US: trend towards weaker hiring in November jobs report expected

We are building up to the Federal Reserve’s 13 December FOMC meeting, where the widely held view is that the central bank will leave its policy rate unchanged at 5.25-5.5% and will remove the final rate hike it had pencilled into its forecasts. Whether it chooses to formally signal we are at the peak for the policy rate is uncertain – but the market is convinced, with more than 100bp of rate cuts now priced for 2024. We are looking for 150bp of cuts next year on the basis that consumer weakness will drag the US growth story much lower, given stagnant real household disposable incomes, diminished household savings and reduced access to consumer credit via bank caution and painful borrowing costs.

Next week’s data highlight will be the November jobs report. October’s was much softer than expected, so there is cope for a bit of a recovery, but the trend is towards weaker hiring, as signalled in the recent Fed Beige Book and the rise in continuing jobless claims. The unemployment rate is expected to stay at 3.9%, but we soon expect it to break above 4%. Subdued wage growth should reaffirm the market’s view that the inflation pressures from the jobs market are weakening fast, aided by improving productivity growth.

Hungary: Headline and core inflation will show lack of repricing power

We're looking forward to an action-packed, heavy calendar in Hungary next week. The first batch of data comes on Wednesday with October industrial and retail performance. With new capacity coming on stream in the export sector, we expect an improvement on a monthly basis. Thanks to the base effect, the year-on-year reading will be close to zero. Fuel prices are falling, supporting the recovery of retail sales. Disinflation will also improve food sales, while non-food retailers will continue to face a lack of demand. As a result, after a strong month-on-month performance, we see a marked improvement in the annual index – although a full recovery is still a long way off.

Friday will bring us another set of important data. First and foremost, both the headline and core inflation figures will show the lack of repricing power, and due to the base effect, both readings will fall by around 2ppt compared to the October figures. A strong export performance in industry will keep the trade balance in a large surplus. Speaking of surpluses, November could also be a strong month for the budget, thanks to recent one-off receipts from the sale of state stakes in some companies and dividend prepayments from state-owned utility company MVM.

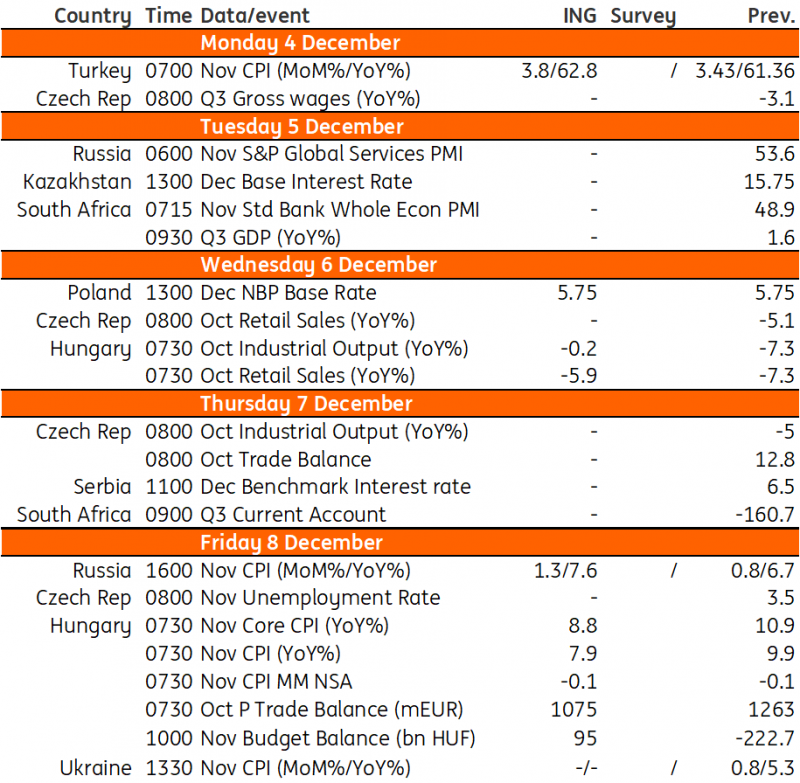

Key events in developed markets next week

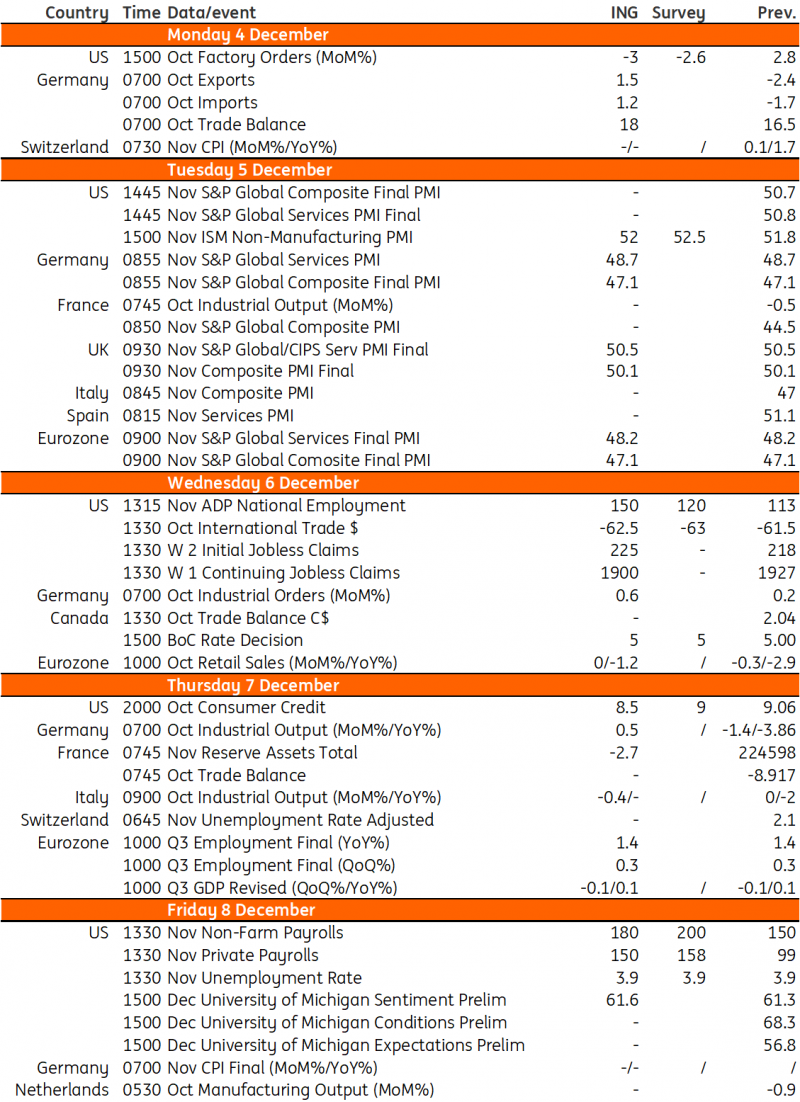

Key events in EMEA next week

Key events in EMEA next week