GBP/USD is correcting at 1.1959; however, bears continue to put pressure.

This week, there will be a lot of data important for the Pound. For example, on Tuesday, the United Kingdom is scheduled to report on Claimant Count Change, which is expected to rise. On Friday, there will be data on Retail Sales, which might drop a little. However, despite current growth in the pair, any negative numbers might lead to a new decline. On the other hand, the British economy unexpectedly improved in May and the GDP was revised upwards, which might be a signal for the Bank of England to raise the benchmark interest rate in August. The inflation rate showed 9.1% y/y in May and such a growth might result in a 50-point rate hike. If it happens, the Pound may rise from its current levels. After all, it’s been the third serious test of the support area – earlier, the bulls managed to “steal the thunder” and push the pair above 1.4000.

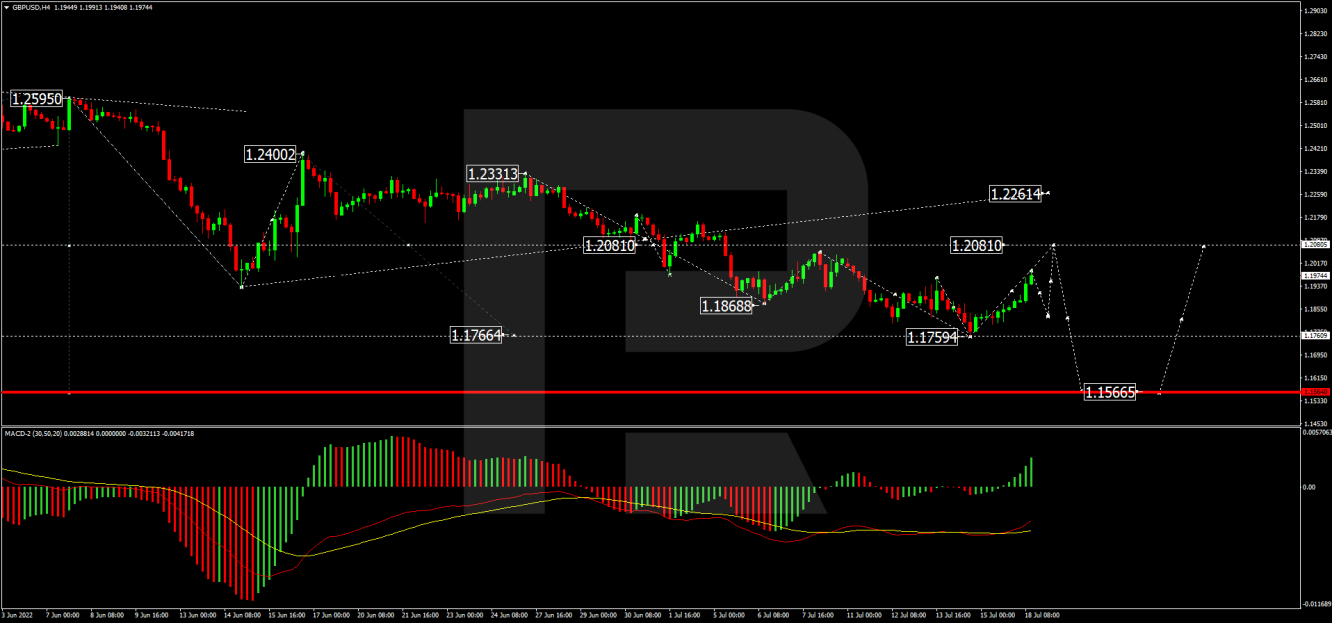

As we can see in the H4 chart, after finishing another descending wave at 1.1766, GBP/USD is correcting upwards to reach 1.2081. Later, the market may resume trading within the downtrend, with the target at 1.1566. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving below 0 and may soon grow to test this level from below. In the future, the line may resume falling to update the lows.

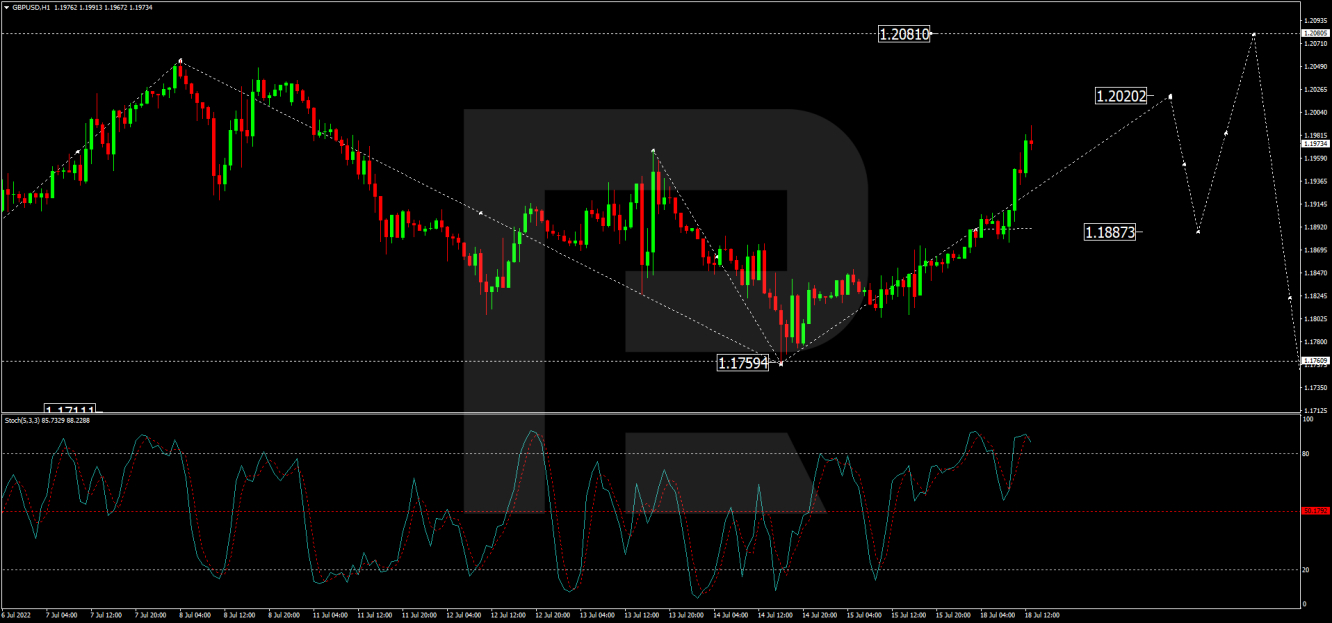

In the H1 chart, having completed the ascending wave at 1.1887 and forming a new consolidation range around this level, GBP/USD has broken it to the upside and may later continue growing towards 1.2020. After that, the instrument may form a new descending structure to return to 1.1887 and then resume growing with the target at 1.2081. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 50 and reaching 80, its signal line is expected to return to 50, rebound from it again, and resume growing to re-test 80.

By Andrey Goilov, Analyst at RoboForex

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.