Wall St futures steady after weekly gains as Fed meeting looms

According to a forecast by the market research company Gartner, Google (NASDAQ:GOOGL) will have to hand over about a quarter of its search volume to AI chatbots and ‘answer machines’ by 2026. In addition to start-ups such as You.com and Perplexity, large companies such as Meta and OpenAI are also entering this billion-dollar market.

More and more providers are positioning themselves between Google and its users by using generative AI. The German start-up You.com made the first move at the end of 2022, followed by Perplexity last year. Meta recently launched its AI assistant based on the new flagship model Llama 3, which answers user questions directly. And now OpenAI is entering the market with SearchGPT. It was clear that Microsoft (NASDAQ:MSFT) would not miss out on this market. After all, Microsoft has already invested billions in OpenAI and is treading water with its own browser.

We are not yet able to judge how You.com and Perplexity will develop, or whether they will perhaps be bought by a large company, but it is certain that with OpenAI/Microsoft and Meta, two major players are entering the scene that could take market share away from Google.

The idea behind it is simple: these new providers interpret users' search queries, search for relevant content on websites and use AI to generate an answer that can be displayed as text, graphics or images. This means that users can get the information they want faster without having to click on links, while also benefiting from advances in AI technology. They can choose the best model for the answer and, in the next step, even use AI agents to book a restaurant or order a book, for example.

The shift of search queries to AI chat models

A significant step in this direction is Meta's introduction of an AI search slot that will be integrated into Facebook (NASDAQ:META), Instagram and WhatsApp, reaching more than three billion people. OpenAI is also developing a chatbot that reads information from websites in real time and converts it into answers. Sam Altman, CEO of OpenAI, has hinted that it is not just about creating a better version of Google Search, but potentially a whole new way of finding, using and summarising information.

You.com founder Richard Socher expects a large proportion of global search queries to be shifted to such chat models. This development could have a significant impact on Google's business if there are enough competitors in the market.

The search for the best business model

The business model for these new AI services is still unclear. Using expensive AI for simple answers does not seem to be worthwhile, especially since no direct revenues are generated through advertising. Socher expects two models to prevail: a paid premium version and a free version that may later integrate advertising. However, this advertising would have to be designed in such a way that it does not distort the AI answers.

Google is also considering charging for AI answers while maintaining the traditional advertising model. Socher remains realistic and does not believe that Google will lose its importance overnight. Even if a company captures only a small share of the search engine market, it can still become a billion-dollar company.

Socher sees the real business potential in offering companies the use of AI response engines. Companies could use these services to increase their efficiency. Perplexity is also pursuing a similar strategy, offering a new version for companies to make their employees more productive.

Google's response to the change: ‘Search Generative Experience’

Google has already responded to the change and last year introduced the ‘Search Generative Experience’, in which AI responses are placed via organic links. However, this new search function has not yet been fully rolled out. Google is facing an ‘innovator's dilemma’: the company currently earns $500 million a day from search engine advertising and therefore has little incentive to change its business model. Nevertheless, Google needs to show that it is evolving in order to stay competitive.

Interestingly, Google even supplies Meta AI with real-time information, which surprised Mark Zuckerberg. Google provides this information in exchange for prominent placement in Meta's AI responses to generate traffic. This agreement is said to be mutually beneficial.

Google stock shows clear weakness

Will it soon be back on its feet, or do we have to prepare for a major price correction? We will now answer this question.

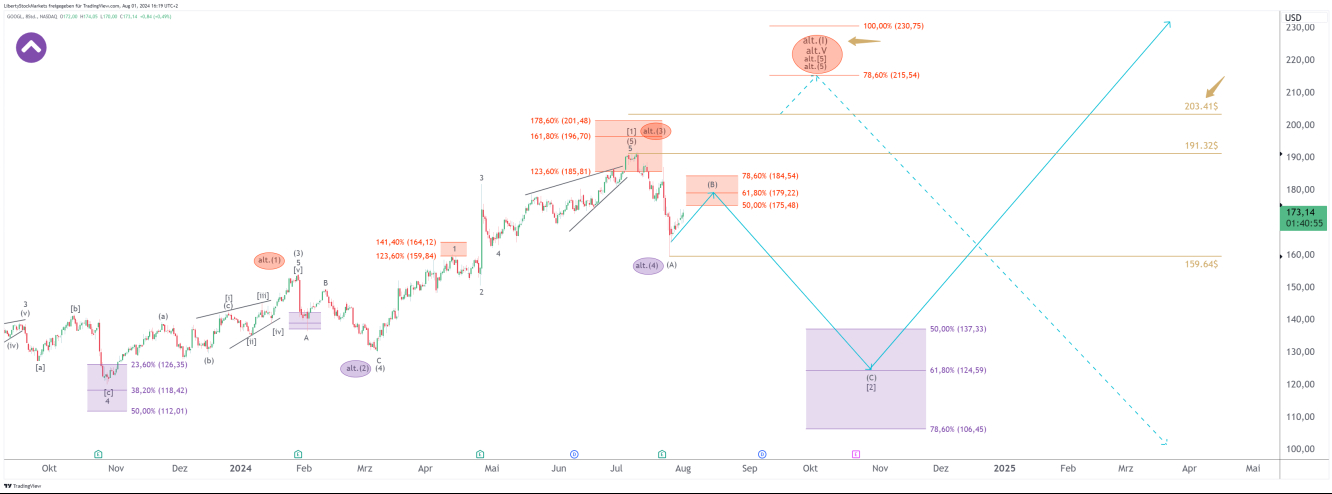

Google continues to follow our forecast exactly. The price has entered the red box at the top of the chart, between $185.81 and $201.48, and has been on a downward trajectory ever since. We communicated this target a few months ago on our YouTube channel and to our members (you can access our website via the link next to my profile picture above this text).

We are sticking to our forecast that the share price will have to fall significantly.

We can very well imagine that the stock is currently in a recovery phase that could easily extend to the red box at $175.48 to $184.54. This is an ideal area to initiate a downward trend reversal.

However, we must be aware that a recovery phase could also extend to $203.41 (please see the beige arrow in the chart). A corrective wave (B) would have room to run up to that point. Anything below this price level is likely to be part of the correction. Only when the stock manages to break through this level will our alternative, which we describe below, come into effect.

If we compare Google with other technology stocks from the Nasdaq and with the Nasdaq itself, it is most likely that the stock will fall to the purple box between $137.33 and $106.45. This is where we plan to buy.

The alternative is not a reason to rejoice. If the stock manages to extend the recovery phase significantly upwards and even break through the $203.41 level, we would expect to see a very pronounced high in the area of the red circle at $215.54 to $230.75. And while this would be good news at first, because the share price would continue to rise sharply, a devastatingly strong correction would then be expected. You can find more details on our website.

Challenges for publishers, established brands and online shops

The shift from search queries to AI chatbots could have a significant impact on many business models on the internet. According to estimates, traditional search engines will lose about 25 per cent of their search volume to AI chatbots and virtual agents by 2026. Companies therefore need to adapt their marketing strategies as generative AI is increasingly being integrated into all aspects of business.

Publishers, online shops and platforms such as Amazon (NASDAQ:AMZN), which receive a large proportion of their visitors via Google, also need to adapt to these changes. They are working on being present in the AI machines in order to maintain their traffic. One option is to provide AI with its own content or to develop its own AI search engines.

It will also become more difficult for search engines to assess the quality of content, as AI-generated texts and images will appear alongside original content. Google has announced that it will not devalue AI content across the board, which could further intensify the competition for the best positions. Initial analyses show that many search hits that would normally appear in the top 10 of organic search results were not considered by the AI responses. This could make it necessary for well-known brands and websites that have previously been prominently represented on Google to adjust their marketing strategy.

You can find out more about us on our website, which you can access via the link next to my profile picture above this text.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.