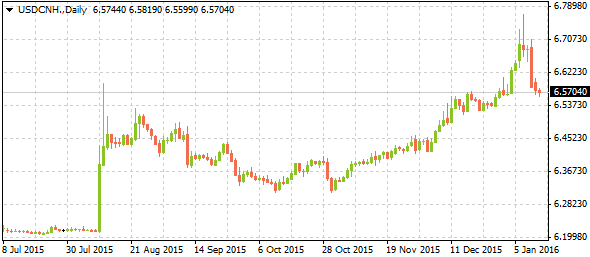

In a drastic distancing from the relatively poor growth seen in China on the back of economic difficulties in late 2015, signs of recovery have surfaced, as evidenced by a trade balance report released during the latest session. After a devaluation and subsequent revaluation of the yuan during the early week’s crash, China’s trade surplus has increased to CNY 600.93 billion from the 541.03 billion seen in November. The yearly figures are just as impressive, with the headline yearly surplus figure from 2015 printing at $594.50 billion up from a surplus of $382.50 in 2014. While the numbers are certainly excellent without context, an understanding of how the statistic is measured reveals the trends driving this phenomenon. While an increasing surplus is beneficial, and the contraction in exports has been slowing, but not nearly as fast as imports are shrinking, with the last 12-months of data showing a decline of -7.60%. This imbalance has pushed the headline figure up temporarily and without much optimism, as the only reason exports did not match the slide in imports was likely the heavy accommodation from policymakers.

Analysts might call the slight rebound a “dead-cat bounce”, with the main number hiding the mediocre fundamentals behind it, namely international trade and energy. China is unlikely to fully recover without oil also recovering, as its dependence on the commodity has plagued Chinese markets since the debacle began. Perhaps the surplus results will fuel short-term confidence in the economy, but the veil will soon be torn off. Policymakers in the country have stated their unwillingness to install the serious stimuli that China may need, threatening to turn problems like spare capacity and low demand into catalysts for the next great capital exodus from Chinese markets. Bankers in the country are currently trying to fix a very leaky tap with words alone, and their inability to provide a meaningful solution makes their efforts almost worthless as confidence in China hits an all-time low.