The UK labour market report released this morning showed job losses, rising unemployment and persistent wage pressures. But the report doesn’t seem to have changed much for the market as the focus remains on the two inflation reports that will be delivered before the next BoE meeting in June. GBP/USD was a marginal move higher after the release but the pair pulled back to 1.2509 as the US dollar picked up some buying support ahead of the US PPI release later this afternoon. The momentum is likely to be dominated from the dollar side of the trade this week as investors digest how price pressures have evolved in the US. A stronger-than-expected reading would continue to push back on the hopes of rate cuts from the Federal Reserve, likely propelling the dollar higher again, weighing on GBP/USD further towards 1.2450. Conversely, a weakening in inflationary pressures could reignite risk appetite, weighing on the dollar and allowing GBP/USD to resume the bullish drive to break and hold above 1.26.

GBP/USD daily chart

Past performance is not a reliable indicator of future results.

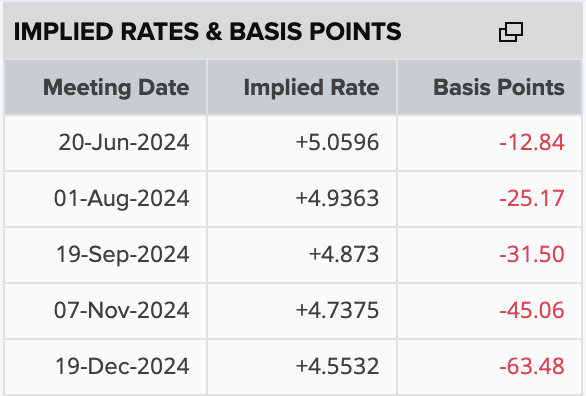

From the UK side, next week will be a big one as the April CPI data will be released on Wednesday. Investors will want to see whether Bailey’s claims that inflation has dropped significantly in April are true. The updated projections from the Bank of England at their meeting last week showed CPI returning to 2% in Q2 of this year. If so, that would mean the central bank is one step closer to cutting rates, the question is whether June is too soon. Current pricing from Reuters shows a 25bps cut fully priced in for August, but there are 12.8 basis points priced in for June, roughly a 50/50 chance of a cut. The data next week will be key in adjusting these expectations, with a significant drop in CPI likely pushing the balance in favour of a cut in June, which could propel the FTSE 100 even higher, but weigh on GBP based on rate differentials with other currencies.

Market-implied rate cuts from the BoE in 2024

Source: refinitiv

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GBP/USD Latest: focus on US and UK inflation to determine where to go next

Published 14/05/2024, 11:36

GBP/USD Latest: focus on US and UK inflation to determine where to go next

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.