The case for international diversification from a US-investor perspective usually centers on how to carve up a global equities allocation. The global bond footprint, by contrast, tends to be an after-thought for most investors. But after reviewing year-to-date results for bonds ex-US, strategists may be inspired to rethink the oversight.

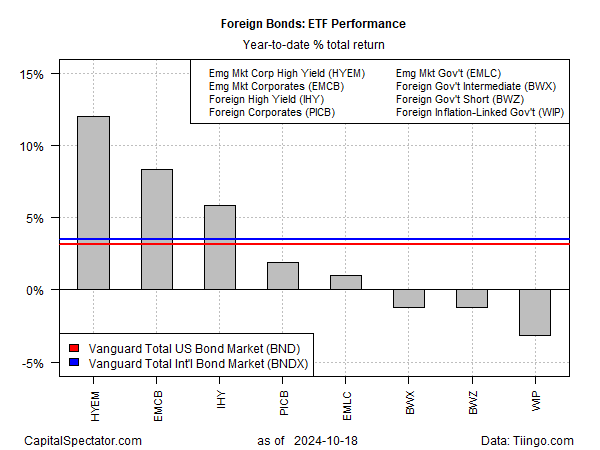

Below-investment-grade bonds issued by companies in emerging markets are outperforming by a wide margin in 2024, based on a set of ETFs. VanEck Emerging Markets High Yield Bond ETF (NYSE:HYEM) has rallied 12.1% year to date through Friday’s close (Oct. 18). That’s a hefty premium over the rest of the field, including a global ex-US bond market benchmark (BNDX) and the US investment-grade benchmark (BND).

Notably, HYEM’s rally is also adding leading the rally in US-based junk bonds (E:JNK): 12.1% vs. 7.8%.

Several factors are providing a tail wind for EM junk, starting with a change in the interest-rate cycle following the Federal Reserve’s reduction in the Fed funds rate last month. If the cut is the start of new easing cycle, the shift is good news for emerging markets, which are sensitive to the US interest rates.

“Eventually EM local-currency bonds should benefit from global easing,” says Anders Faergemann, a senior portfolio manager at Pinebridge Investments. “However, from a total return perspective, the relief rally in the US dollar and domestic delays to monetary-policy easing may have triggered some profit-taking.”

Although the US dollar has rallied recently, it remains well below its previous peak set in the spring. All else equal, a softer dollar translates to higher foreign assets after translating foreign currencies into US dollars.

Skeptics counter that while foreign junk is leading this year, over longer time frames it’s not obvious that diversifying into non-dollar high-yield assets makes sense. Comparing JNK to HYEM over the trailing 5-year window shows the latter underperforming the US junk portfolio while posting higher volatility.

The question is whether HYEM’s stellar run so far in 2024 is the start of a virtuous cycle for foreign junk? For the moment, the fickle wisdom of the crowd is voting in the affirmative.