Much to talk about in the week ahead briefing despite it being a holiday-shortened week. From rate decisions from the European Central Bank and Bank of Canada to earnings from the big US investment banks and US CPI

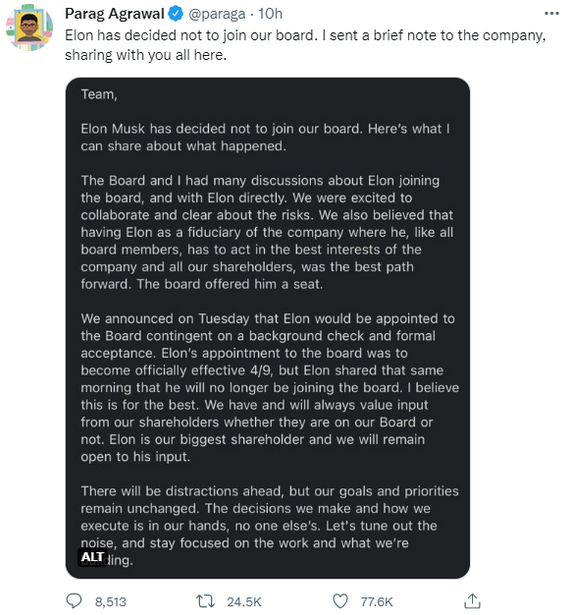

ELON MUSK SOAP OPERA

Elon Musk has decided not to join the board of Twitter (NYSE:TWTR) but the Tesla (NASDAQ:TSLA) boss remains Twitter's largest shareholder and the firm will remain open to his input. Addressing Mr. Musk's decision to decline a seat on the board, Twitter CEO Parag Agrawal said: "I believe this is for the best".

FRENCH ELECTION UPDATE

Macron and Le Pen will face off in the final Presidential vote on the 24th April, pitched as the battle of two different versions of France. Macron likely characterised as Pro Europe, elitist, President of the rich vs Le Pen framed as being a Putin sympathiser and a risk for France and liberal world order. Expect French markets to get a little jumpy over the coming 2-weeks.

RETALIATION BITES

United States 10-Year yields have breached the top of a 30-year downward trend channel. Yields are now trading at 2.7%, the highest since March 2019 after the Fed minutes.

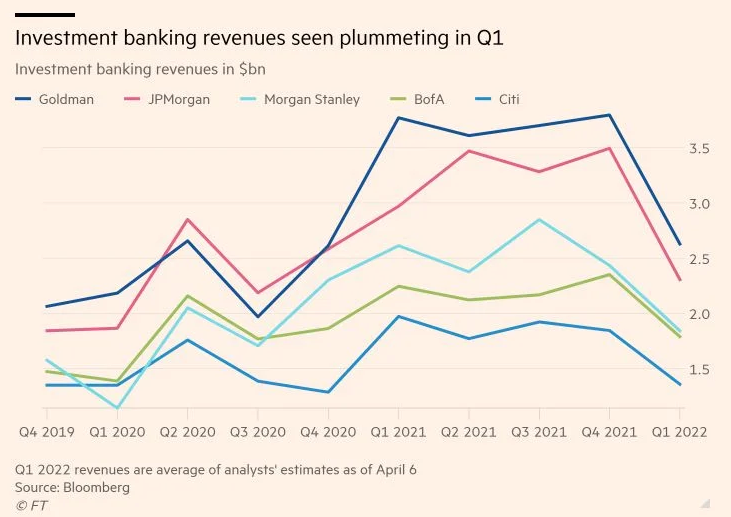

INVESTMENT BANK FEES TO PLUMMET

This week the big US investment banks such as JPMorgan Chase & Co (NYSE:JPM), Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) kick off Q1 earnings season where expectations are for the biggest slowdown in IB revenues in recent years (More).

Thanks for reading and catch you tomorrow!