Elections have consequences and so Donald Trump’s return to the White House as the 47th president will surely change the calculus. The policy differences between the Republican president-elect and the Biden administration are substantial on multiple fronts, ensuring that the next four years will bring significant changes to trade, taxes and numerous other areas over which the federal government holds sway. All the more so since the Republicans took back the Senate, although control of the House (as of this writing) is still undecided.

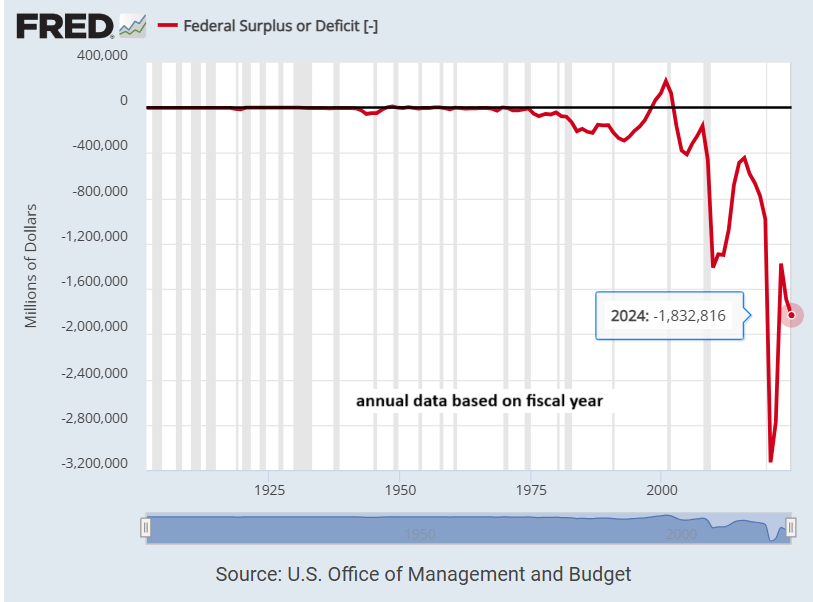

The elephant in the room for the new administration is the federal deficit, which was ignored on the campaign trail by both candidates. The oversight won’t last long. The US budget deficit is plumbing depths unseen – by wide margins – relative to the pre-pandemic era. The current level of red ink for fiscal 2024 is $1.832 trillion. That’s sharply above the $3.132 trillion deficit reached during the height of the pandemic in 2020, but budget forecasters see the deficit deepening in the years ahead without sizeable policy changes.

A key factor for the budget outlook is how, or if, the government responds to the expiring tax cuts passed during Trump’s first administration that are due in 2025. The Tax Cuts and Jobs Act of 2017 (TCJA) will sunset next year, expiring on Dec. 31, 2025. Extending the tax cuts would add would add $4.6 trillion to the deficit over the next 10 years, estimates the Congressional Budget Office.

Tariffs on imports is another area that comes with significant implications for the economy. Trump says that he wants to impose across-the-board tariffs of 10% to 20% and a levy of 60% on all goods coming from China. The president-elect also wants to deport millions of immigrants, many of whom take jobs that might otherwise go unfilled.

The combination of a sharp reduction in the workforce and a surge in tariffs on imported goods strikes some economists as a recipe for higher inflation. “Normally, if you’re cutting off migrant labor, you try to get goods from outside. And if you’re cutting off goods from outside, you try to get migrant labor. If you cut off both, you almost certainly get inflation, if not stagflation,” says Adam Posen of the Peterson Institute for International Economics.

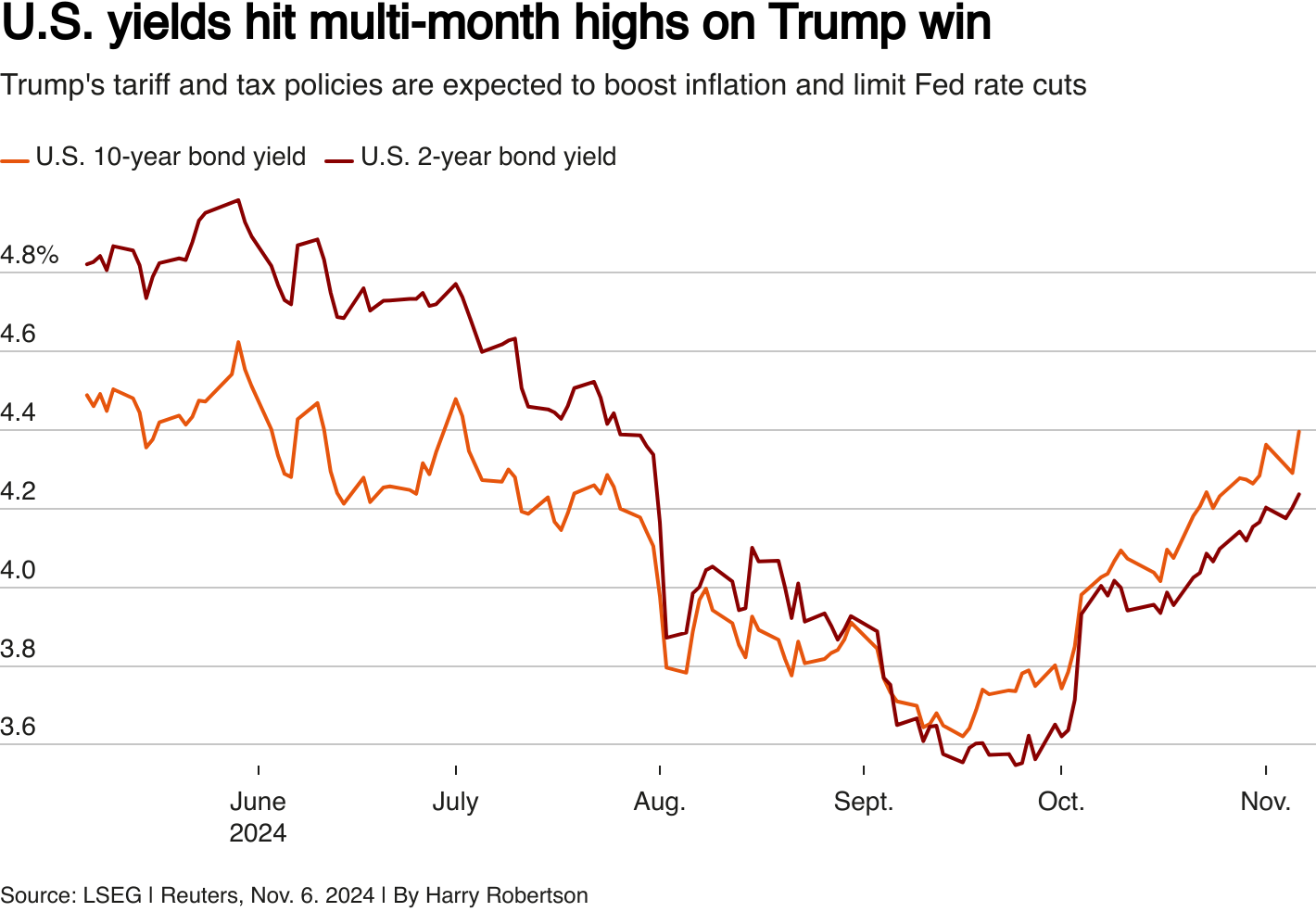

The bond market seems to be paying attention to these risks — tax cuts that fuel bigger deficits and higher inflation borne of mass deportations and sharply higher tariffs.

“We need to watch what happens to bond yields, and there could be a tipping point if US Bond yields continue to rise,” says Seema Shah, chief global strategist for Principal Asset Management. “The bond vigilantes are out.”

Optimists say that the dire warnings over overblown. Just as the dark forecasts after Trump’s first electoral victory in 2016 turned out to be misguided so too will the pessimistic views prove to be this time, runs the counterview.

“It looks like a Trump presidential win but also a win for Republicans in House and Senate. If that happens, you’re going to see the US economy really taking off,” advises Mark Mobius, Mobius Emerging Opportunities Fund chairman in an interview with CNBC before the final vote result was announced.

By some accounts, even a full sweep of Congress by Republicans may not give Trump carte blanche. For instance, Trump has said that he’d like to exclude Social Security from taxes, a change that would significantly add to the deficit by lowering government revenue.

“A Republican Congress is not going to bend over backward to exempt Social Security benefits or overtime pay from tax, both on the merits of those ideas, and the cost,” predicts Don Schneider, a former Republican congressional aide now at Piper Sandler. “There simply are not the votes to do that.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.