Sentiment toward indices and the NASDAQ 100 in particular remains heavily tilted in favor of the bears...

After a decade of prices going essentially straight up, NASDAQ 100 (US Tech 100) traders are now adjusting to the exact opposite scenario.

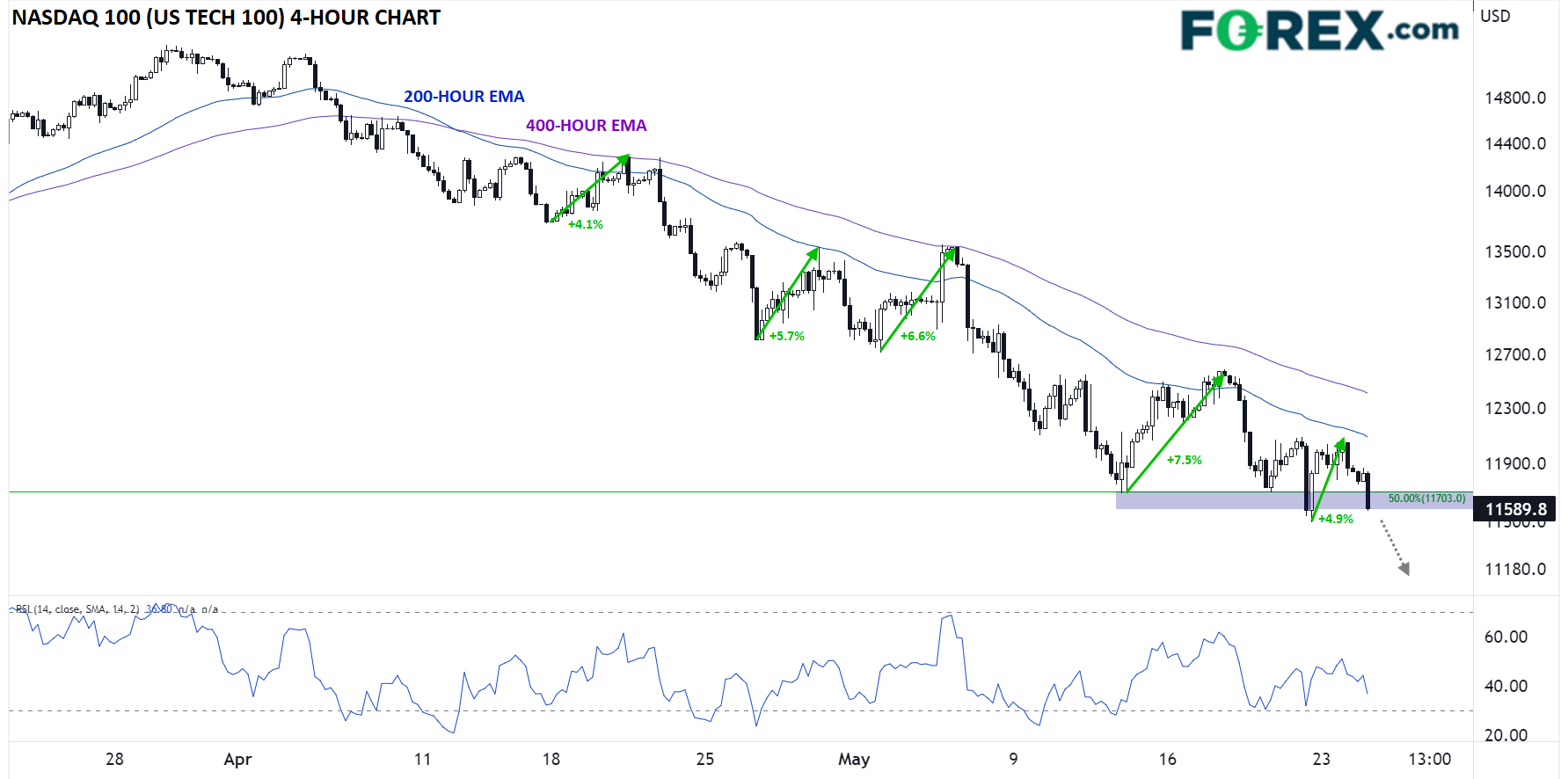

Since peaking near 15,250 in late March, the NASDAQ 100 has traded essentially straight lower for the last two months, losing nearly a quarter of its value with only small, short-lived bounces to pause the relentless selling. As the chart below shows, the index has seen just 5 countertrend rallies of 4%+, none of which lasted more than a couple days:

Source: StoneX, TradingView

Over the past 6 weeks, the 400-hour exponential moving average (100-period EMA on the 4-hour chart) has consistently put a lid on these rallies, and as of writing, the index is once again at risk of breaking down to a new low as bears set their sights on last week’s low in the 11,500 area. Below that zone, there’s little in the way of notable support until the November 2020 lows near 11,000.

From a fundamental perspective, the index has been getting hit on two sides: Not only are the valuations investors are willing to pay declining as inflation and interest rates rise, but the earnings growth for many of the mid- and large-capitalization growth names is at risk of stalling, as recent results from prominent names like Netflix (NASDAQ:NFLX) and Cisco Systems (NASDAQ:CSCO) demonstrate.

At the end of the day, sentiment toward indices and the NASDAQ 100 in particular remains heavily tilted in favor of the bears. With the so-called “generals” of the market—previously-unassailable mega-cap giants like Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA)—hitting new lows as we go to press, the path of least resistance remains lower. Bulls will need to see markets stabilize and the selling dissipate for more than a couple of days before even considering the prospect of the dominant downtrend ending.