It was another ugly data set from the ISM manufacturing read, but it may not mean we’re headed for a full-blown recession.

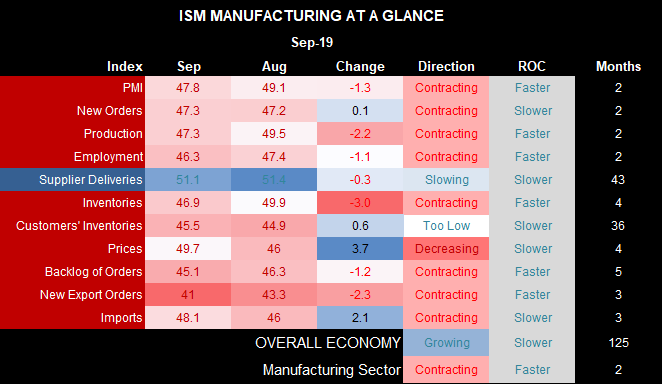

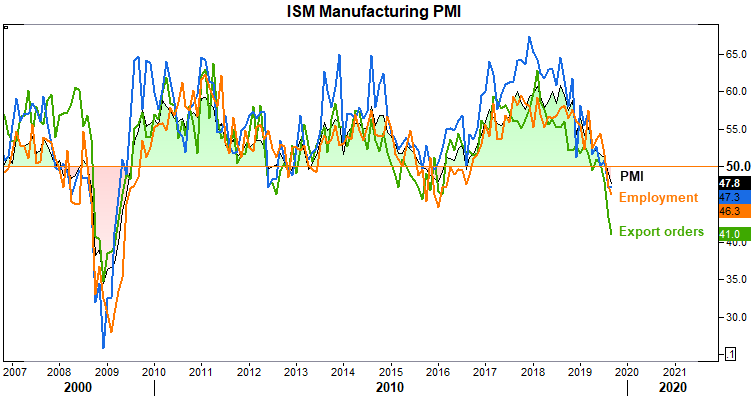

If last month’s data was ugly, then this is even uglier. Not only have the headline PMI, but new orders and production also contracted at their fastest pace since the great recession, employment is its lowest since 2007 and exports fell off a cliff. On the backdrop of global growth concerns, this only exacerbated these fears and resulted in the S&P500 shedding -1.2% and USD/JPY printing a potential top and basically slamming risk appetite. Whilst this has seen further calls for a recession, we’d want to see the service PMI also read tank before placing that bet.

ISM Manufacturing PMI data remains a firm favorite for predicting recessions, as it has done an excellent job since its inception since 1948 (albeit a few false signals). Yet times are changing. Data from the world bank suggests that as of 2017, the US Services sector accounted for over 77% of GDP. Therefor Services PMI could warrant a closer look in tandem with manufacturing PMI, to better access whether the US, in fact, is headed towards, or already, in a recession.

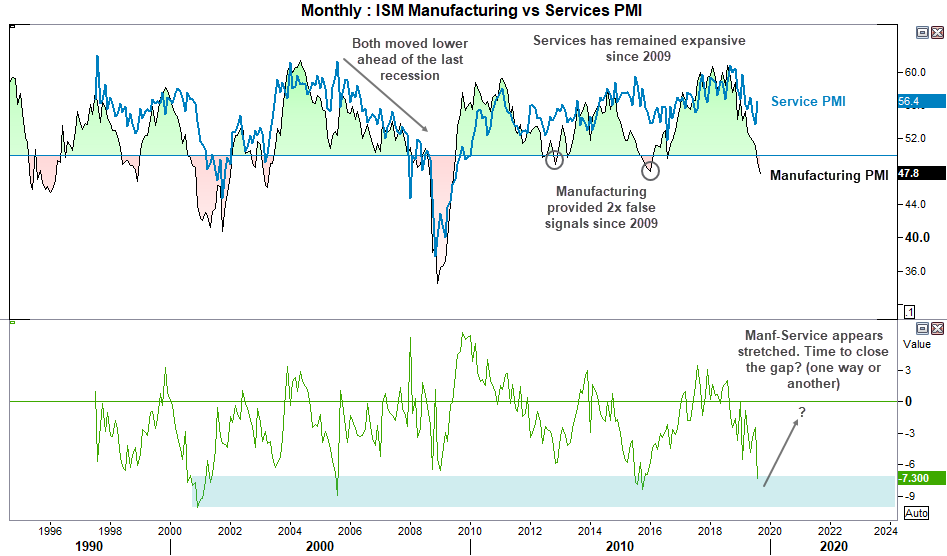

Upon first inspection, a clear divergence appears between the two; services PMI remains firmly expansive whilst manufacturing is contracting at its fastest rate since 2009. So, which one is correct?

Service PMI has remained expansive since the last recession in late 2009, whilst manufacturing PMI has provided two false signals in 2012 and 2016 (we’ll ignore the marginal, 1-month contractions around these key dates). On both occasions, service PMI remains defiantly expansive, and the US did not head into a recession.

However, when growth momentum for manufacturing declined between 2004 – 2008 and ultimately predicted a recession, service PMI weakened in tandem, essentially confirming the broad-scale deterioration of the broader economy. Yet this doesn’t seem apparent this time around.

That said, the spread between manufacturing-service PMI is reaching levels which usually prompts mean reversion which leaves the following scenarios:

- Service PMI drops to close the gap

- Manufacturing bounces to close the gap, or

- They meet somewhere in the middle.

Two out of those three likely ends with both in the expansive territory, so perhaps we’re not heading to the end of the world in recessionary terms yet.

Still, a weak manufacturing PMI is clearly bad for that sector. So should come as no major surprise to see the Dow Jones Transportation Index falling over -2.3%. The iShares Transportation ETF has been ranging between ~175 – 200 since April, but momentum is pointing lower, and prices appear to be headed for the lows. Given the bad numbers from manufacturing PMI, we’d expect the index to head for and break beneath 175 over the coming week/s.

Since the prior analysis, FedEx has broken out of a small, bearish pennant and the June 2016 low. The mixture of the trade war and contracting manufacturing are likely to weigh on the stock without a solid turnaround in sentiment, so we remain bearish. Over the near-term, we’d like to 147.82 holds as resistance, although we could also use 154.57 as a more conservative approach for risk management. For now, we’re waiting to see if the stock can, make its way down to the January 2016 low.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."