Labour market data are a seemingly intuitive way to understand the economy. If employment is up and unemployment is down, economic conditions are positive, and vice versa. Because of labour data’s apparent importance, financial publications we follow regularly trumpet employment reports’ latest results and their potential downstream effects. But when Fisher Investments UK reviews such supposedly telling labour market indicators, we find them late-lagging and of little significance to equity markets.

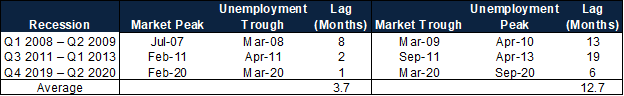

As Exhibit 1 shows, labour market turning points tend to lag equities. Take the three most recent eurozone recessions – deep and/or prolonged economic contraction – as defined by the Centre for Economic Policy Research-Euro Area Business Cycle Network (the eurozone’s official recession arbiter). In all cases, bear markets (fundamentally driven equity market downturns exceeding -20%) associated with them preceded the recession and rising unemployment rates.

Exhibit 1: Unemployment Lags Equities and Economic Growth

Source: FactSet, as of 9/9/2024. MSCI Economic and Monetary Union (EMU) Index returns with net dividends and eurozone unemployment rate, 31/12/1999 – 31/8/2024.

Unemployment’s April 2013 peak, for example, trailed eurozone markets’ trough by 19 months – the entirety of 2011 – 2013’s recession, underscoring how equities generally lead the economy and labour data. This fits with Fisher Investments UK’s reviews of historical market data showing equities look forward and generally price in likely economic outcomes around 3 to 30 months in advance.

In contrast, labour data usually lag, providing only a backward-looking snapshot of past economic conditions. Why? Consider how a hiring manager might weigh employment decisions. Onboarding new employees often takes considerable company resources and expenses (e.g., recruiting, interviewing and training). When Fisher Investments UK reviews corporations’ hiring practices, we observe they typically delay increasing their payrolls until client demand forces them to add headcount to meet it – well after economic conditions have brightened. We find corporations favour workforce additions as a last resort, preferring to make do with what they have until necessary.

Similarly, because businesses generally value their firms’ human capital – amongst their most valuable assets – we have noticed they are reluctant to let workers go, even when times start to get tough. When confronted with cost cuts amidst navigating a challenging economic period, companies try to avoid layoffs unless there is no alternative, often choosing instead to prioritise expense reductions elsewhere (e.g., expansion plans, marketing, inventories, bonuses and administrative overhead), based on our observations. Fisher Investments UK’s reviews of corporate behaviour find most firms don’t want talent they invested heavily in going to waste if they don’t have to, knowing that the time, effort and costs of replacing it later could put them at a substantial competitive disadvantage.

Now consider the investment implications of this: job reports reflect information that are an after-effect of economic growth, based on Fisher Investments UK’s reviews of corporations’ aggregate employment decisions. In our view, this puts job indicators on the business cycle’s trailing edge, whereas equities are at the forefront, moving ahead of economic trends before they become widely evident.

So how can investors put this insight – labour’s lagging nature – to work? Financial commentators we follow tend to place an inordinate amount of importance not only on what job reports allegedly reveal about the current state of the economy, but its future. As our research shows, though, this is mostly noise and incidental to forward-looking equities. We think investors can tune out chatter about what employment trends supposedly predict for the economy and markets.

However, we do think labour measures are useful to follow from another perspective: gauging sentiment. Whilst Fisher Investments UK’s reviews of employment data find they don’t drive equities’ direction, broad reactions to job growth data – and attitudes to labour markets in general – are one way to determine whether people are largely pessimistic or optimistic about the economy. The degree to which this weighs on – or buoys – expectations can make it easier (or harder) for reality to clear them.

Fundamentally, in our estimation, it is this gap between reality and expectations that moves markets most. The dourer moods are, particularly to factors like employment reports that have little bearing on future economic growth, the greater the likelihood outcomes turn out better than appreciated – sending equities higher – and vice versa.

As Fisher Investments UK reviews labour market data, don’t look to any such series for where reality will go, but for how folks are feeling and whether that is justified or not when assessing how the economic outlook likely evolves over the foreseeable future.

Disclosure:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.