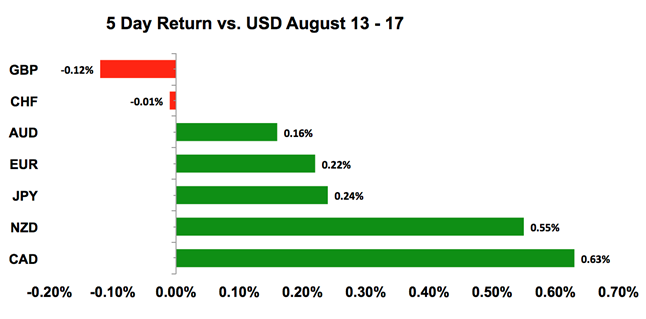

The second full week in August was another good one for the US dollar.

The greenback extended its gains against most of the major currencies but the rally is slowing. We’re beginning to see short covering in pairs like EUR/USD and AUD/USD but the moves have been cautious. The problem is that as we look to the weeks ahead, the recent stabilization was driven by questionable developments for Turkey and US-China trade. Neither problem has been resolved and the uncertainties are preventing a full-fledged recovery in currencies. Looking ahead, the most important event risk on this week’s calendar will be the US and China’s trade talks on August 21 and 22. If the talks go well, risk appetite will improve allowing deeply oversold currencies like the Australian dollar to recover. However, if the US and China continue to bump heads, we could see renewed losses for euro, sterling and aussie along with gains for the US dollar.

US Dollar

Data Review

- Retail Sales Advance 0.5% vs 0.1% Expected

- Retail Sales Ex Auto 0.6% vs 0.3% Expected

- Retail Sales Ex Auto and Gas 0.6% vs 0.4% Expected

- Industrial Production 0.1% vs 0.3% Expected

- Manufacturing Production 0.3% vs 0.3% Expected

- NAHB Housing Market Index 67 vs 67 Expected

- Housing Starts 0.9% vs 7.4% Expected

- Building Permits 1.5% vs 1.4% Expected

- University of Michigan Sentiment 95.3 vs 98 Expected

- University of Michigan Current Conditions 107.8 vs 114.4 Prior

- University of Michigan Expectations 87.3 vs 87.3 Prior

Data Preview

- Existing Home Sales - Higher interest rates offset by stronger growth. However, data likely to be softer

- FOMC Meeting Minutes - Minutes should be hawkish

- New Home Sales - Will have to see how existing home sales fare

- Durable Goods Orders - Durable goods orders can be market moving but hard to predict

Key Levels

- Support 110.00

- Resistance 112.00

After hitting a 13-month high this past week, the rally in the US dollar is beginning to lose momentum leading many investors to wonder if the dollar has peaked. To answer this question, we need to consider what drove the dollar’s decline. Demand for the greenback started to ease after Turkey secured $15bn investment from Qatar. Then the lack of buying turned into selling on reports that trade negotiations between the US and China will resume later this month. The pressure intensified on the back of softer US data – the Philadelphia Fed index dropped to a 20-month low, housing starts grew only 0.9% against a forecast of 7.4% and consumer confidence declined.

But has the political and economic landscape changed?

Not really. David Malpass, the US’ Undersecretary of International Affairs will be meeting with Wang Shouwen, China’s vice commerce minister. Unfortunately, these are lower level talks where the sole job is to determine if both sides can make enough concessions to hold higher-level negotiations. An easy win that the US could get is on the Yuan - China has been weakening its currency to help exporters and they could be willing to appease the Americans by tempering its slide. Wang, however, is a tough negotiator and China will want the US to hold back the new round of tariffs set for the end of the month. Given the tight timing, it's not clear if the Americans are willing to hit the pause button on the tariffs. Also on the day that the talks were confirmed, President Trump said China is attacking US farmers by not buying from them so he’s certainly not easing up. Meanwhile, last week’s rally in the Dow and the strong US retail sales report confirms that the US economy is doing well. These improvements keep the Fed on track to raise interest rates next month. Meanwhile, the only things worth watching on the US calendar this week will be the FOMC minutes and the Jackson Hole Summit. There’s very little reason to expect anything other a commitment to gradual tightening. So the bigger surprise should come from the trade talks especially given the market’s extreme sensitivity to evolving political dramas. USDJPY could hit 109.90 or 110 on profit taking but we don’t expect the sell-off to extend beyond that level.

British Pound

Data Review

- Claimant Count Rate 2.5% vs 2.5% Prior

- Jobless Claims Change 6.2k vs 3.8k Expected

- Avg. Weekly Earnings 2.4% vs 2.5% Expected

- ILO Employment Rate 4.0% vs 4.2% Expected

- Employment Change 42k vs 93k Expected

- CPI 0.0% vs 0.0% Expected

- Retail Price Index 0.1% vs 0.2% Expected

- PPI Input 0.5% vs 0.1% Expected

- PPI Output 0.0% vs 0.5% Expected

- PPI Output Core 0.0% vs 0.2% Expected

- Retail Sales Ex. Auto Fuel 0.9% vs 0.0% Expected

- Retail Sales Inx. Auto Fuel 0.7% vs 0.2% Expected

Data Preview

- No Data

Key Levels

- Support 1.2650

- Resistance 1.2850

Of all the major currencies, sterling experienced the weakest recovery. With short positions at their highest level since May 2017, GBP/USD was at the greatest risk of a short covering rally. However, that did not happen despite the pullback in the US dollar and better than expected U.K. data last week. Consumer spending rose 3 times more than expected in July, year over year CPI growth accelerated to 2.5%, well above the central bank’s 2% target and the unemployment rate dropped to its lowest level in 43 years. There was a slowdown in wage growth and zero price growth on a month to month basis, but the improvements should have overshadowed the deterioration. Yet it did not, which shows how strong the selling pressure really is. The problem is that the risk of a no-deal Brexit is growing but taking a look at the GBP/USD daily chart – higher highs and higher lows suggest that a stronger recovery is brewing. If it happens, it would be driven by Brexit headlines or a deeper pullback in the US dollar because there are no major UK economic reports for the rest of the month.

Euro

Data Review

- GE GDP 0.5% vs 0.4% Expected

- GE CPI 0.3% vs 0.3% Expected

- EZ Industrial Production -0.7% vs -0.4% Expected

- EZ GDP 0.4% vs 0.3% Expected

- GE ZEW Survey Current Situation 72.6 vs 72.1 Expected

- GE ZEW Survey Expectations -13.7 vs -21.3 Expected

- EZ ZEW Survey Economic Sentiment -11.1 vs -18.7 Prior

- GE Wholesale Price Index 0.0% vs 0.5% Prior

- EZ Trade Balance 22.5b vs 16.5b Expected

- EZ Current Account Balance 24.0b vs 24.0b Prior

- EZ CPI Core (YoY) 1.1% vs 1.1% Expected

- EZ CPI -0.3% vs -0.3% Expected

Data Preview

- GE and EZ PMI’s - Weaker German IP and factory orders are offset by stronger ZEW

- GE GDP - Revisions are hard to predict but changes can be market moving

Key Levels

- Support 1.1300

- Resistance 1.1500

There’s also signs of stabilization in the euro, which hit a fresh 1-year low of 1.13 against the US dollar but ended the week above 1.14. Investors were relieved that Turkey secured a lifeline from Qatar but the $15B direct investment is a fraction of what Turkey needs to turn their economy around and pay off their debt. By circumventing the US, Turkey risks inflaming President Trump. He is the wildcard because at any point in time he could dial up pressure on China and Turkey. US Treasury Secretary Mnuchin warned that there could more sanctions if the American pastor is not released. Turkey is also not the real problem as their troubles sent Italian bond yields on a rollercoaster ride. While Italian banks have limited exposure to Turkish debt, the country’s borrowing costs are rising and growth is slowing. Investors are worried that a financial crisis could be looming especially if Turkey’s problems worsen. Like the US, slightly weaker Eurozone trade and current account data had very little impact on the currency. Eurozone PMIs are due for release in the week ahead and of all the economic reports on the calendar, these are the most important because previously, we’ve seen very little sign of trade tensions impacting the Eurozone economy but if the August numbers show a slowdown, euro will resume its slide. If the data shows that manufacturing and service sector activity continued to expand at a faster pace, EURUSD could extend its gains to 1.15.

AUD, NZD, CAD

Data Review

Australia

- NAB Business Conditions 12 vs 15 Prior

- CH Retail Sales (YoY) 8.8% vs 9.1% Expected

- CH Industrial Production (YoY) 6.0% vs 6.3% Expected

- CH New Home Prices 1.21% vs 1.11% Prior

- AU Consumer Inflation Expectation 4.0% vs 3.9% Prior

- AU Employment Change -3.9k vs 15.0k Expected

- AU Employment Rate 5.3% vs 5.4% Expected

- Full-Time Employment Change 19.3k vs 43.2k Prior

- Part-Time Employment Change -23.2k vs 15.0k Prior

New Zealand

- PMI Services 55.1 vs 52.7 Prior

Canada

- Existing Home Sales 1.9% vs 4.1% Prior

- Manufacturing Sales 1.1% vs 1.0% Expected

- CPI 0.5% vs 0.1% Expected

- CPI Core (YoY) 1.9% vs 2.0% Expected

Data Preview

Australia

- RBA August Meeting Minutes - Governor Lowe’s positive tone means RBA minutes should have a positive bias

New Zealand

- Retail Sales Ex. Inflation - Potential for downside surprise given slightly weaker retail sales and confidence

- NZ Trade Balance - Potential for downside surprise given Weaker PMI Manufacturing index

Canada

- Retail Sales - Employment growth strong but will we’ll have to see how wholesale sales fares

Key Levels

- Support AUD .7200 NZD .6500 CAD 1.3000

- Resistance AUD .7400 NZD .6700 CAD 1.3200

All three of the commodity currencies bounced off their lows this past week with the Canadian and New Zealand dollars leading the gains. CAD benefitted from stronger than expected consumer price growth and talk of a possible breakthrough in NAFTA negotiations. Canadian data has been good and the 0.5% uptick in CPI last month took the annualized pace of growth to 3%, the highest level since September 2008. The market is now pricing in 76% chance of a hike in October and 82% chance of tightening by the end of the year. Canadian retail sales are scheduled for release on Wednesday. While last month’s 2% increase (which was the strongest in 2 years) will be hard to beat, the consistent improvement in the labor market favors a continued rise in spending. NAFTA headlines will be just as important as data to the path of USD/CAD in the week ahead. We believe it should only be a matter of time before the pair takes another trip below 1.30.

Stronger than service sector activity and producer price growth also helped to drive NZD/USD higher. However, the upcoming trade data and retail sales report may not be as helpful to the currency because dairy prices have been falling and Chinese growth has been slowing. Taking a look at the charts, given how deeply oversold NZD/USD has become, we could easily see a short squeeze to 67 cents.

The Australian dollar also turned higher at the end of last week. Unlike New Zealand, Australian data was mixed but positive comments from Reserve Bank of Governor Lowe, the resumption of US-China trade talks and the recovery in the Chinese yuan all helped to lift the currency. According to the forwards market, the cost of shorting the Yuan rose to its highest level since 2016 so a further recovery is likely which should lead to further strength in AUD. In his semiannual testimony, RBA Governor Lowe reminded us that the Australian economy is moving in the right direction and the next move for the central bank is more likely to be a hike and not cut. AUDUSD broke 73 cents last week and is now on track for a move to .7350.