- Gold prices were volatile on Monday, swinging between 2650 and 2614, ultimately settling at 2635, driven by fluctuations in the US Dollar and tariff news.

- US Services PMI data will be a key focus, as a positive figure could boost the US dollar and weigh on gold prices.

- Technically, gold appears poised for another leg higher, but overarching fundamentals may keep gains in check.

Gold prices (XAU/USD) experienced significant volatility on Monday, kicking off the week with significant price swings. The metal reached a high of around 2650 during the day, dipped to a low of approximately 2614, and eventually settled for the day at 2635.

This turbulent movement appeared closely tied to fluctuations in the US Dollar Index. Early in the day, the US Dollar lost strength following a Washington Post report suggesting the possibility of universal tariffs, which weighed down the currency. Later, incoming President Trump dismissed the report as false, causing the greenback to briefly regain momentum.

This series of events contributed to the seesaw action in gold prices, underscoring the ongoing sensitivity of the market to tariff developments and potential Trump policy on the US Dollar.

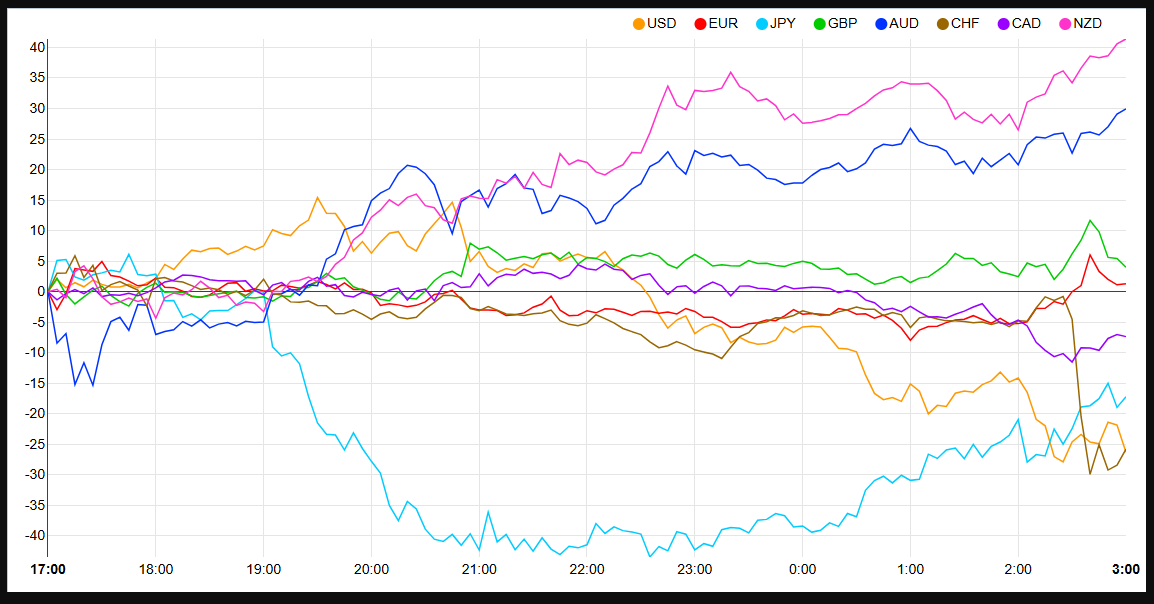

In early European trade, the US Dollar has remained under selling pressure as you can see on the currency strength chart below.

Currency Strength Chart: Strongest – NZD, AUD, GBP, EUR, CAD, JPY, CHF, USD – Weakest

Source: FinancialJuice

Trade War Concerns to Keep Gold Supported?

Looking at the week ahead Gold is facing an interesting period. At present there is a definite tug-of-war between bulls and bears with trade war fears likely to support the precious metal. On the other hand, the expectation of a more restrictive monetary policy and fewer rate cuts in the US will provide headwinds for the precious metal.

This means that moving forward any news relating to tariffs and developments around policy will have an impact on the price of Gold. Any changes to rate-cut expectations moving forward will play a similar role.

The bullish case for gold in 2025 has definitely been tempered significantly since Donald Trump’s election victory. This is further evidenced by Goldman Sachs (NYSE:GS) downgrading their 2025 price target for gold from a previous $3000/oz. The investment bank has now stated that they believe tighter US monetary policy will prevent such a move.

I would not be so quick to rule out such a move. The delicate geopolitical situation globally and rising risks pose a threat and should these risks increase with another war in the Middle East or further developments over Russia-Ukraine, $3000/oz may be possible.

Another avenue that could prove supportive remains central bank buying. 2024 proved to be a big year for central banks with many stepping up their gold buying. The monthly gold report in August revealed as much with many central banks seeing gold buying continuing into 2025.

The Week Ahead

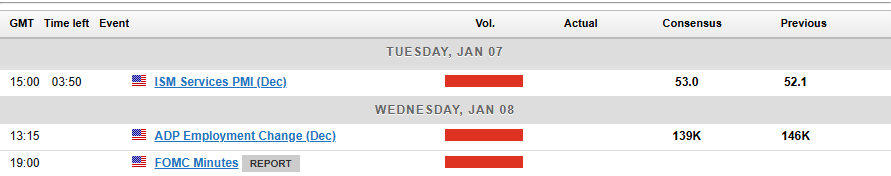

Today we await US Services PMI data which is a significant data point given the US is seen as a service-driven economy.

Last week, ISM Manufacturing Data came in at 49.3, which is 1.1 points higher than the expected 48.2. This shows growth in the US manufacturing sector and highlights the economy’s strength.

A positive and better-than-expected US Services PMI figure could add some weight to the US dollar and weigh on Gold prices.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, this analysis is a follow-up from the technicals last week. Read: Gold (XAU/USD) Price Analysis: Will Prices Continue to Soar in 2025?

Gold appears poised for another leg higher looking at basic price action on a daily timeframe.

The precious metal has printed higher highs and higher lows since the December 19 low of 2582. Yesterday the daily candle left a long wick to the downside while maintaining the overall bullish structure setting the precious metal up for another push higher.

However, the overarching fundamentals may keep gains in check and a lot of this may depend of US data later in the day.

Immediate resistance rests at yesterday's high of 2650 before the 2664 and 2674 handles come into focus.

A move to the downside today may find support at 2624 or yesterday's lows at 2614. While a break of these levels could lead to a renewed test of the 2600 handle.

Gold (XAU/USD) Daily Chart, January 7, 2025

Source: TradingView

Support

- 2624

- 2614

- 2600

Resistance

- 2650

- 2664

- 2674

Most Read: Bitcoin Breaks $100k: MicroStrategy Buys, Trump Effect, and Elon Musk’s X Factor