InMed Pharmaceuticals’ (INM’s) Q222 financial results reflect its evolution from a pure-play biotech firm to one with commercial sales to the health and wellness market, with revenues of $0.3m, all cannabichromene (CBC). As of January, it also began selling cannabicitran (CBT) to the health and wellness market. The now-completed BayMedica acquisition boosts its product portfolio for rare cannabinoids and rounds out InMed’s manufacturing capabilities. INM continued advancing its drug development programs, including its ongoing 755-201-EB Phase II trial and preparing for an INM-088 FDA pre-investigational new drug meeting to treat glaucoma.

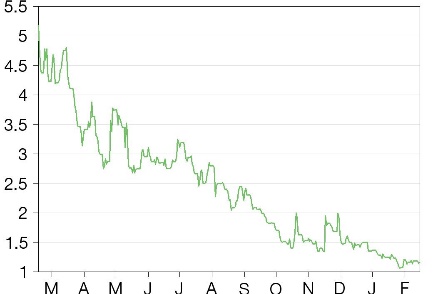

Price - $1.16

Market cap - $16m

Share price performance

Business description

InMed Pharmaceuticals is a Canada-based biopharmaceutical company focused on manufacturing and developing cannabinoids. Its biosynthesis platform may be able to produce cannabinoids for less cost and with improved purity compared to currently used methods. The company is also developing a proprietary pipeline, including INM-755 for epidermolysis bullosa and INM-088 for glaucoma. The BayMedica acquisition added a complementary commercial product pipeline for the health and wellness market.

Q222: Results reflect BayMedica acquisition

InMed reported its first post-BayMedica acquisition (13 October 2021) results, with revenues of $0.3m from BayMedica’s sales. Net losses grew to $4.3m versus $1.9m in Q221, driven by increased R&D and G&A expenses from INM-755’s clinical trials, acquisition expenses and the inclusion of BayMedica’s operating results. With $11.3m of gross cash, management expects to have sufficient cash to fund opex and capex into Q123.

Extending focus to the health and wellness market

With the BayMedica acquisition, InMed has expanded its focus towards the health and wellness market, introducing B2B sales of CBT in January as well as planned product launches of CBDV and THCV in H222. Furthermore, InMed has several other high-value, rare cannabinoids in various stages of development. Management anticipates that this product pipeline will generate substantial revenue growth in the next several quarters, and to support this growth of wholesale B2B revenues, InMed announced the hiring of a VP of sales, Gerard P. Griffin III.

Notable advances in pharma drug development

InMed also announced several notable advances in its drug development program. Enrollment for the 755-201-EB trial (to treat Epidermolysis bullosa) began in December and management expects to complete it during CY22. Also in December, INM announced a peer-reviewed scientific article regarding using CBN to treat glaucoma. It continued preparing for its FDA meeting re: INM-088 and also filed an international patent application for using rare cannabinoids to treat neurodegenerative diseases such as Alzheimer’s, expanding its IP portfolio.

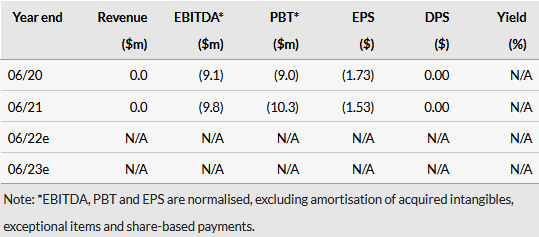

Valuation: Forecasts under review

Our forecasts are under review, and we will update our model and valuation to reflect the BayMedica acquisition in an upcoming Outlook note.