This article was written exclusively for Investing.com

- Lowe’s stock has fallen 24% from the 12-month high close in December of 2021

- The company just raised the dividend by 31%

- Earnings are growing at a robust pace

- The Wall Street consensus rating is bullish

- The market-implied outlook is slightly bullish

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Home improvement stores, notably Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) have thrived for years because of ultra-low interest rates and soaring housing prices. The pandemic provided a further boost as people made their homes more comfortable and functional to accommodate working from home.

Over the past year, however, these drivers of growth have diminished. People are spending less time at home, interest rates have risen, and consumer prices have escalated. Since reaching an all-time high close of $261.38 on December 10, 2021, LOW has subsequently fallen 24%. LOW has a year-to-date (YTD) total return of -23.8%, as compared to -25.5% for the home improvement retail industry (as defined by Morningstar) and -13.3% for the SPDR S&P 500 (NYSE:SPY).

Source: Investing.com

LOW reported Q1 results on May 18th, beating expectations on earnings but missing on revenues. Management focused on an unseasonably cold and wet April that reduced sales of seasonal items as the explanation for lower-than-expected sales. LOW has delivered consensus-beating earnings over each of the past 6 quarters, reflecting the overall strength of the home improvement market. The consensus for expected earnings growth over the next 3 to 5 years is 19.9% per year.

Source: E-Trade

Green (red) values are amounts by which EPS beat (missed) the consensus expected value

The EPS outperformance in recent quarters suggests that perhaps the substantial share price decline is an over-reaction. The P/E ratio, 15.93, is at almost a 10-year low.

I last wrote about LOW on November 22, 2021, at which time I maintained a buy / bullish rating. Since then, LOW has reported quarterly results for Q4 of 2021 and Q1 of 2022, beating earnings expectations for both. While the shares looked somewhat expensive in November, the Wall Street consensus rating was bullish, with a consensus 12-month price target that was about 9% above the share price.

Along with looking at fundamentals and the Wall Street consensus outlook, I rely on a consensus outlook derived from options prices, the market-implied outlook. In November, the market-implied outlook for LOW to mid-2022 was slightly bullish.

For readers unfamiliar with the market-implied outlook, the price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires.

By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated the market-implied outlook for LOW to early 2023 and compared this with the current Wall Street consensus outlook in light of the improved valuation.

Wall Street Consensus Outlook For LOW

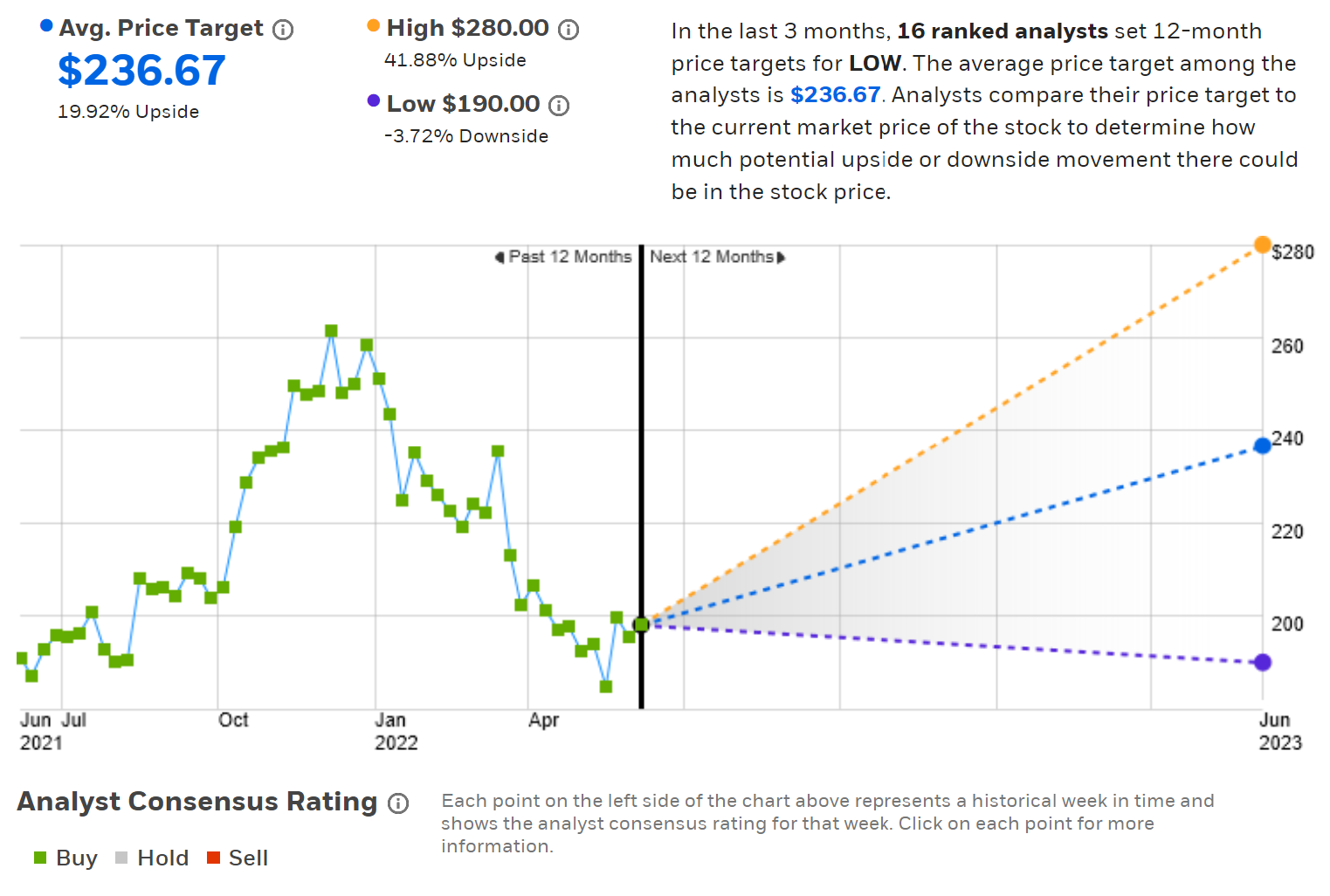

E-Trade calculates the Wall Street consensus outlook for LOW by combining the views of 16 ranked analysts who have published ratings and price targets over the past 3 months. The consensus rating is bullish and the consensus 12-month price target is 19.9% above the current share price. The consensus price target is slightly lower than it was back in November, but the share price has fallen by a much greater amount, so the 12-month price appreciation implied by the consensus is considerably higher now.

Source: E-Trade

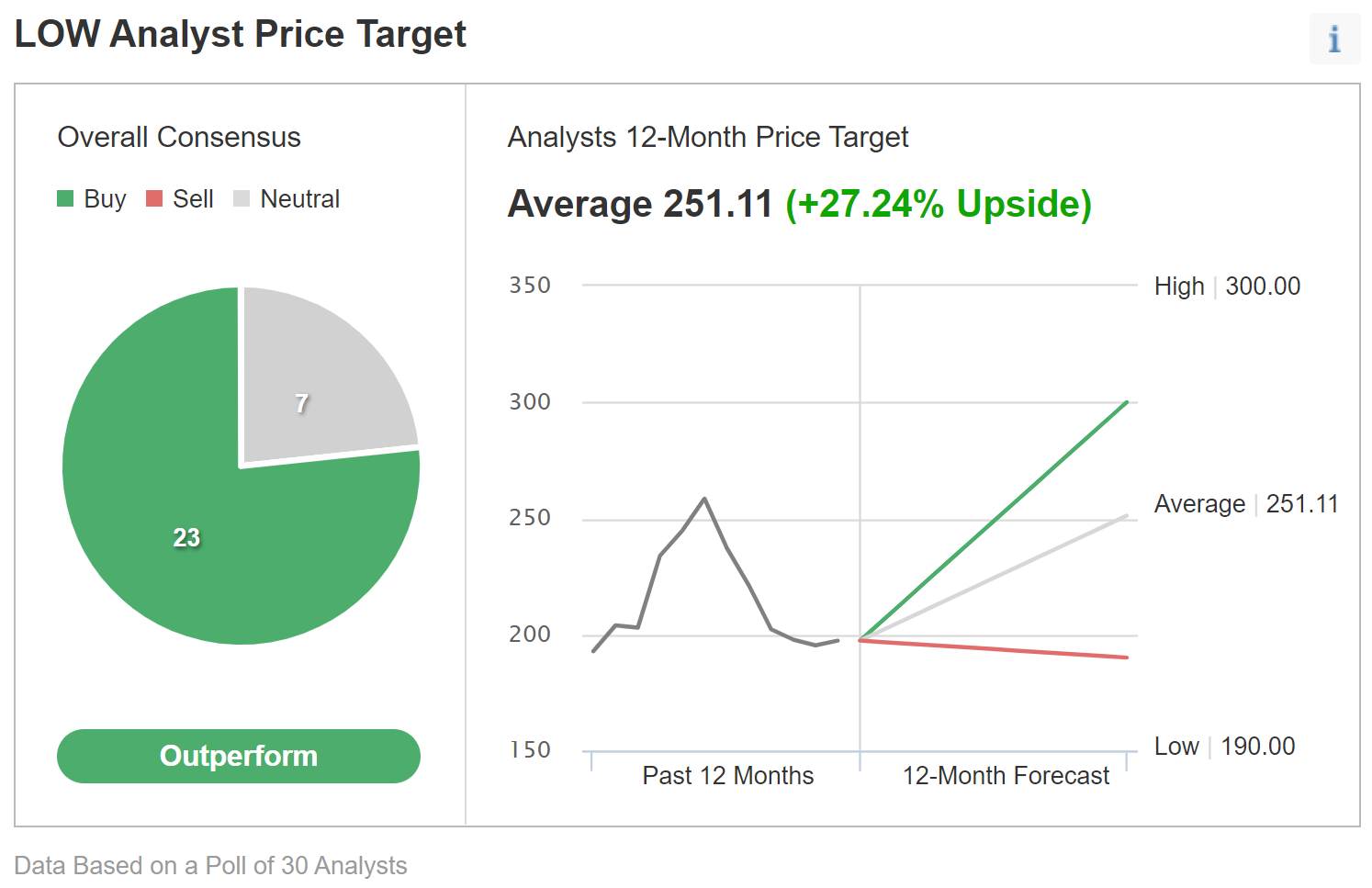

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 30 analysts. The consensus rating is bullish, consistent with E-Trade’s results, but the consensus price target implies considerably higher appreciation potential of 27.2%.

Source: Investing.com

The changes in the consensus price target relative to the share price indicate that the shares have been oversold, as compared to analysts’ estimates of fair value.

Wall Street Consensus Outlook For LOW

I have calculated the Wall Street consensus outlook for LOW for the 7.45-month period from now until January 20, 2023, using the prices of call and put options that expire on this date. I analyzed options with this expiration to provide a view into early 2023 and because the options expiring in January tend to be among the most highly traded.

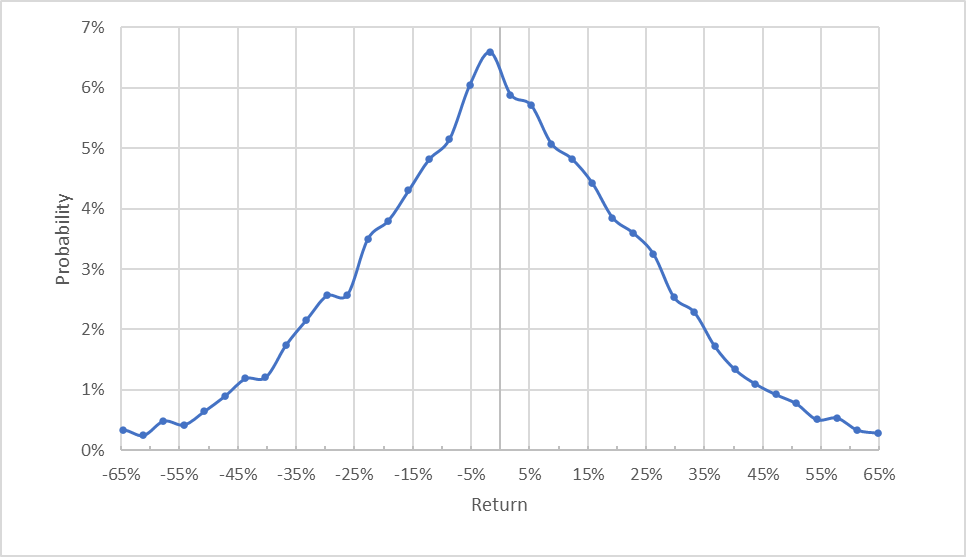

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to January 20, 2023, is generally symmetric, with comparable probabilities for positive and negative returns of the same size, although the peak in probability is slightly tilted to favor negative returns. The maximum probability corresponds to a price return of -1.75%. The expected volatility calculated from this outlook is 34% (annualized).

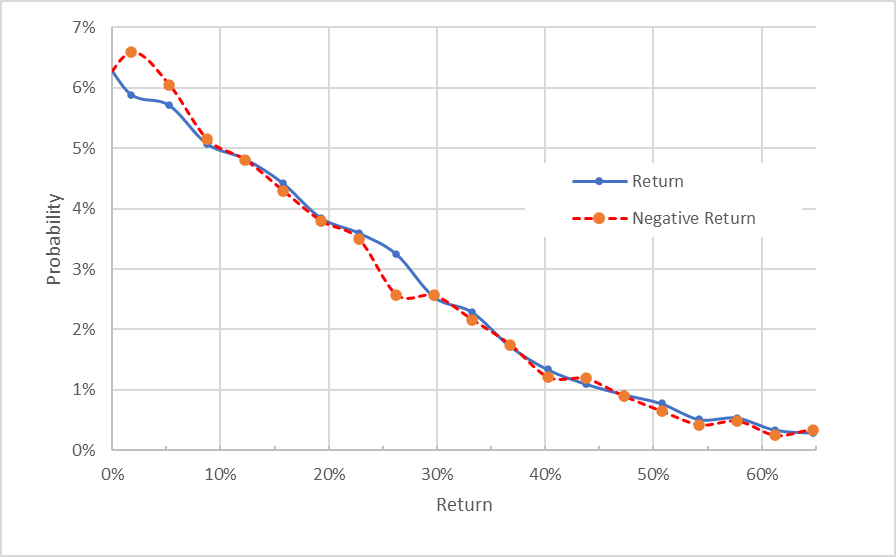

To make it easier to compare the relative probabilities of positive and negative returns directly, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

Note: The negative return side of the chart's distribution has been rotated about the vertical axis. This view shows that the probabilities of positive and negative returns match almost perfectly across the range of probabilities (the solid blue line is almost on top of the dashed red line).

Theory suggests that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk-averse and thus tend to overpay for downside protection (e.g., put options). While there is no way to measure whether this effect is present, the potential for this negative bias means that matching probabilities of positive and negative returns should be interpreted as a slightly bullish outlook.

This market-implied outlook is more bullish than the results in November.

Summary

In light of rising interest rates, which should temper the housing market, it is not surprising that investors have sold off shares in LOW as the broader market declines. However, the solid earnings for LOW in recent quarters suggest that the shares are oversold.

Furthermore, despite a strong earnings growth outlook, the stock currently trades at a 10-year low P/E level. The Wall Street consensus outlook is bullish, and the consensus 12-month price target implies a total expected return of 25.7% (averaging the E-Trade and Investing.com price targets and adding the 2.15% dividend).

The Wall Street consensus outlook is slightly more bullish than in November. As a rule of thumb for a buy rating, I want to see an expected 12-month total return of at least half the expected annualized volatility (34%). Even with a significant discount to the Wall Street consensus price target, LOW can meet this criterion. I am maintaining my overall rating of buy/bullish for LOW.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »