With a focus on long-term growth, Henderson Opportunities Trust (HOT) seeks investment opportunities across the breadth of the UK market. This includes a strong bias towards smaller and earlier-stage companies with significant potential to become tomorrow’s leading British businesses. There are tentative signs that the significant three-year underperformance of these smaller companies, and of HOT, may be coming to an end. If so, the trust is well placed to benefit and its differentiated, truly all-market approach is one that many investors would struggle to replicate. Moreover, HOT’s size and permanent capital base means that it can act nimbly in less liquid parts of the market and take a patient approach.

Positive indicators for smaller company performance

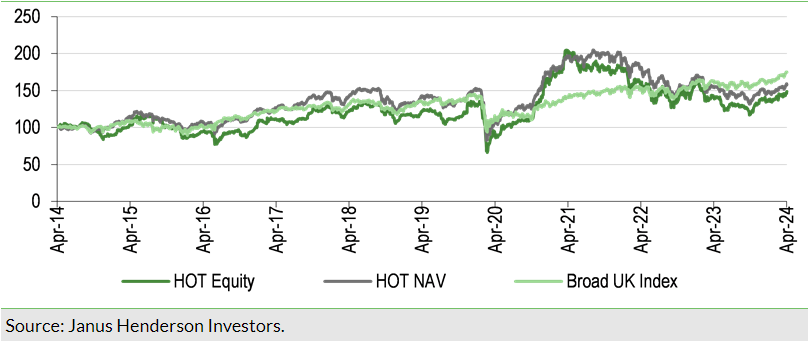

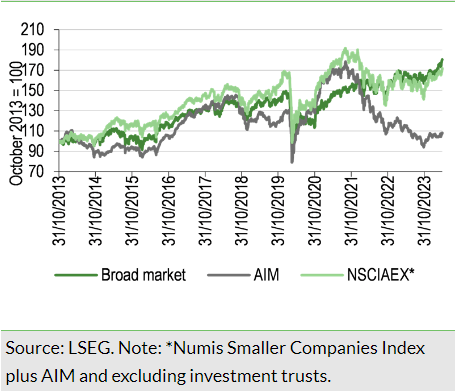

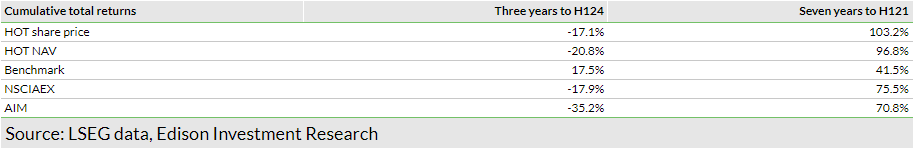

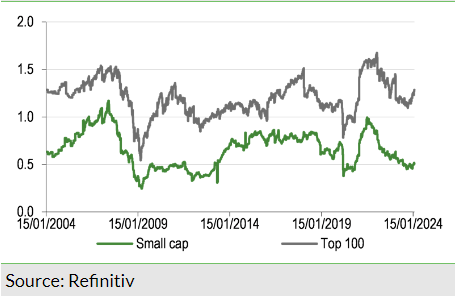

When investor confidence is low, the share prices of smaller and mid-sized (SME) companies and growth stocks are often weaker, especially compared with large global stocks. In the past three years this has been extreme, especially for domestically focused businesses, and this is reflected in HOT’s performance. In the first seven of the past 10 years, HOT’s NAV total return was almost 100%, more than double that of its broad market benchmark, and significantly ahead of the Numis Smaller Companies Index including AIM (NSCIAEX), which better matches its investment approach. The past three years have seen this more than fully eroded. This is overwhelmingly the result of SME underperformance, with no material change across the period in HOT’s strategy and aims, or in the consistent approach applied by the managers, including running a diversified portfolio to manage risk.

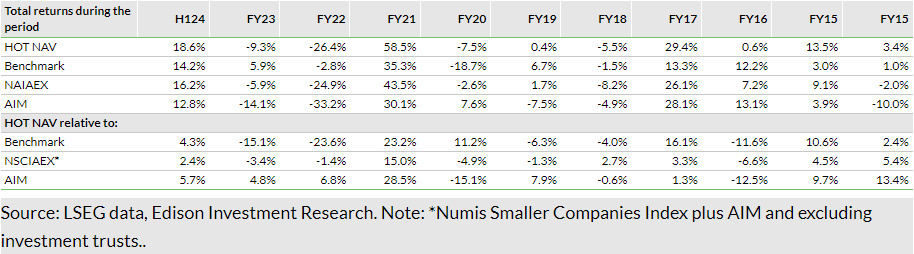

There are early indications that the tide may be turning. The margin by which overseas-oriented, often defensive larger stocks outperformed SMEs narrowed in 2023 and since October 2023, the start of HOT’s FY24, sensing a turn in the interest rate cycle, the NSCIAEX has outperformed. So too has HOT, with an NAV total return of 18.6%, 4.3% ahead of its broad market benchmark and 2.4% ahead of the NSCIAEX. It is uncertain whether the recovery in SMEs will be sustained, but valuations are low and the managers argue that a tough economic outlook is more than priced into share prices. They note that a recovery towards historical norms of profits and valuations would be a potent cocktail for returns.

NOT INTENDED FOR PERSONS IN THE EEA

Targeting growth with stability

HOT has consistently provided an investment strategy that is complementary to a wider range of more mainstream offerings, seeking to provide long-term growth, mainly from SME companies, while balancing the risks through a high level of stock diversification (c 90 holdings) and meaningful exposure to larger, more established businesses. For many investors, this would be difficult to replicate, and HOT’s permanent capital base is ideally suited to the long-term, patient approach required. While market conditions since late 2021 have been extremely challenging for UK smaller companies, past recoveries have shown that this can quickly change.

HOT has been managed consistently for many years by two experienced investment managers, James Henderson (since 2007) and Laura Foll (since 2018) of Janus Henderson Investors (JHI). In turn, they are supported by the broader resources of the JHI equity team. The trust aims to achieve capital growth in excess of the broad UK market from a portfolio of primarily UK investments, with a secondary objective of delivering dividend growth over time. The trust’s all-cap focus gives it the flexibility to seek growth opportunities from across the market, including companies listed on AIM, underpinned by a value-driven style that invests in out-of-favour or under-researched companies. At its core, the HOT portfolio is a blend of what could be tomorrow’s leading British companies, across a wide range of activities and market caps, at different stages of their life cycle, from promising early-stage businesses to established businesses reinventing themselves.

Summary of the investment case

The key reasons to consider an investment in HOT at this time, explored in detail in this report, include:

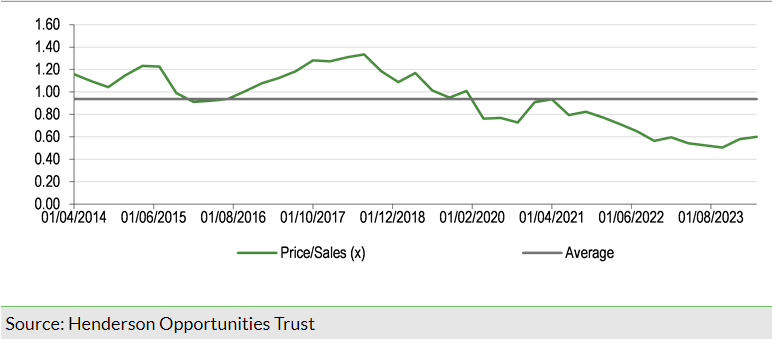

- The valuation of UK equities is low in historical and relative terms, and for smaller companies even more so. On a price to sales (P/sales) ratio (our preferred method) smaller companies are trading at the very low end of their range in absolute terms and versus their larger peers. The HOT portfolio P/sales ratio of c 0.6x is well below its 10-year average of over 0.9x.

- There are signs that the divergent share price performances of large versus smaller companies may have come to an end. In the first six months of HOT’s FY24 financial year, smaller companies were broadly in line with overall market, and the trust outperformed.

- While the valuation opportunity in smaller companies has not yet been widely recognised in the market, low valuations are being increasingly underpinned by takeover activity.

- Smaller companies are typically more exposed to the UK economy than larger companies, and with the economic outlook uncertain it may be too early to call a sustained turn in performance. The investment managers believe that a tough economic outlook is more than priced into share prices and note that history suggests that buying good stocks when they are on low valuations enhances long-term returns.

- HOT’s relatively small size gives it the opportunity to act nimbly in what can be illiquid markets in smaller companies.

- Despite its size, with a competitive management fee, HOT’s ongoing charges are in line with its peer average.

- Whilst HOT is primarily focused on growth, the trust does seek to grow dividends over time. Over the past five years, DPS has increased by an average 11% pa and the FY23 DPS increased 4.4% to 7.1p (35.5p prior to a 5:1 stock split that was effective in March 2024). HOT’s 3.2% yield is above the average of its peer group.

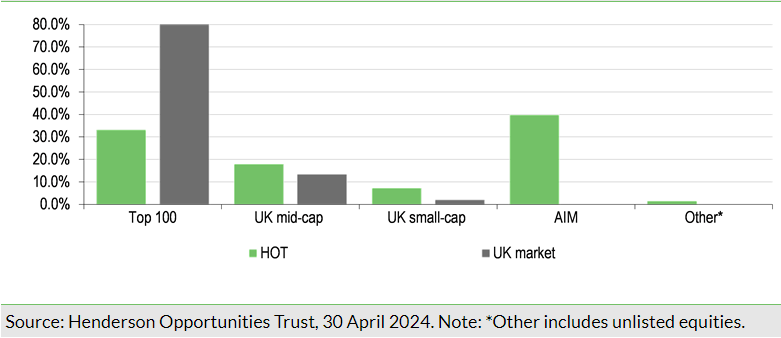

Complementary investment offering

HOT’s differentiated, truly all of market investment approach is reflected in very significant divergences versus its broad market benchmark. In many ways it may be better compared with a blend of mid- and small-cap indices. The trust’s exposure to the top 100 UK-listed companies is well below the broad UK market weighting of more than 80%. Conversely, its investment in smaller stocks, many of which are listed on the AIM market, is well ahead of the benchmark weight, and it is here where the managers identify the strongest opportunities for long-term growth and the most attractive valuations.

What’s in the bucket?

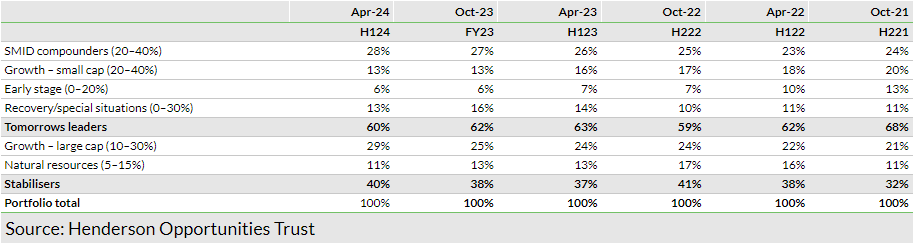

To help investors make sense of the trust’s strategic positioning, the managers look deeper than the basic distinctions of small, mid and large cap, instead grouping their holdings under one of six classifications or ‘buckets’, The stocks within each of these, with the exception of resources, are expected to generate above-average earnings and capital growth over time. To clarify the process even further, the buckets are grouped under the two broad headings of ‘tomorrow’s leaders’ and ‘stabilisers’. As the name suggests, it is among ‘tomorrow’s leaders’ that the managers expect to see the strongest growth over time, and these companies represent around two-thirds of the portfolio. Balancing the expected returns with the risks involved, the managers select a diversified list of companies across all stages of the growth cycle. Tomorrow’s leaders are complemented in the portfolio by investment in stabilisers. These are often larger, mature but still growing businesses, with more predictable cash flows, as well as natural resources companies that provide a hedge against unexpected developments in commodity markets. We provide details of each bucket, with stock examples, later in this report.

Exposure to tomorrow’s leaders has reduced over the past three years, particularly to smaller and early-stage growth companies, with a corresponding increase in stabilisers.

The changes over the period reflect a combination of capital allocation towards those areas in which the managers identify the most attractive opportunities, as well as the sharp de-rating of small-cap stocks. The managers expect to increase their allocation to tomorrow’s leaders, as this is the area where sentiment has been weakest and valuations are, in their view, more attractive.

Recent underperformance of smaller companies masks longer-term successes

HOT benchmarks its performance against the broad UK equity market index. Given its greater focus on smaller companies, performance divergence from the benchmark is to be expected over shorter periods, but the extent and duration of smaller company underperformance is notable, and this is reflected in the trust’s more recent returns. In this respect, we believe the Numis Smaller Companies Index, including AIM, and excluding investment trusts (NSCIAEX) to be more reflective of the trust’s clearly expressed and consistently applied strategy.

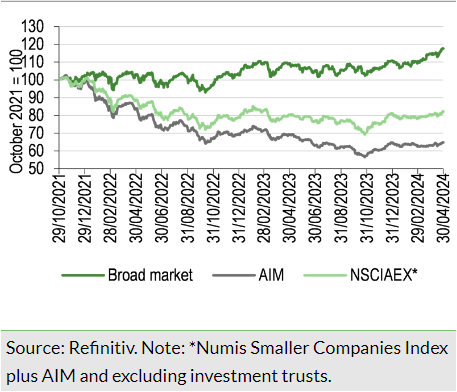

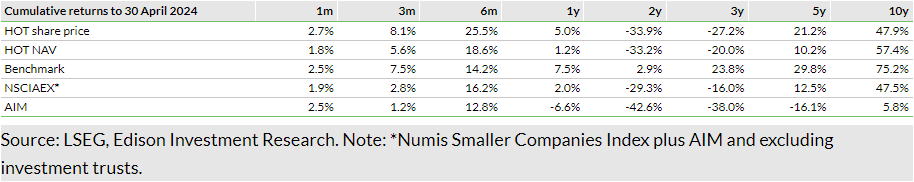

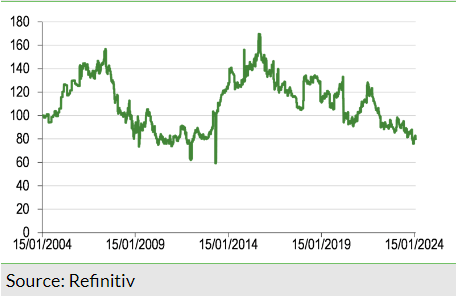

In the 10-year period to April 2024 (HOT’s H124) there is no material difference in the performance of the NSCIAEX and the broad UK equity market, even though the former was outperforming for most of the period, as was the AIM market. In the past three years, smaller companies have materially underperformed.

The recent weakness of smaller companies has significantly affected HOT’s otherwise strong performance record and we make no apology for examining this in some detail. Looking at the past 10 years, performance for the first seven of those was very strong, compared with an even more significant period of underperformance over the most recent three years. The reasons behind this turnaround are informative and provide a useful insight into likely the drivers of future relative performance. This is especially the case because there has been no material change across the period in HOT’s strategy and aims, or in the consistent approach applied by the managers, which includes running a diversified portfolio to manage risk.

During the first seven-year period, HOT’s NAV total return of 97% was more than twice that of the 42% delivered by its benchmark. Smaller companies were outperforming during the period, but HOT’s performance was still well ahead of the NSCIAEX return of 76%.

In the more recent three-year period, HOT’s NAV total return has materially underperformed its broad market benchmark, resulting primarily from small-cap weakness, especially among the AIM-listed companies that represent a large share of the trust’s portfolio. This is despite the rebalancing during FY21 towards stabilisers, which the managers say, with the benefit of hindsight, was insufficient in scale. Performance has been broadly in line with the NSCIAEX, despite the weak performance of AIM. Stock selection was only a modest contributor to the three-year underperformance and in the year to FY23 had a positive impact.

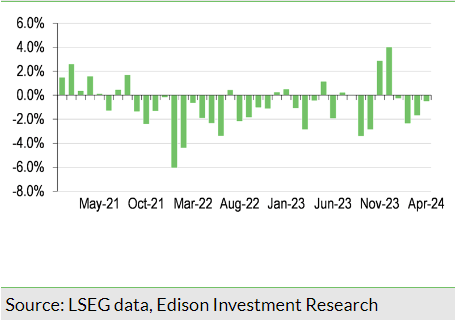

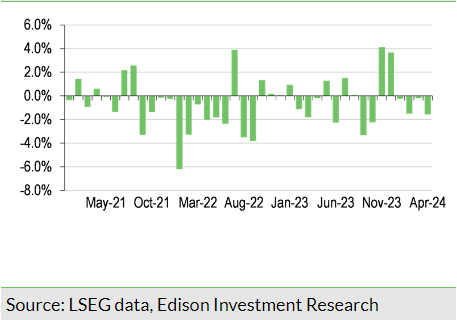

The significance of the shift in performance that occurred in 2022 is less apparent from the more usual presentation shown in Exhibit 6, which shows the trust underperforming over all time periods until the past six months.

That HOT’s underperformance stems from the period since FY22, and particularly that year, can also be seen clearly in the annual performance data. Somewhat distorted by market volatility during the pandemic,1 HOT has tended to outperform the index when the market is rising. In FY22, although the broad market fell only modestly, positive performance by the largest 20 companies (almost 60% of total market cap) was offset by strong declines across the wider market, and especially AIM.

The FY20 and FY21 years straddle the market recovery from its pandemic low point.

During the past six months (H124), both mid-cap stocks and the NSCAIEX have been outperforming the broader market, although AIM has continued to lag. HOT has outperformed mid-cap stocks, the NSCIAEX and AIM, and, in inconsequence, its benchmark.

The improved absolute and relative performance of smaller companies over the past six months reflects a strong bounce in November and December 2023 as market expectations shifted towards a faster decline in interest rates. Those expectations have subsequently been tempered by stubborn inflation data, and a more sustained change in market dynamics, and in HOT’s performance, is not yet confirmed. Nonetheless, the sharp upward movement in both mid- and small-cap stocks in October and November demonstrates how quickly market conditions can turn.

Why has AIM been so weak?

Although AIM-listed companies cover a wide range of market caps (several companies have market caps of more than £1bn and up to c £2bn), the main purpose of the market is to encourage younger, smaller, more entrepreneurial businesses, some of which will succeed – often spectacularly – and many others will fail. While this has limited the long-term performance of the AIM index, it remains the case that selective, long-term investing in AIM-listed companies can be highly rewarding so long as the risks are well managed. It is within the AIM market that HOT’s investment managers expect to find most of what they hope will be tomorrow’s leading businesses. Correspondingly, the bulk of HOT’s small and early-stage company investments are AIM-listed. Over the longer term, HOT’s investments in AIM stocks have created significant value, driven by a combination of stock selection and risk mitigation. Over the past five years,2 the top performers within the portfolio were all AIM-listed stocks (Ceres Power (LON:CWR), Serica (LON:SQZ), IQGeo (LON:IQG), Learning Technologies and Vertu Motors (LON:VTU))

Data to 31 March 2024.

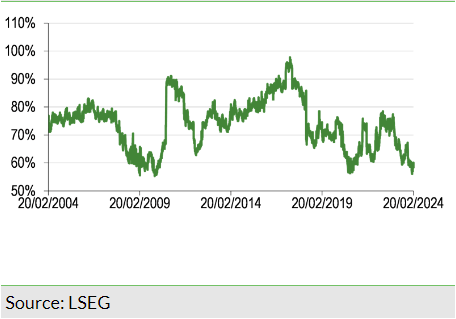

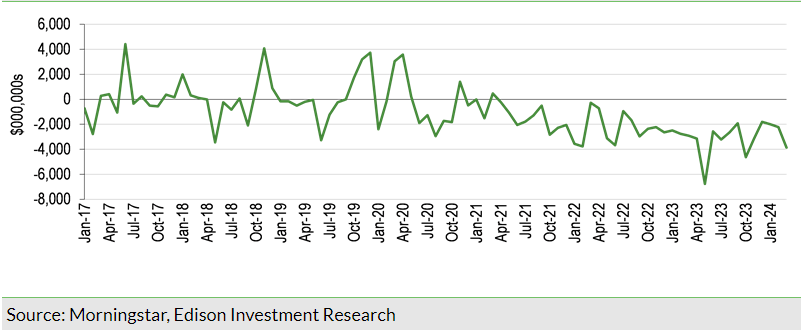

In common with smaller companies in general, AIM stocks are by and large more exposed to the sluggish domestic economy, and have been affected by sustained UK retail equity fund outflows. Liquidity can often be restricted in smaller AIM stocks and for many institutional investors this has forced divestment. Smaller and early-stage companies are often more volatile, and more affected by market sentiment, performing strongly when investors are confident and, more recently, selling off sharply when risk aversion is high.

Attractive UK equity valuation

That the UK market is lowly valued in absolute terms and relative to other global markets is not new, but the investment managers point out also that earnings forecasting remains ‘cautious’, especially for domestically focused SME companies. It is here they see particular value.

There may be no immediate catalyst for a re-rating of the UK market and fund flows remain weak. Overseas investors have little enthusiasm for UK equities, UK pension funds have continued to reallocate away from equities and for many other UK institutional investors, smaller companies have become too small and too illiquid, while UK retail funds continue to see negative outflows. This poses the risk of the market being a ‘value trap’ but, as investors wait, a reasonable yield and the low P/E should mitigate against adverse economic or global equity market corrections. Although the valuation opportunity in SME companies has not as yet been widely recognised in the market, it has been reflected in much-increased takeover activity across the market.

A reassessment of UK prospects would benefit HOT

Many investor concerns, such as geopolitical tensions, are not specific to the UK, where the differentiating factor has been the level of pessimism about the domestic economy. Although GDP was flat during 2023, this was a better outcome than had been widely expected at the beginning of the year. The economy has quickly bounced back from the short technical recession in the second half of the year. Preliminary estimates for Q124 GDP show growth of 0.6% compared with declines in Q3 and Q4 of 2023 of 0.1% and 0.3% respectively. Preliminary data is often revised, however, and for now, it is probably fair to say that the UK economy is continuing to flatline, as it has since early 2022.

Positively, a combination of higher wages and declining inflation is lifting consumers’ real disposable incomes, with the prospects of interest rate cuts to follow. This more favourable perspective would be consistent with the general picture that the investment managers are getting from their interaction with many companies and is the key reason why they see potential for a stronger UK economic development than is widely forecast. The managers also note that many domestically focused businesses, some of which are operating under recessionary conditions (eg UK housebuilding and advertising), have continued to make operational improvements such as reducing costs while maintaining capacity to participate when end-markets recover.

Looking at P/sales ratios, rather than using earnings (often a less reliable indicator of underlying value), the small-cap index trades at a lower level than larger companies. While this is not unusual, at c 0.5x on a trailing basis it is at the lower end of its historical range. This is equally the case relative to larger companies.

HOT’s portfolio includes a number of early-stage companies (6% of the total), typically with a high P/sales ratio, reflecting valuations that anticipate very strong future sales growth from a low base. Nonetheless, on a blended basis, including its larger company exposure (which would typically push up the portfolio average), HOT calculates its current P/sales ratio at c 0.6x, well below the 10-year average of a little more than 0.9x and high of more than 1.3x.

Investment process is bottom up, with a strong underlying valuation discipline

The portfolio managers are focused on long-term returns, with investment decisions driven by a selective, bottom-up approach. They are looking for the best capital growth opportunities, with no specific sector or size remits, although these are most often found among smaller companies, particularly those at an early stage. Their experience is that by staying close to companies, they can invest with conviction and better add value than would be the case by relying on top-down macroeconomic forecasting. As a result, there is no common theme to stock selection other than that the managers are seeking to identify the next generation of leading companies across a wide range of activities. Interaction with companies is a key part of the stock selection and investment monitoring process, with the managers undertaking several hundred meetings and site visits each year. They firmly believe that company management is one of the most important factors in identifying possible investments, noting that a good management team can navigate a difficult economic backdrop, while poor management can get it wrong even in the good times. Although the managers do not use specific quantitative screens to whittle down the large number of stocks in their investment universe, their focus on buying good companies at attractive prices means they employ a range of valuation criteria, such as P/E ratios, price/book value and enterprise value to sales. By way of example, they note that the small-cap end of the spectrum often offers superior earnings growth while trading at an attractive P/E discount to the wider market, albeit with the risk of lower liquidity and greater volatility of returns. Diversification is key to managing smaller company risk. As we have shown above, successful smaller companies can deliver exceptional growth and investment returns, but others will struggle or even fail, while liquidity constraints limit the opportunity to react. The managers take an active but measured approach to topping up and reducing holdings, to lock in gains and mitigate the possibility of future losses.

Portfolio positioning

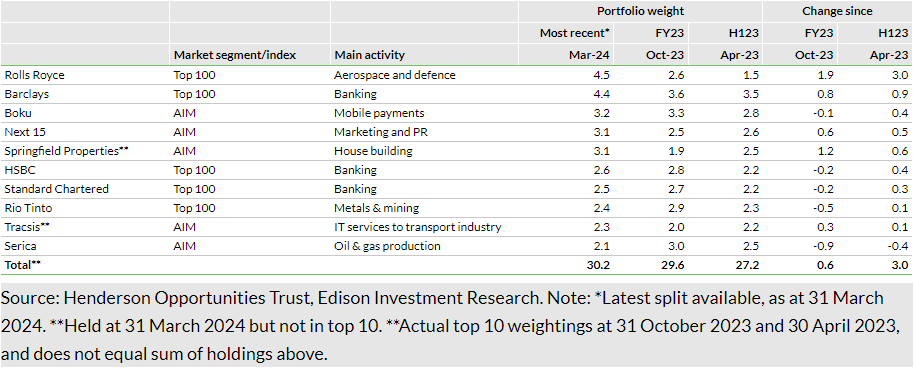

At 31 March 2024 (the latest available data) there were 87 holdings in HOT’s portfolio. This remains within the 70–100 stock range that is typical for the trust, but has been gently and deliberately declining as the managers seek to consolidate the portfolio and add to holdings where they have higher conviction.

Five of the top 10 names were AIM stocks, with three banks (Barclays (LON:BARC), Standard Chartered (LON:STAN) and HSBC (LON:HSBA)), Rolls Royce (LON:RR) and miner Rio Tinto (LON:RIO) accounting for the balance. Together, the top 10 holdings accounted for c 30% of the total portfolio. As a measure of the diversification of smaller company holdings, the other 73 holdings were on average 0.9% of the portfolio each.

The managers expect bank earnings and dividends to continue to grow as they benefit from the increased level of interest rates, combined with strong balance sheets. Rolls Royce has seen a strong earnings recovery, the result of ongoing self-help measures from new management and a recovery from the pandemic in airline flying hours. Rio Tinto provides ‘stabilising’ resources exposure, with access to low-cost iron ore production as well as structurally growing demand for copper.

The AIM stocks are a diverse group, by activity and size (market caps shown are as at the date of publication):

- Boku (market cap: c £500m) is a mobile payments company that allows its customers to charge for their services via an individual’s mobile bill. The company is growing rapidly and is establishing itself globally, including Google (NASDAQ:GOOGL), Meta and Amazon (NASDAQ:AMZN) among its customer base.

- Next Fifteen Communications (market cap: c £900m) is a marketing and PR company with a focus on the faster-growing technology industry. The shares have de-rated in recent years as technology companies have curtailed advertising spend. On a pick-up in spending activity the company would be well placed.

- Springfield Properties (market cap: c £100m) is a leading Scottish builder of both private and affordable housing. The company has a strong track record of growth, but its shares significantly de-rated as interest rates rose and the housing market slowed. The company is well positioned for future growth with a sizable land bank.

- Tracsis (market cap: c £270m) provides specialist software for the transportation industry, supporting customers in delivering mission-critical activities with increased efficiency, enhanced performance, higher productivity and increased safety. There is a long pathway of potential earnings growth ahead from further digitalisation in rail, both in the UK and overseas.

- Serica Energy (market cap: c £780m) is an oil exploration and production business focused on the North Sea and acquired assets at attractive prices as the oil and gas majors were reducing capital expenditure. The mangers note that the share price, negatively affected by the petroleum revenue (‘windfall’) tax and weaker oil prices, has left the company’s assets significantly undervalued, while fossil fuels will inevitably remain a major source of energy supply for a very long time to come.

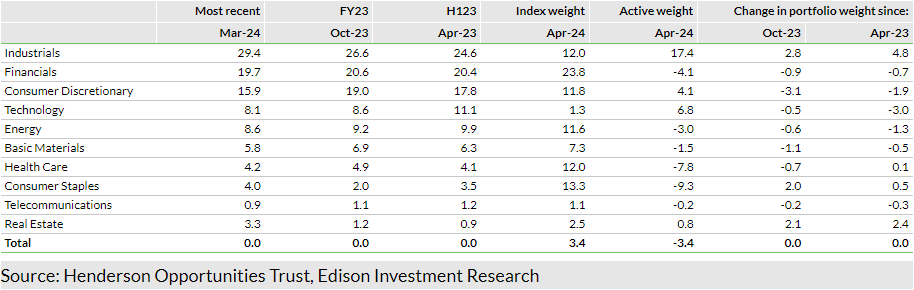

As we highlight above, the best guide to HOT’s portfolio positioning is the classification by bucket. However, for completeness, we show the portfolio sector weightings in Exhibit 17. These are an output of stock selection rather than a target or input into the investment process, but nonetheless show a broad spread of exposures.

The buckets in detail and examples

The portfolio stabilisers (40% of the portfolio) include:

Growth large cap

- Target (NYSE:TGT) range: 10–30%

- H124 weighting: 29%

These stocks are usually familiar to all investors. They act as ballast for the portfolio and are generally large, well-managed and reliable companies where the managers expect continuing sales and earnings growth, albeit at a more modest pace than for those companies at an earlier stage in their life cycle. These can increase the liquidity of the overall portfolio and may also be an important source of yield.

The largest three holdings at the end of FY23 were Barclays, HSBC and Standard Chartered.

Natural resources

- Target range: 5–15%

- H124 weighting: 11%

Commodity selection determines positioning within the sector, but the lower end of the exposure range has been deliberately set at 5% (not zero), meaning that there will always be some exposure, providing the managers with scope to benefit from unexpected developments in commodity markets. The majority of holdings in this classification are smaller companies that are less well understood and where the managers seek to add additional value by paying attention.

The largest three holdings at the end of FY23 were Serica Energy, Rio Tinto and Jersey Oil & Gas.

Tomorrow’s leaders (60% of the total) comprise:

Early stage

- Target range: 0–20%

- H124 weighting: 6%

These are typically companies that could serve large end markets, potentially with disruptive technologies, at an early stage of commercialisation and yet to generate meaningful revenues and earnings. In aggregate, they offer significant upside potential, but individually they represent the highest element of risk in the portfolio, often with binary outcomes. Share price performance is typically volatile, driven by the developments within these businesses and investor perceptions of their prospects, often with little correlation to wider equity market moves or the economy.

The largest three holdings at the end of FY23 were Surface Transforms, AFC Energy (LON:AFEN) and Creo Medical.

Growth small cap

- Target range: 20–40%

- H124 weighting: 13%

Although still at the beginning of their life cycles, these are companies that are more established than the early-stage companies, with the potential to become much larger businesses in time. They have strong management capability and operate in fast growing end markets or are disruptors within more established markets.

The largest three holdings at the end of FY23 were Boku, Next 15 and Tracsis.

Small- and mid-cap compounders

- Target range: 20–40%

- H124 weighting: 28%

These are typically good-quality, well-established companies with strong management and a consistent record of sales and earnings growth, offering long-term compounding of returns.

The largest three holdings at the end of FY23 were Vertu Motors, Springfield Properties and Van Elle.

Recovery/special situations

- Target range: 0–30%

- H124 weighting: 13%

These are typically out-of-favour companies, where the managers have identified a specific trigger for a re-rating, providing contrarian value opportunities. The triggers for unlocking this value may include a strategic repositioning of the business, management change or the prospects for a sales and earnings recovery.

The largest three holdings at the end of FY23 were Rolls Royce, Redcentric and International Personal Finance.

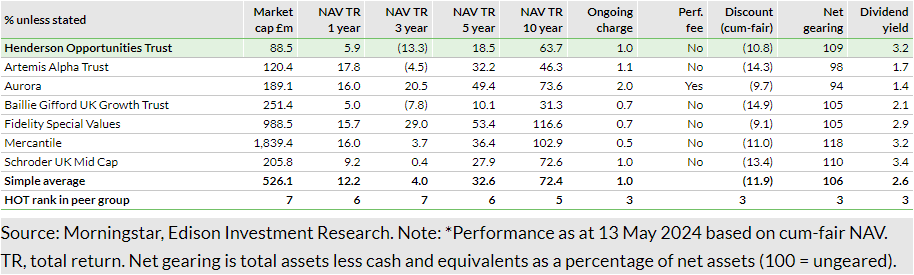

Peer group comparison

HOT is a member of the AIC’s UK All Companies sector, comprising seven member trusts,3 of which HOT is the smallest. Given there are separate sectors for UK Equity Income and UK Smaller Companies, in reality the UK All Companies sector is home to UK equity funds that do not have a specific income or small-cap mandate. Within the sector, HOT is the only trust that is truly UK and truly all-cap.

The group previously included JP Morgan Mid-Cap Investment Trust, which merged with JP Morgan Smaller Companies Investment Trust and was renamed JP Morgan UK Small Cap Growth & Income, becoming a constituent of the AIC UK Smaller Companies sector.

Looking at the constituents in greater detail, while there is undoubtedly overlap between investment strategies, there are also significant differences in emphasis. As its name suggests, Schroder UK Mid Cap is a mid-cap specialist, while Mercantile invests in small- and mid-cap companies. Aurora, with a concentrated portfolio of 15–20 stocks, and Baillie Gifford UK Growth Trust, both have a mid-cap bias (c 50% or over), while Artemis Alpha Trust and Fidelity Special Values both have significant (c 20–30%) non-UK holdings.

For the reasons discussed above, HOT’s exposure to smaller companies, and AIM-listed stocks in particular, has significantly affected its short-term performance versus this diverse peer group and this has fed through to the long-term performance data. The trust’s discount to NAV is nonetheless in line with the peer group average, although on a market cap weighted average it is above the average, which is significantly influenced by the lower discounts at which the largest trusts trade.

The positive NAV impact of a turn in sentiment for smaller stocks would be reinforced by the trust’s gearing, which although recently reduced (see ‘Gearing’ section below) remains above the sector average. Despite HOT’s modest size, its ongoing charges are in line with the group average, and despite its focus on capital growth, dividend growth has been strong and HOT provides the second highest yield in the sector. If followed by a discount narrowing, this would represent a further benefit to shareholders.

HOT’s approach to ESG

HOT’s managers view responsible investing as a long-term process that depends not just on businesses meeting current legislative standards, but also on operating with an understanding of changing societal attitudes towards issues such as climate change, pollution and working conditions. While ESG risks do not preclude ownership of a stock, they are a key consideration in arriving at an appropriate valuation and position size. Where evidence of poor practice emerges, the managers will engage with the company to discover how the problem is being addressed and will monitor progress to assess evidence of improvements. Specifically on governance, HOT always votes at the AGMs of investee companies, and the managers seek to work constructively with firms on appropriate executive remuneration structures to ensure the best alignment of the interests of management and shareholders.

Rather than relying on external ratings, which may be absent in the case of smaller companies or based on flawed, outdated or incomplete data, the managers review each new investment idea for potential ESG shortcomings. Any material issue they discover is discussed with JHI’s governance and sustainable investing team and/or the company itself before an investment is made.

For HOT’s full ESG statement, please see its entry on the AIC website.

Additional company information

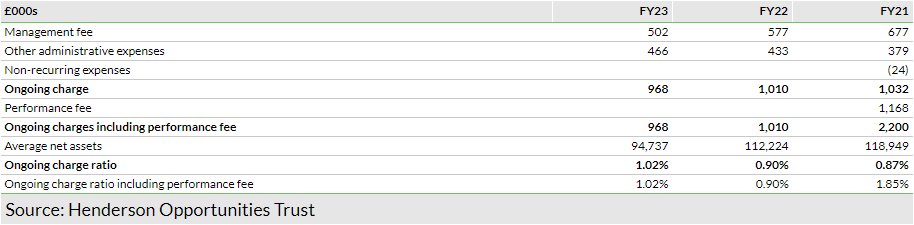

Fees and charges

The management fee is a completive 0.55% of net assets per annum, paid quarterly. As a result, despite HOT’s relatively low size, its ongoing charge ratio (OCR) is in line with its peer group. The OCR nonetheless increased in FY23, to 1.02% compared with 0.90% in FY22, driven by the reduction in average net assets during the year. Management fees declined but the company’s operating expenses increased with inflation. The investment manager performance fee4 was removed from the start of FY24. Although none had been paid since FY21, the removal ensures that shareholders will fully benefit from a performance recovery.

This was set at 15% of any outperformance of the benchmark, subject to the NAV having increased in absolute terms, with a cap on total management and performance fees of 1.5% of average net assets. Any underperformance versus the index (or any unrewarded outperformance over the fee cap) was carried forward and set against outperformance or underperformance in subsequent years.

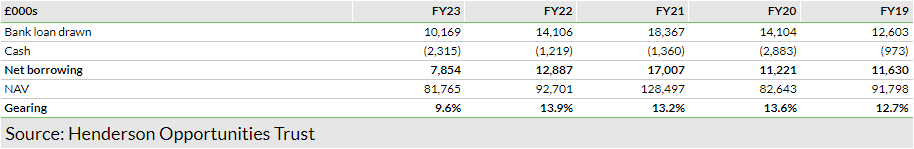

Gearing: Mid-teens level is still broadly neutral

The ability to take on gearing is a key benefit of the investment trust structure and has been a positive contributor to long-term returns. However, more recently, in FY22, it has been a detractor.

The board and the investment managers decided to reduce gearing5 during the second half of FY23, to around 10% from a typical 13–14%, still well below the 25% limit that has historically been set by the board. The reduction in gearing takes account of the volatility in markets and the increased cost of borrowing. HOT has a £30m unsecured, floating rate loan facility, which enables borrowing as and when the company deems it appropriate. It is priced at a margin over the SONIA benchmark rate.

Gearing has a positive impact on returns when markets are increasing, which has been the case over the long term. More specifically to HOT, it can also efficiently support the process of capital recycling within the portfolio, particularly where the shares being traded are relatively illiquid.

Capital structure and shareholders

The 2024 AGM approved a stock split, with each share of 25p nominal value split into five shares of 5p nominal value. There are now 39.5m ordinary shares in issue (unchanged over the past 12 months) excluding 0.5m held in treasury, and there has been no issuance or repurchases during the past three years.

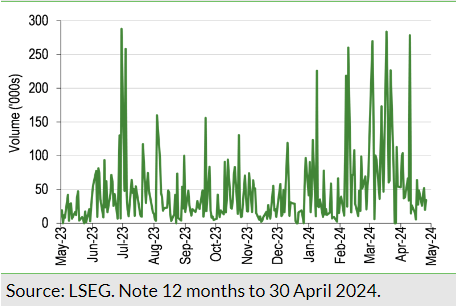

The main purpose of the split is to assist monthly savers and those who reinvest their dividends, or those who are looking to invest smaller amounts (such as younger investors), and it reflects the more than doubling of the share price over the past 10 years. The split also has the potential to enhance trading liquidity in the shares. The value of shares traded over the past 12 months is approximately £12m (c 15% of the market cap) or an average c £50k per trading day.

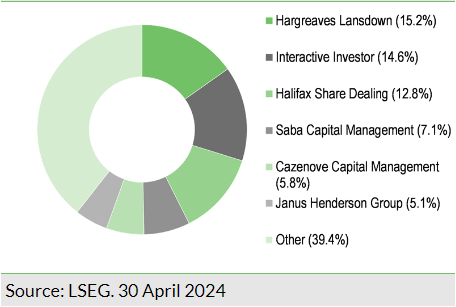

The shares are widely held by retail investors (HOT says 77% as of 31 December 2023), with holdings via the Hargreaves Lansdown (LON:HRGV), Interactive Investor and Halifax Share Dealing platforms accounting for more than 40% of shares outstanding. Outside of this, its largest shareholders are Saba Capital Management (7.1%6), Cazenove (5.8%) and Janus Henderson (5.1%, held through other funds that it manages). Saba Capital Management, a New York-based investment adviser, founded in 2009, has been an investor in HOT for some time and first disclosed an interest of 5.05% in May 2022. Among a range of investment strategies, within investment trusts it focuses on securities that are trading at significant discounts to NAV, and selectively pursues an activist approach where it believes this may be an effective way to unlock shareholder value.

The last published interest in the voting rights of the company, as reported at 31 October 2023. HOT had received no notification of changes as of 31 January 2024.

A continuation vote is held every three years, most recently at the March 2023 AGM. A clear majority of votes cast (c 76%) were in favour of continuation, although this was lower than in 2020 (99%) and just 27% of the total voting rights of the company were cast. There will be another continuation vote in 2026.

Discount management

As we note above, the current c 11% discount to NAV is narrower than the three, five and 10-year average (14–15%) and is not materially different to either HOT’s peer group or the UK smaller companies sector. With SME companies significantly out of favour, we would be surprised if the board were to change its current approach to discount management. It does not believe that a formal discount control mechanism is in the best interests of shareholders. It sees the use of share buybacks as negating some of the benefits of the closed-end structure, as well as potentially shrinking the size of the trust, reducing the audience of potential investors, increasing the ongoing charges ratio and reducing liquidity in the shares. In the board’s opinion, the best way to close or eliminate the discount is to provide attractive returns and to engage as broadly as possible with investors.

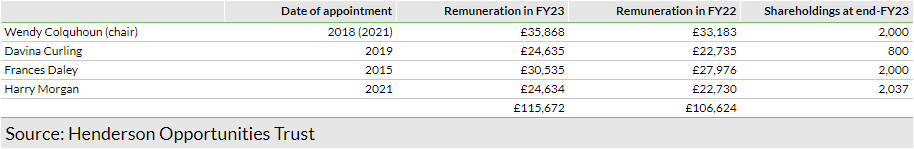

The board

Board members are all independent and non-executive (NED). Wendy Colquhoun joined the board in 2018 and has been chairman since 2021. She was previously a senior corporate partner at international law firm CMS Cameron McKenna Nabarro Olswang and advised investment trust boards for more than 25 years. She is also an NED of Schroders (LON:SDR) Mid-Cap Fund, Murray International Trust (LON:MYI) and of Capital Gearing Trust. The other current directors are Frances Daley, Davina Curling and Harry Morgan. Detailed biographies can be found in the annual report.

______________________________________

General disclaimer and copyright

This report has been commissioned by Henderson Opportunities Trust and prepared and issued by Edison, in consideration of a fee payable by Henderson Opportunities Trust. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI