US stocks fell on Tuesday

Yesterday was the first trading day of the week because the market was closed on Monday for Presidents day.

All three major indexes have registered losses.

The S&P 500 finished at -2.00%, the Nasdaq ended the trading session at -2.50% and the Dow Jones dropped nearly 700 points at -2.06%.

The reasons behind the negative movement are the worries about interest rate increases by the Federal Reserve.

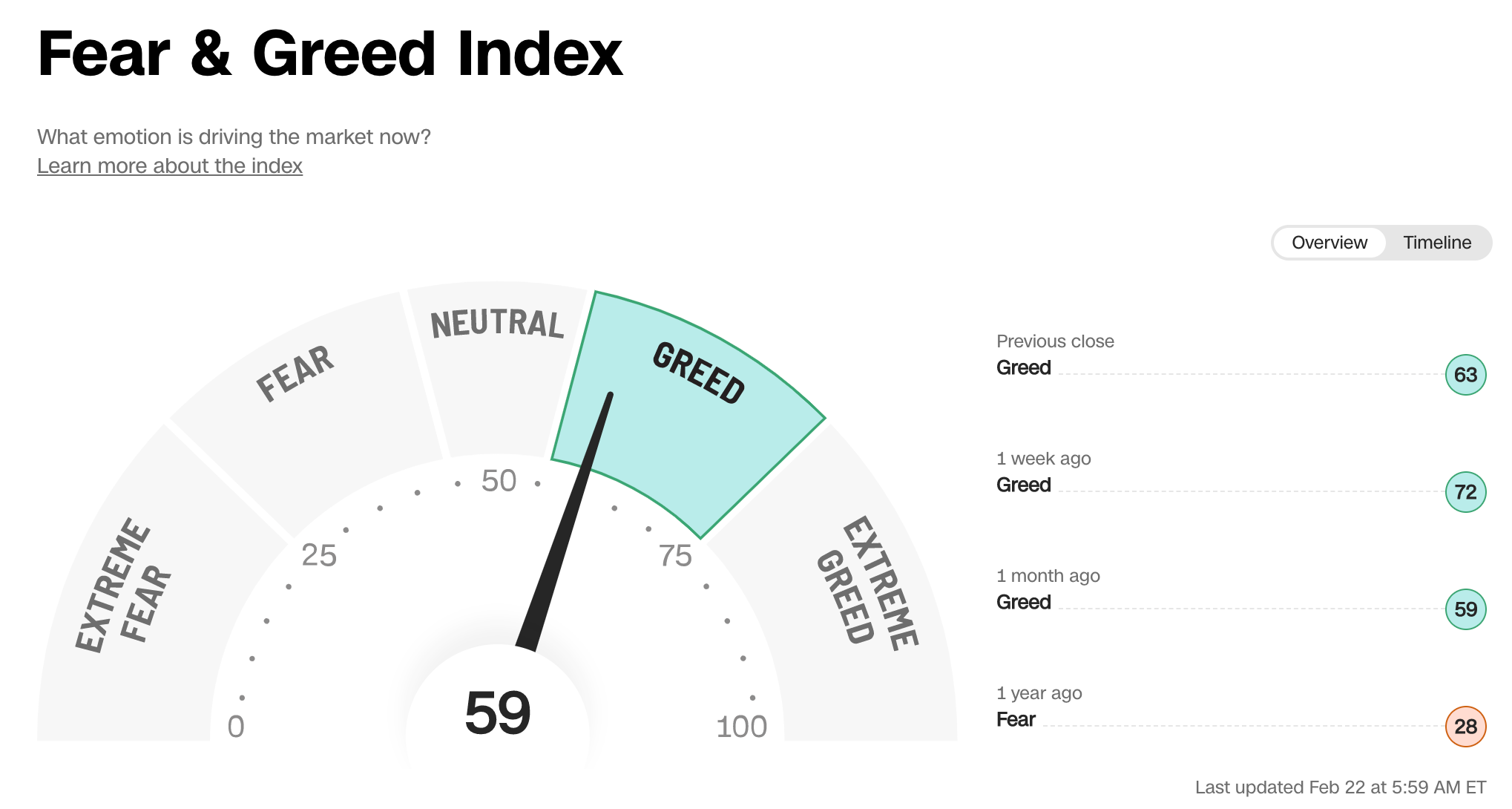

The investors' sentiment remains bullish as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 59 in the “Greed” mode, but far less than the data registered one week ago.

Investors' fears about the next Fed's action

The latest economic data in the US have shown a strong economy.

CPI and PPI went up more than expected.

Retail sales rose to the biggest monthly percentage in almost two years.

The labour market remained strong.

Investors are worried that since the economic data are still robust the Federal Reserve will raise interest rates higher and for a longer time than expected.

This scenario could lead to severe economic damage and possibly a recession.

What to watch today

The meeting minutes, of the US central bankers, which happened on January 31 and 1 February, are going to be published today at 19:00 GMT.

During the last meeting, Fed's members voted unanimously to raise the interest rates by 25 basis points but in a recent speech, two Federal Reserve officials (without voting rights) expressed their favour of a 50 basis points rate hike.

Investors are looking forward to see the releasing the FOMC meeting minutes to know about the next Fed's action.

Based on the latest economic data and the hawkish Fed officials' comments, some traders believe that during the next gathering, the US central bankers will increase the rate to 50 basis points in March.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Investors' fears about the next Fed's action

Published 22/02/2023, 12:24

Investors' fears about the next Fed's action

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.