People have treated gold as a treasured commodity for millennia. Used as money, jewellery and adornment, this shiny metal has long fuelled ideas about luxury and prosperity. Some investors want to look beyond gold’s cultural worth to determine whether gold makes a good long-term investment. They are drawn by ideas of gold’s role as a supposed safe haven during turbulent markets or as a reliable hedge against inflation. But has gold lived up to its reputation?

At Fisher Investments UK, we believe gold’s performance history does not support these popular reasons for investing in gold, whether through physical gold, derivatives or gold-based ETFs.

Why the attraction to gold?

Gold’s use as jewellery and ornamentation for almost all of human civilization has caused it to be seen as a store of value and a medium of exchange—that is, as “money.” Gold was used as currency for much of the last 2,000 years. Even when not used as a fiat currency, people tied the value of paper currencies directly to gold through a system called “the gold standard.”

Like other commodities, the price of gold is driven by supply and demand. The lower the supply, the more people will tend to pay. Rising supplies tend to keep prices lower. The supply of gold is somewhat stable since gold isn’t “consumed” like natural gas or timber, and new mining doesn’t drastically increase the gold supply. Fisher Investments UK sees demand for precious metals mainly driven by investor sentiment and speculation—forces that can drive short-term price volatility.

Gold’s emotional appeal and its historical associations with wealth and success often make it hard for investors to look beyond its symbolic worth to see if true value lies beneath. As a result, people who choose to invest in gold often end up focusing on the metal’s history and physical characteristics, overlooking a long-term track record of inconsistent performance and low relative returns.

A dull record of diversification and growth

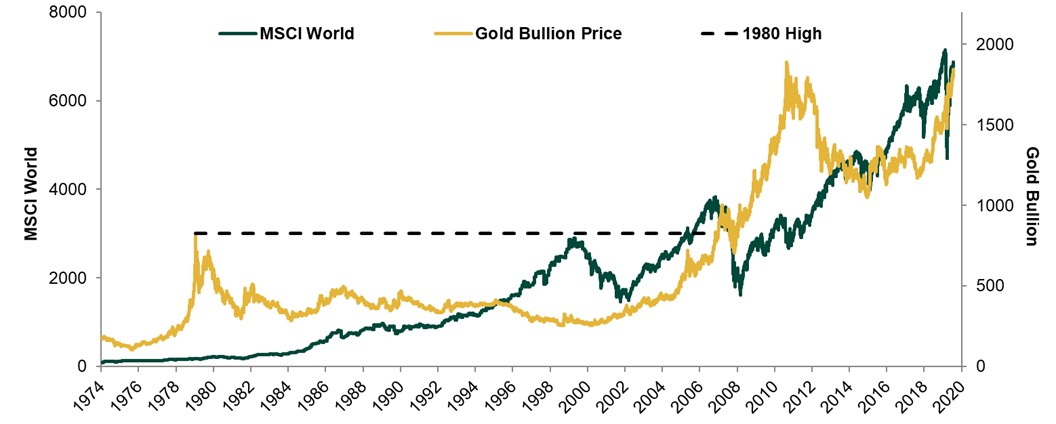

Some investors rally around gold because they believe the metal can protect investment portfolios against equity market downturns. While it is true that gold goes through up and down cycles, those periods do not always counteract equity market gyrations (Exhibit 1). Since the early 1970s, gold’s performance hasn’t displayed a consistently inverse relationship with world equity performance (i.e., gold rises when world equities fall and vice versa). Fisher Investments UK believes this indicates investors shouldn’t rely on gold to effectively diversify against market declines—the results may disappoint you.

Gold also has a poor record of delivering the level of returns required by many long-term investors. Since the early 1970s, gold has experienced long periods of low or no growth (Exhibit 1)—conditions very few long-term investors can afford. For example, after peaking in 1980, gold took over 25 years to get back to that previous high point (the dotted line in Exhibit 1).

Exhibit 1: Gold and Global Equities

Source: FactSet, as of 23/07/2021. MSCI World Total Return Index and Gold Bullion Price from 31/12/1974 to 31/12/2020. Presented in US dollars. International currency fluctuations may change the returns.

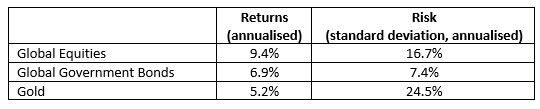

The modern period of gold investing began when gold became freely traded in the United States in 1973. From January 1974 through the end of 2020, world equities returned 9.4%, annualised. Over that same time period, gold returned 5.2%, annualised. Gold’s annualised returns are also lower than global government bonds’ (a proxy for risk-free fixed interest returns) total returns of 6.9%, annualised.

Now compare the risk associated with those returns and gold loses even more lustre. Exhibit 2 presents the annualised returns and standard deviation (a measure of volatility) of global equities, global government bonds and gold. Gold provides returns lower than both equities and fixed interest—and has significantly higher volatility.

Source: Factset, as of 23/07/2021. Global equities (MSCI World Total Return Index), global government bonds (GFD Indices World Government Bond GDP-weighted Return Index) and gold (gold bullion spot price) from 31/12/1974 to 31/12/2020. Presented in US dollars. International currency fluctuations may change the returns.

If gold doesn’t offer lower volatility or higher returns than equities—or even government bonds, then Fisher Investments UK questions its potential as viable investment candidate.

Success requires absolutely perfect market timing

Successfully investing in gold means you must be an extremely gifted market timer—able to enter and exit the market at precisely the right time to collect gains and avoid losses. Otherwise, you may have to patiently weather long periods of poor results with gold. As the previous example demonstrated, gold prices can stagnate or decline for years—potentially for decades as happened after 1980. So rather than asking whether gold is a good investment, ask how good you are at market timing. Most people aren’t good enough to time gold. Are you?

Here’s an example of how difficult it can be for investors to flawlessly time an asset class’s performance. Fisher Investments UK suggests these are all the steps an investor would have had to execute successfully to perfectly time equities’ performance over the last several decades:

- Invest in US technology shares in the 1990s before their legendary rise.

- Take a short position (a market position that profits when a share declines in value) in tech shares in March 2000.

- Buy back into equities after the 2000-2002 bear market.

- Hold that long position until 2007.

- Get out of equities in October 2007 to avoid the entirety of the 2008 market collapse.

- Reinvest before the subsequent bull market began in March 2009.

- Sell again, just before the COVID-related lockdowns in 2020.

If you didn’t get those big equities swings right, chances are you may not be suited to time gold either.

Ultimately, Fisher Investments UK believes long-term investors would be better served by viewing gold for what it really is—a commodity, a shiny metal offering investors limited protection against volatility and little prospect of superior relative average returns.

Follow the latest market news and updates from Fisher Investments UK:

Facebook https://facebook.com/FisherInvestmentsUK/

Twitter https://twitter.com/FisherInvestUK

LinkedIn: https://www.linkedin.com/company/fisher-investments-uk

Investing in equity markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments UK and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.