So here is the thing. During a bull market or very bullish phase, indicators give the all-clear. Come on in, the water’s fine! Investors are always going to be complacent and market/economic signals at least stable (or quite positive) at market tops. It’s the way the markets work. Recall 2000 and 2007. As Steven King would say, “nope, nothin’ wrong here.”

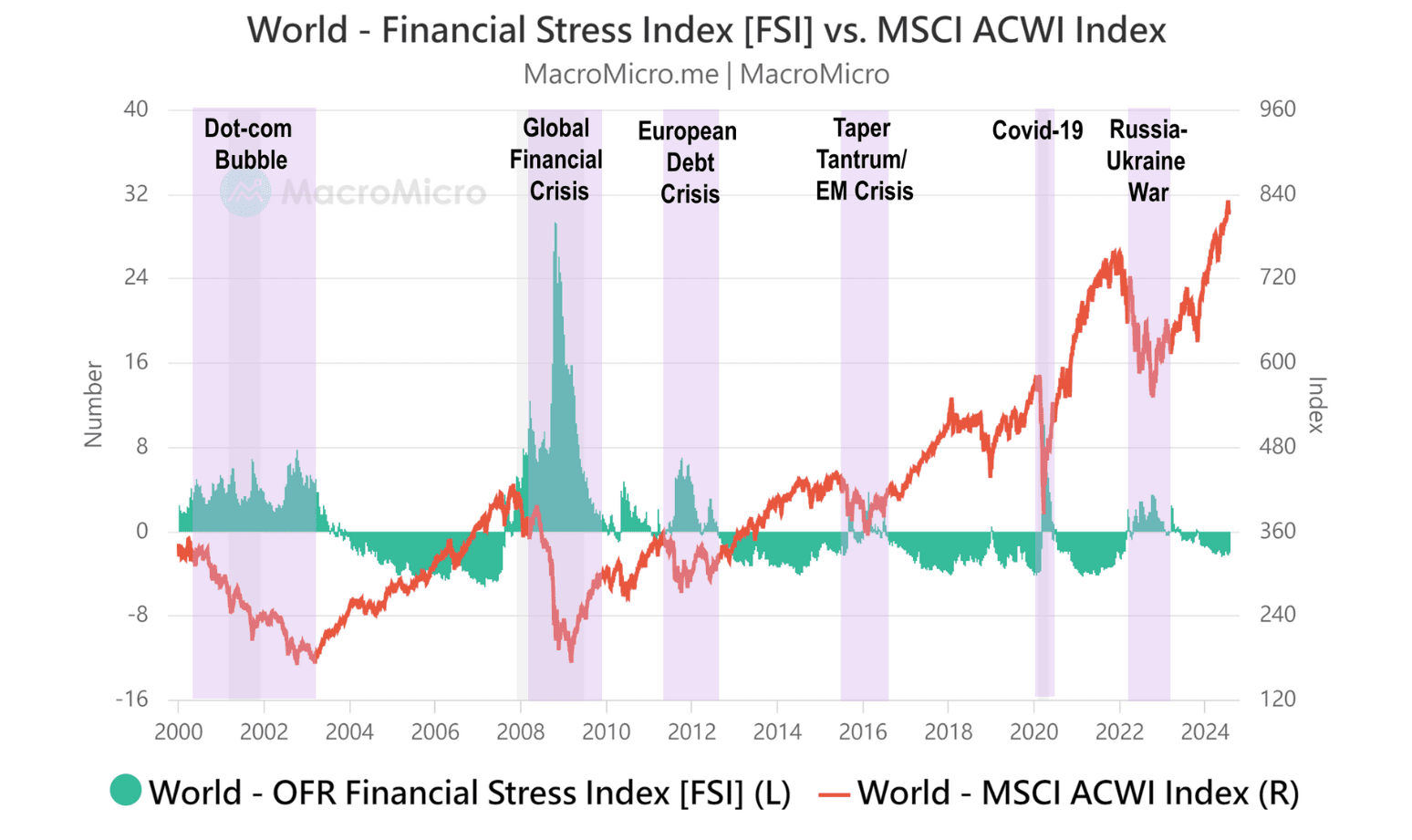

This chart from MacroMicro illustrates the point. During a bull phase in the markets things are fine, and then suddenly, out of nowhere, NOT fine. So pictures like this tell us what we already know; the market is bullish and the waters are calm.

That is why I use indications beneath the surface of things. From the spread between long and short-term Treasury yields (yield curves) to the spread between gold (less cyclical/inflation utility) and silver (more cyclical/inflation utility), gold and copper, gold and stocks, etc.

We want to dial in the sensitivity of indications as best as possible because it is more than likely that financial market stress indicators are going to be flashing ‘just fine and dandy’ at the next top. It’s after the herds start to stampede that these indicators flash their “warning”.

So to me, financial market stress indicators are risk indicators. When they indicate ‘all clear’, risk is actually high. When they are alarmingly out of control to the stressful (up) side, risk is actually low. Again, it’s the way markets work.

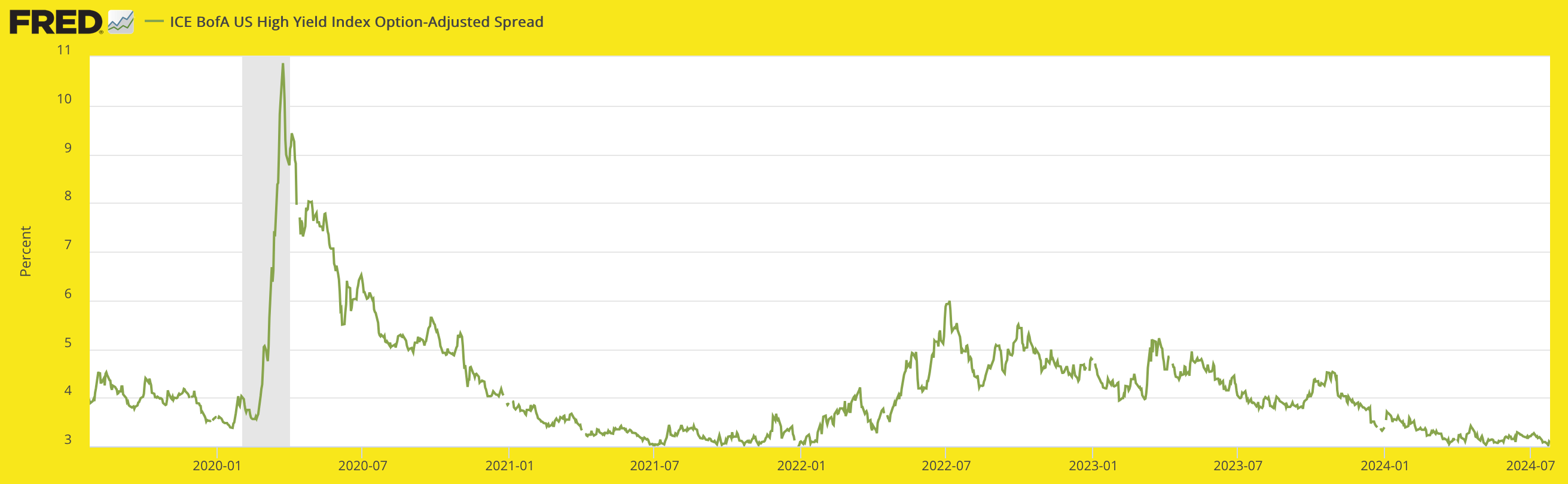

Here is a look at US High Yield spreads, which indicate a calm, complacent backdrop when depressed and market/economic anxiety when rising. Risk is about a million miles higher today than it was in March of 2020.

That was, by the way, the time NFTRH was getting bullish because the herds were terrified and the Fed was printing the new bull market with all its manipulative might.

So a combo of contrary sentiment and macro observation works well. But the macro observation has to discriminate between indications, selecting the right ones.

Source: St. Louis Fed

Considering that market trends are up from short to long-term views, this information tells us that a committed bear case is not yet indicated in real-time. But also that a mother-of-a-bear phase is coming. We have our long-held view of “to or through” the US election.

But with risk this high, being prepared along the way is a good idea. Also, there is no rule that says I am right about “to or through” the election, as in within weeks or a few months, post-election. But that has been our primary objective to this point, and it still is.