- Focus shifts to the key inflation data due today

- This data will play a pivotal role in deciding the year-end rally's fate

- Decline in shelter inflation has continued, increasing odds of a lower-than-expected number

Today could be decisive in terms of determining whether the stock market's year-end rally will materialize, as all eyes turn to the looming inflation report.

Inflation, a driving force in the markets for the past two years, directly influences rate decisions by the Fed and ECB. Powell has repeatedly said that the Fed is focused on getting inflation back toward the 2% target.

So, let's shift our focus to the market's expectations to see if we could get any closer to that target today.

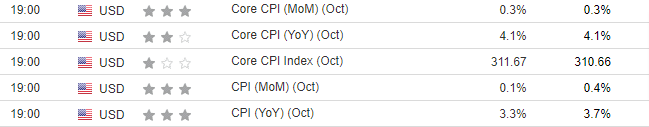

Our economic calendar anticipates a nearly flat core CPI, signaling minimal change, along with a decline in both monthly and annual CPI figures.

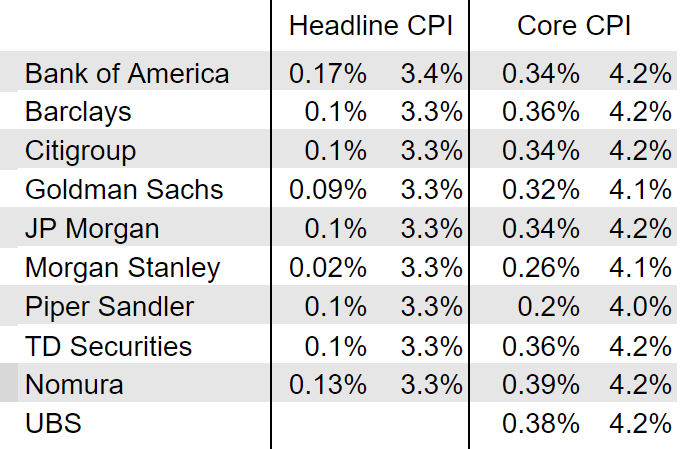

However, major investment banks offer a slightly different perspective, as illustrated below:

Source: The Internet

Specifically, while expectations for the CPI figure align, showing a decline at +0.1 percent change on a monthly basis and +3.3 percent change annually, the core figure anticipates a slightly larger annual change (averaging 0.1%).

We will find out in the next few hours if these figures are confirmed or if there is a deviation.

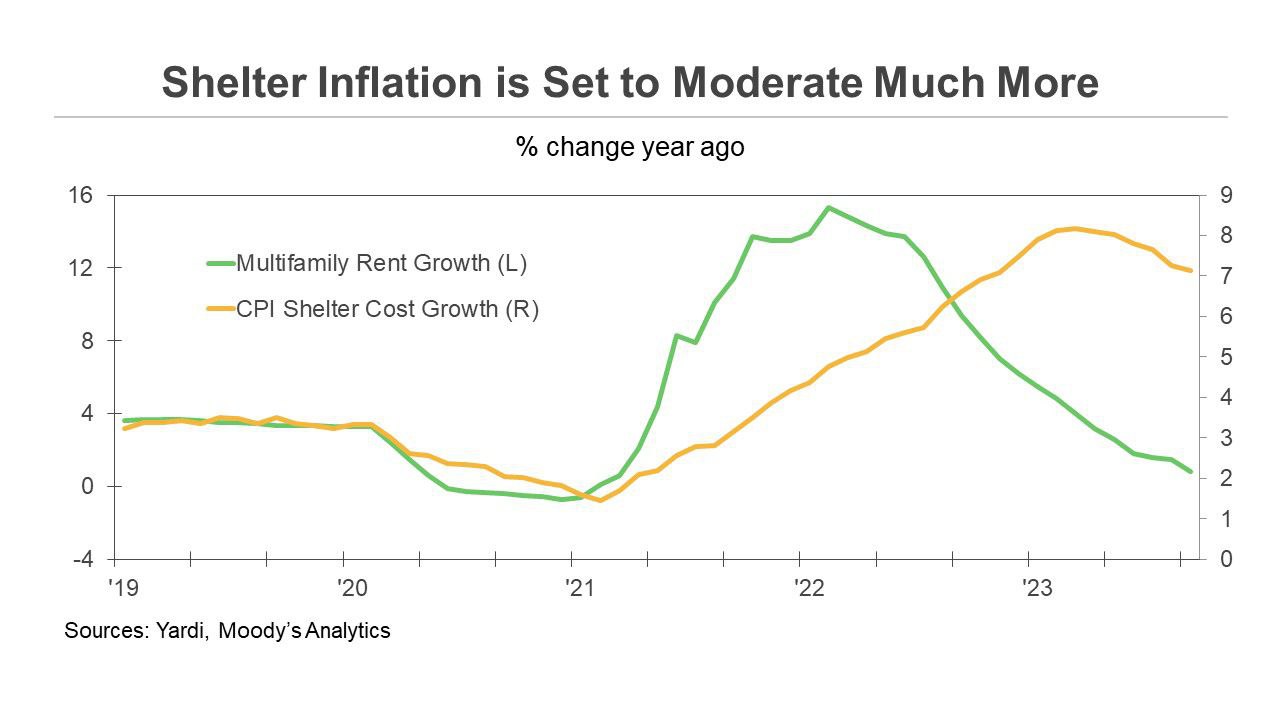

What remains certain is that one of the crucial components of the price figure, the Shelter component (comprising about one-third of the total figure), has been exhibiting signs of a slowdown for several months.

Source: Yardi

This could contribute to the overall decline. As is customary, the market's response to the report will be pivotal, likely favoring a positive reaction to a lower-than-expected figure and conversely reacting unfavorably in the opposite scenario.

Patience is key, not only after today's probable knee-jerk response but also throughout the entire week, to get a comprehensive understanding of how market participants perceive and digest the data over time.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.