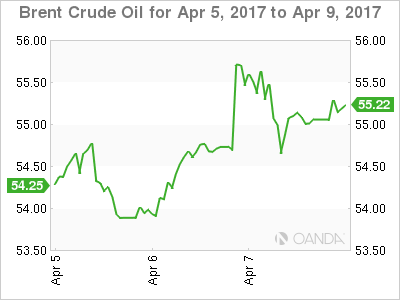

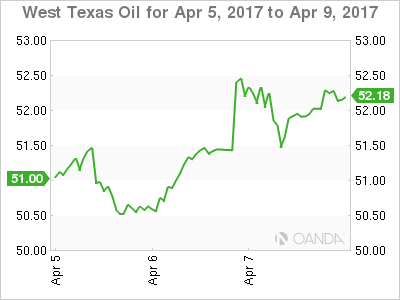

Crude continued its great comeback into the finish of the week, as geopolitical tensions in the Middle East overrode an anaemic Non-Farm Payrolls and yet another jump in the Baker-Hugh’s Rig Count. Both Brent and WTI have now recouped all of their March losses, with Brent, in particular, looking the more constructive on the technical picture.

Both crudes will continue to be headline rather than fundamentally driven this week. Although Friday’s Syria strike was almost certainly a one-off, with so many players in proximity, the situation will remain “fluid” to say the least. Early Asia trading appears to have received another boost with the news that a U.S. carrier battle group has been dispatched to waters of the Korean peninsula on sabre-rattling duty.

WTI spot basis has traded 0.5 cents higher in early Asia trade and has resistance at 52.70 and then 54.60.

Brent spot basis will open with a bid tone around 55.00 with resistance at 56.00 initially. Above here looms the key 57.00 level with a daily close above being a very bullish indicator of potentially more gains ahead.