Gold prices set for weekly gains on dovish Fed outlook; silver near record high

Once synonymous with innovation, Intel (NASDAQ:INTC) is now in deep crisis. While competitors such as Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD) and TSMC are celebrating records due to trends such as AI and cloud computing, Intel is fighting for its existence. Now the previous CEO Pat Gelsinger has resigned unexpectedly – a signal of the seriousness of the situation.

Strategic mistakes

Intel's decline began with its failure to capture the mobile market. As early as 2007, it rejected a possible chip deal with Apple (NASDAQ:AAPL), which competitors such as Samsung (LON:0593xq) and later ARM-based manufacturers took advantage of to displace Intel. The cooperation with Apple finally ended in 2020, when Apple switched to its own chips. With success, as we know today.

In addition, there were technical setbacks: while TSMC and Samsung introduced modern technologies such as extreme ultraviolet lithography (EUV), Intel stuck with outdated processes. Result: smaller and more efficient chips from the competition displaced Intel's products. The booming AI industry is also dominated by Nvidia and AMD today – a market that Intel slept through.

Technical and operational setbacks

Security problems such as the ‘Downfall’ vulnerability in August 2023 further damaged Intel's reputation. A necessary patch cost users up to 50% system performance. At the same time, initiatives such as Intel's entry into the GPU market with ARC GPUs (2022) were unsuccessful – the market share fell to almost zero per cent, according to analysts.

Even Gelsinger's plan to position Intel as a chipmaker for external customers has failed so far. Burst deals, for example with Sony (NYSE:SONY), prevented urgently needed revenue.

Government support as a lifeline

Nevertheless, Intel is receiving backing from the US government, which considers the company to be strategically important. Most recently, Intel secured almost $8 billion in government funding under the CHIPS Incentive Programme.

New leadership, uncertain future

The dual leadership of CFO David Zinsner and Michelle Johnston Holthaus faces immense challenges: a restructuring plan could cost 15% of the workforce, and plants in Poland and Germany are to be closed. The first rays of hope are offered by deals with Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) and the launch of a new production process (18A) – albeit not before 2027. However, the gap to its competitors remains enormous. Once upon a time, ‘Intel Inside’ stood for innovation – today, the company is fighting to remain relevant at all.

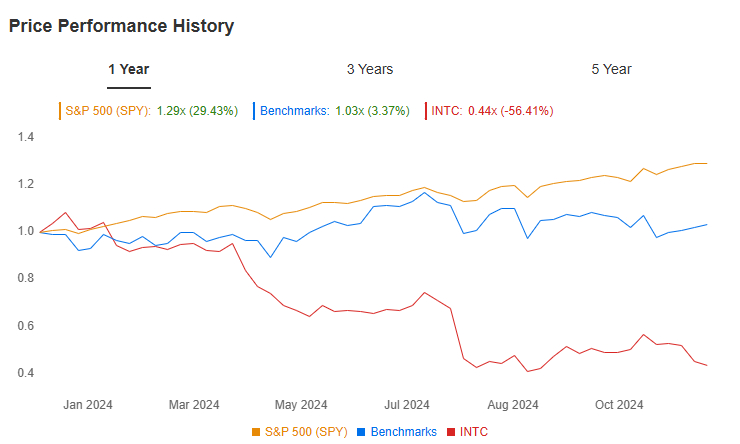

The market is completely re-sorting itself. Just as German carmakers underestimated the growing competition from China, Intel slept through the AI boom and underestimated Nvidia. Intel's stock is in free fall. If it doesn't turn things around soon, Intel could become a penny stock. Find out what matters now on our website. Take your chance and test us for a full 14 days for free.

A blanket bet on stocks like ASML (AS:ASML), Samsung, Apple, AMD and TSMC could also backfire. The market is much more complex. AMD has a good chance of catching up further, while Samsung's stock is in free fall, even though the company is well positioned in the market and can secure further market share by contract chip manufacturing. At ASML, we are also still waiting for a breakthrough, which has not yet happened.

Stocks follow their own complex logic that you have to understand to be successful in the market in the long term.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.