2021 has been the year of the retail investor. In the wake of the Covid-19 pandemic, we’ve seen individual investors gain so much power across Wall Street that they’ve been able to coordinate and bite back against their institutional counterparts through calculated short squeezes. Retail investors have never had the collective buying power that they have today, so why are they so obsessed with buying nostalgia stocks?

The short squeeze of GameStop (NYSE:GME) stocks that shocked WallStreet in January should’ve been regarded as a warning sign for what’s to come. Retail investors coordinated across Reddit group r/WallStreetBets squeezed the price of the beloved video game retailer from their collective childhoods to send prices surging 1,600% in a matter of days.

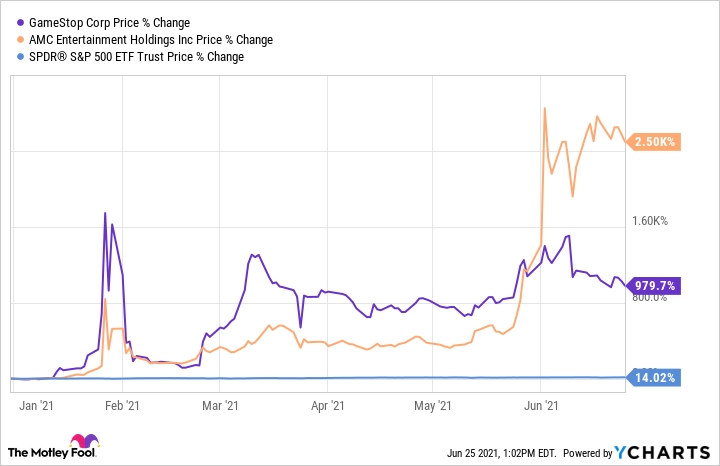

(Image: Motley Fool)

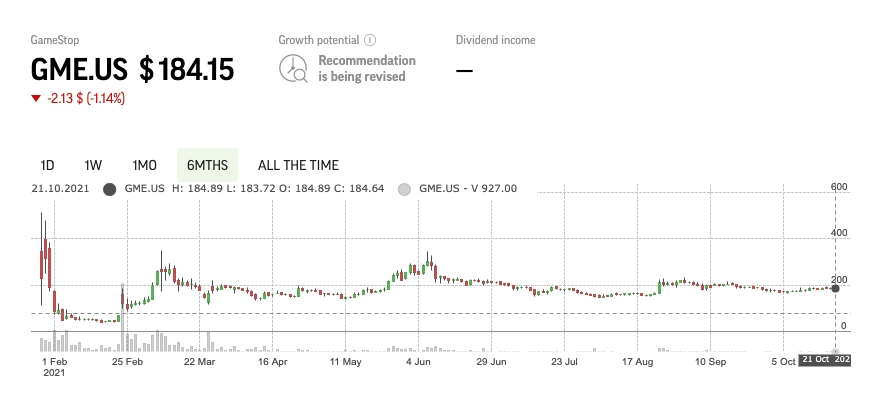

Although the coverage that the GameStop short squeeze got was extensive, the rally was overtaken in late may by another squeeze, this time on AMC Entertainment, a US cinema chain. AMC’s share value climbed to 2,500% of its value at the start of the year. According to Freedom24, GameStop is currently trading at $184.15 per share - showing a significant drop from its peak 9 months ago.

The rallies of GameStop and AMC have demonstrated that retail investors have the ability to mobilise and coordinate their investments to cause surges that can outmanoeuvre their hedge fund and institutional counterparts.

Significantly, both GameStop and AMC are investments that are largely sentiment-based. Neither company is working on innovations that could spark a rally, and both stocks have been consistently shedding their value prior to 2021. The key driving force behind these squeezes is that both GameStop and AMC are largely nostalgia-based.

As a result of this more meme-based approach to investing, there are many financial news platforms adapting their output to speculate on where the next meme investment ideas may be.

The Rise of the Retail Investor

The driving force behind the rise of nostalgia investments is the rise of retail investors who, as a result of the Covid-19 pandemic, have been able to invest government stimulus packages into stocks and shares at a rate that’s never before been possible.

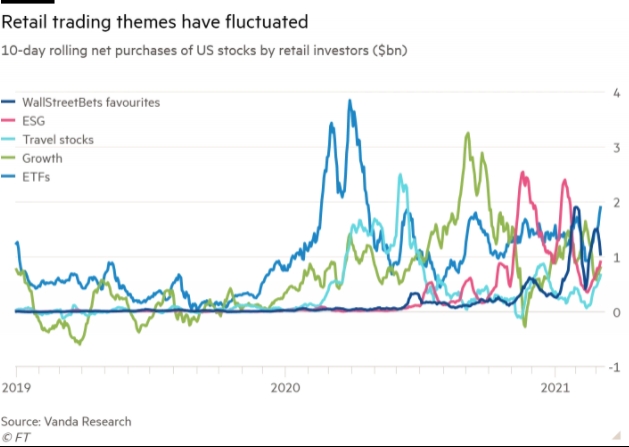

(Image: Financial Times)

Although the chart above shows that the net purchases of US stocks by retail investors is extremely erratic, we can see significant increases in purchases across the board when comparing pre-Covid-19 investing patterns and post-Covid-19 investments.

Amidst the chaos, we can see that WallStreetBets favourites, the meme stocks that have punctuated much of the start of 2021, have climbed from relative obscurity to reach almost $2 billion in net purchases at the beginning of the year.

This new generation of investors arriving on the marketplace is increasingly becoming known as ‘Robinhood investors’ in reference to the app in which 60% of US investors are using to access the equities market.

These new entrants are generally first-time investors who are younger and often belong to the millennial generation. Stimulus packages have allowed them to absorb greater risk in their portfolio and they are less likely to utilise a buy-and-hold strategy - which may explain much of the fluctuations we can see in the chart above. Essentially, these younger investors are entering the market in a bid to get rich quick.

Investing in Nostalgia

Why has this sudden influx of millennial investors correlated with the rise of nostalgia-based investing? It appears that millennials are better placed to allow the reliving of positive memories from the past to have a more profound effect, according to Forbes reporter Laura Friedman.

Alongside busy schedules and mounting responsibilities, fond memories can resonate for the millennial generation, leaving us more responsive towards the growing sentiments surrounding nostalgia stocks. When they care or feel for something, millennials are more likely to act - as are many of us. By sharing a compelling reference from the past with a millennial, they’re more likely to respond on a more emotional level, which can work wonders in the world of investing and the marketing of stocks alike.

In an age that’s populated by impersonal digital media, the building and maintaining of social connections through nostalgia is an easy way to build sentiment and optimism on a foundation of shared childhood memories. This marketing of nostalgia has been pushed beyond the realms of finance and has spilled into advertising too.

By associating brand messaging with rose-tinted references to the 80s and 90s, brands can be humanised to the point where connections are leveraged and individuals are willing to actively buy into stocks with little in the way of fundamentals because they feel an emotional attachment.