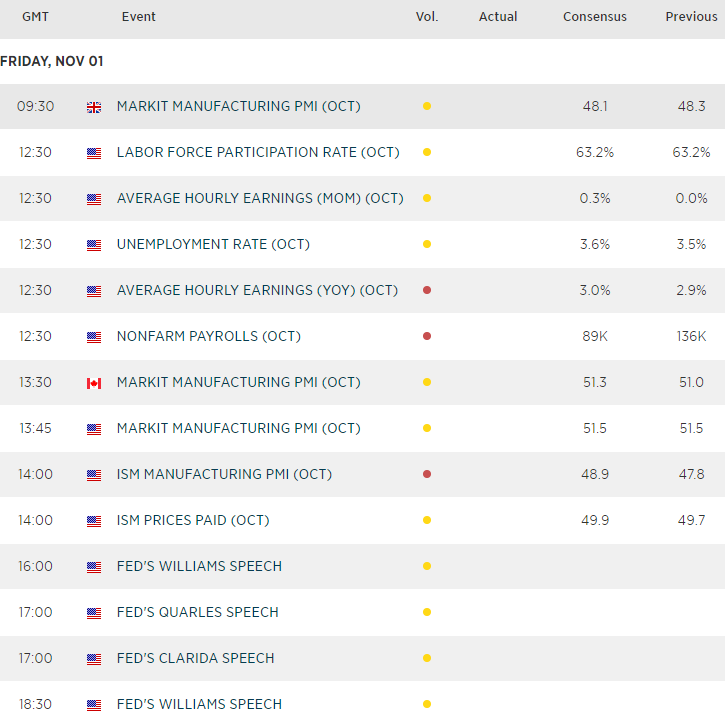

- Today’s NFP report is the main event in today’s calendar. Whilst unemployment is its lowest since the swinging ’60s, job growth is expected to 89k from 136k prior, and all eyes are on hourly earnings after it fell to 2.9%, its sharpest monthly drop in 11-months. And with USD at a make or break point, it could make for an interesting weekly close for several major currencies.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."