As the metals market enters the last quarter of what has been another turbulent year, the industry prepares to gather in London for a week of meetings and contract negotiations.

Although the macro conditions are starting to look brighter, and the Federal Reserve’s long-awaited rate cut has calmed sentiment, uncertainty surrounding the forthcoming US presidential election is dampening risk appetite.

With geopolitical tensions lingering, a still uncertain recovery path for China's economic recovery, despite the recent stimulus boost, and rising protectionism, the uncertainty in the metals markets is far from over. Here’s what we expect people to be talking about:

The Fed

Elevated rates and a stronger dollar have been a drag on industrial metals consumption. The Federal Reserve had held its key policy rate in a target range of 5.25% to 5.5% - the highest level in more than two decades - since last July until earlier this month when the central began an easing cycle with a 50bp cut to interest rates and signalled further reductions at remaining meetings this year.

This has boosted sentiment in the metals complex. We believe a weaker US dollar and declining borrowing costs resulting from the coming rate cuts will slowly improve demand and help the recovery in interest-sensitive sectors like construction and building, with lower rates easing borrowing costs for manufacturers.

However, there is a risk that demand could weaken further if inflation remains persistent or if it rebounds, potentially triggered by tariff increases from a new government.

Our US economist’s forecasts are broadly in line with what the Fed is indicating – with rates expected to come down to 3.5% or a bit below by next summer on the basis that prompt action from the Fed allows the US economy to avoid recession. However, he acknowledges that the jobs market outlook is more concerning and the risks are indeed skewed to the Fed having to do more, and more quickly.

China

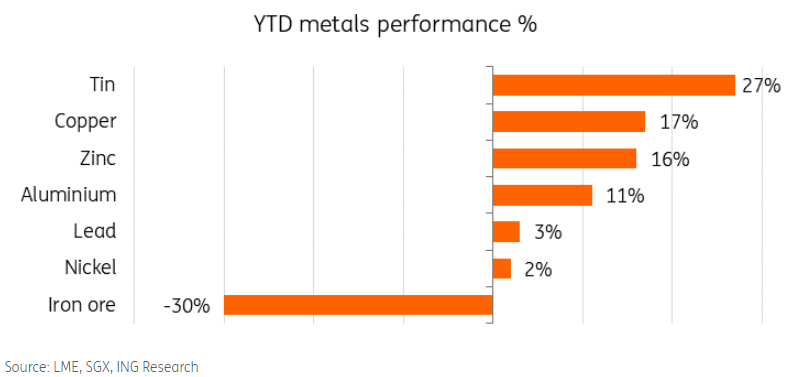

China, the world’s biggest consumer of metals, has been a drag on metals demand for over two years. A broad economic slowdown and, in particular, the crisis in the property sector has seen copper and other industrial metals prices slump.

But this week, copper and other industrial metals got a boost after Beijing called for more measures to support its property sector, crucial for metals demand, and vowed to reach the country’s annual economic goals.

On Thursday, the official Xinhua News Agency reported that China’s Politburo will push for the real estate market “to stop declining” and called for “forceful” rate cuts. This followed a raft of stimulus measures earlier in the week to boost its flagging economy.

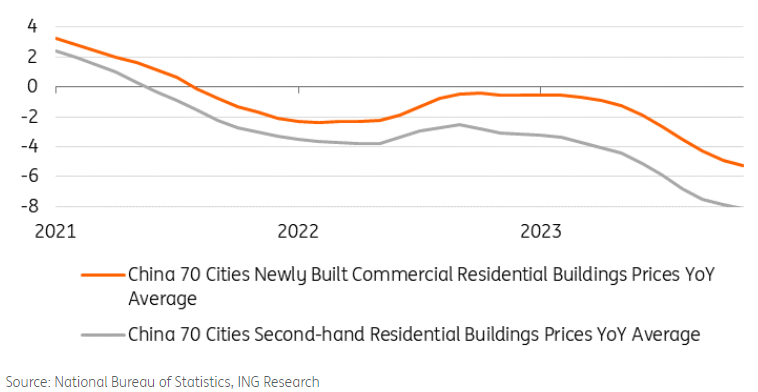

We have seen plenty of property support measures this year, but they have thus far been insufficient to have a meaningful impact on industrial metals demand.

Our China economist believes that this month’s measures are a step in the right direction, especially as multiple measures have been announced together rather than spacing out individual piecemeal measures to a more limited effect. However, he continues to believe that there is still room for further easing in the months ahead and if we see a large fiscal policy push as well, momentum could recover heading into the fourth quarter.

For a recovery of the property market, our China economist believes, two things need to happen. First, we need to see prices stabilise if not recover. Second, we need to see excess housing inventories come down towards historical norms. Until then, the drag on growth will continue.

We believe the continued weakness in the sector remains the main downside risk to our outlook for industrial metals. We believe that until the market sees signs of a sustainable recovery and economic growth in China, we will struggle to see a long-term move higher for industrial metals.

Protectionism

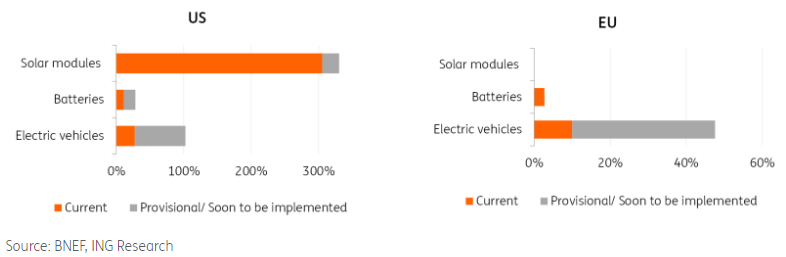

In recent years, the energy transition has been hit by a surge in protectionist policies in an attempt to rein in China’s clean-tech supply chain dominance.

China is the biggest producer of electric vehicles and EV batteries globally and every automaker relies on China for its EV batteries and other components. It also dominates global supply chains of critical raw materials needed to make EV batteries. This is a result of Beijing’s early push towards electrification, particularly through subsidising EVs.

The energy transition has become a key focus for many governments while global trade and political tensions have prompted a reconsideration of global supply chains.

The US and the EU are both poised to raise duties on China’s clean-tech sector to protect their domestic manufacturers.

The push for localisation represents a shift away from the era of unrestricted free trade in recent years with supply chains and trade flows likely to undergo significant changes in the coming years while geopolitical tensions continue to linger.

The rise in protectionist measures, if successful, could foster more resilient supply chains, however, it could also slow down the pace and increase the cost of the energy transition, impacting the scale of investments, supply, and prices. We believe policy and politics will continue to play an increasingly large role in the future of clean-tech supply chains while a continued trade war could be another drag on metals demand long term.