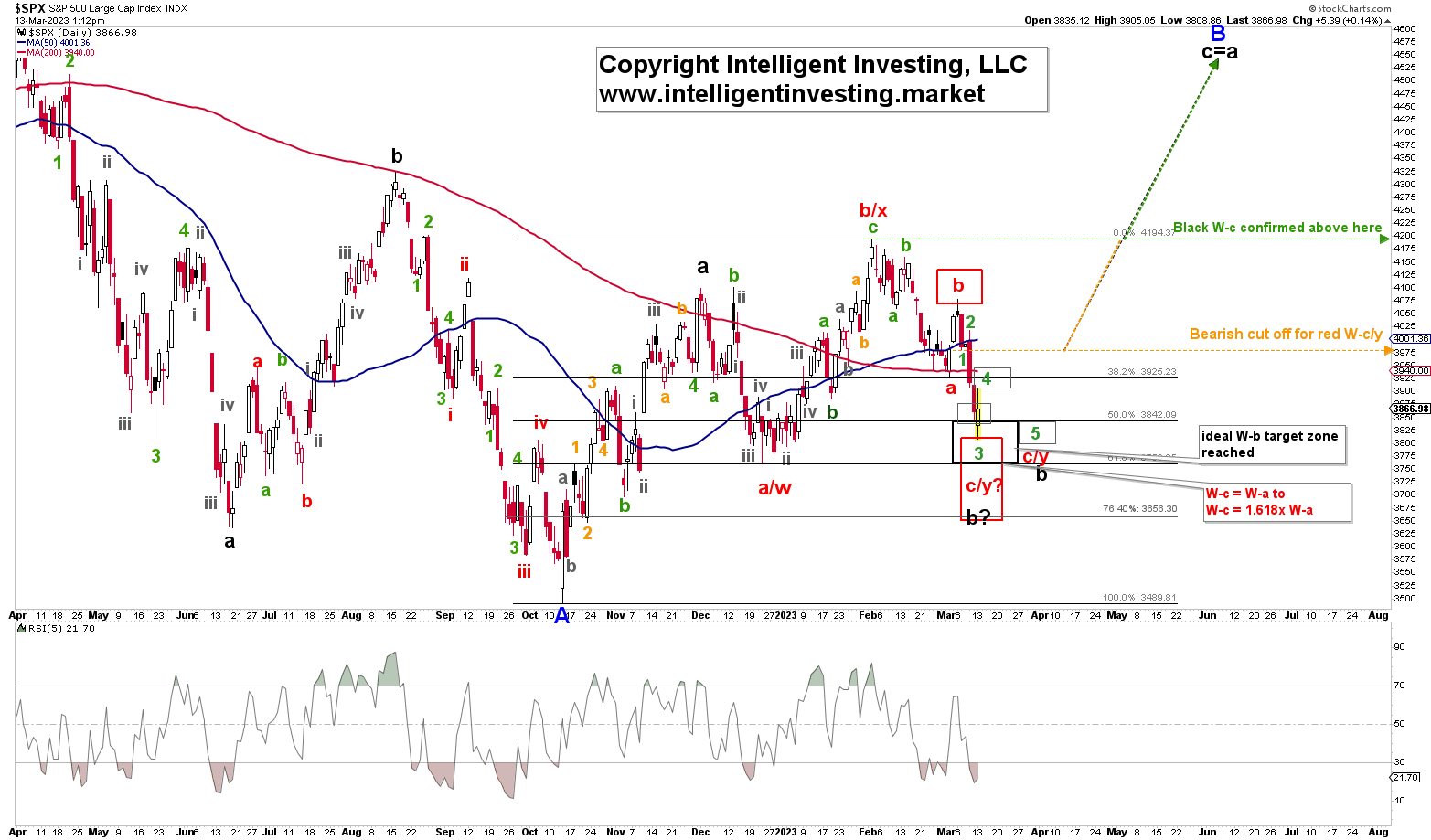

Over the last several weeks, we have been tracking two Elliott Wave Principle (EWP), counts for the S&P 500 (SPX) as the price action has been less-than-ideal, i.e., overlapping and stated,

"Our primary expectation is for a three-wave move to ideally 4272-4374, but we must now be cognizant that the index could stall out at around 4100+/-50 before heading down to 3700-3800.

The first order for the bulls is a move above the … 4028 high, followed by a break back over the February 17 high at 4081."

The SPX rallied early last week to as high as 4078, but not above the critical 4081 level, and continued throughout the week lower. It closed on Thursday, March 9 at 3918, which was our cue that the market chose the alternate "detour" route. See Figure 1 below.

Figure 1.

Indeed, we gave the EED option plenty of room to materialize. It all looked good up to last Wednesday, but we finally got our answer the next day. Moreover, although we expected a more complex, subdividing red W-b, we only got a three-day rally.

In hindsight, this matches better with the average seasonality for the S&P 500 during US Presidential Pre-election Years. See Figure 2 below. It has a high in early March and a low around mid-March. Note these pattern comparisons are not about the magnitudes but about when the lows and highs are expected, which are all +/- 2 to 3 days.

Figure 2

Back to the price chart in Figure 1, we find that although it would look better on a daily time frame with a more pronounced green W-3, 4, 5, the hourly resolution (not shown here) does suggest red W-c/y can be considered complete.

Besides, the index reached the upper end of the red target zone where red W-c = W-a. Thus, a move back above the green W-1 low at 3980 will tell us the current decline is over. The index will then have to break above the February high to confirm black W-c is underway, which could rally to as high as 4500+ for a standard c=a relationship. Sounds outlandish?

Focusing on the seasonality chart in Figure 2 suggests a rally into May, possibly even July. And although the markets do not have to follow average seasonality at all, the current decent YTD correlation suggests it will. We know from the EWP that a rally above 3980 which stalls at ~4075+/-25 and then drops below today's low means the index is well on its way to the mid-2000s.