GBP/USD is unchanged on Wednesday, as the pair continues to have a very slow week. In the European session, GBP/USD is trading at 1.5450. In economic news, the British deficit narrowed to 8.6 billion pounds, beating the estimate of 9.1 billion pounds. BOE Governor Mark Carney will address an event in Oxford, and he is expected to discuss the implications if the UK exits the Eurozone. The only economic release from the US is crude oil Inventories. As well, FOMC member Jerome Powell will speak at an event in New York. Traders should keep a close eye on Thursday’s key events – British Retail Sales and US Unemployment Claims.

BOE Governor Mark Carney testified before the Treasury Select Committee on Tuesday on the proposed Bank of England Bill. This bill would provide some oversight over the BOE, with bill supporters welcoming an increase in transparency. However, critics are concerned that the bill could reduce the independence of the central bank and lead to political interference in its decision-making process. In earlier testimony before the Treasury Select Committee, BOE member Anthony Habgood criticized the bill, saying that it posed a “potential threat to the carefully constructed independence of the policy functions of the bank”. To frame the issue, this is a question of the independence of the central bank vs. its accountability to the public. Carney will speak on Wednesday, and he is expected to address the implications of a “Brexit”, the scenario in which the UK leaves the European Union. The British government has promised a referendum on this contentious and emotional issue in 2017, and a public stance one way or another by the BOE could shake up the markets and the British pound.

US numbers have been mixed recently, which has reduced the likelihood of a rate hike by the Federal Reserve before the end of 2016. The Fed hasn’t cleared the air, as FOMC members continue to send out contradictory messages about the Fed’s plans regarding a rate hike. Still, an improvement in US numbers, especially employment and consumer indicators, could quickly revive speculation about a rate hike and boost the US dollar against its major rivals. This means that the upcoming US Unemployment Claims report will be carefully monitored, and an unexpected reading could have a sharp impact on the direction of GBP/USD. The estimate stands at 266 thousand, higher than the previous report of 255 thousand.

GBP/USD Fundamentals

Wednesday (Oct. 21)

- 8:30 British Public Sector Net Borrowing. Estimate 9.1B. Actual 8.6B.

- 17:00 BOE Governor Mark Carney Speaks

- 14:30 US Crude Oil Inventories. Estimate 3.5M

- 17:30 FOMC Member Jerome Powell Speaks

Upcoming Events

Thursday (Oct. 22)

- 8:30 British Retail Sales. Estimate 0.3%.

- 12:30 US Unemployment Claims. Estimate 266K.

*Key releases are highlighted in bold

*All release times are GMT

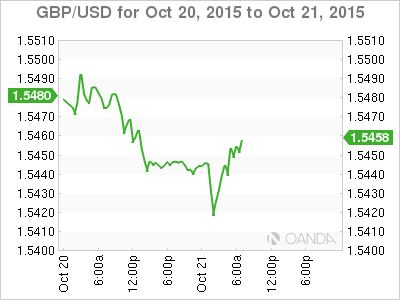

GBP/USD for Wednesday, October 21, 2015

GBP/USD October 21 at 11:00 GMT

GBP/USD 1.5454 H: 1.5461 L: 1.5415

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.5163 | 1.5269 | 1.5341 | 1.5485 | 1.5590 | 1.5660 |

- GBP/USD was flat in the Asian session and has posted small gains in European trading.

- 1.5485 remains a weak resistance line which could be tested during the day.

- 1.5341 is a strong support level.

- Current range: 1.5341 to 1.5485

Further levels in both directions:

- Below: 1.5341, 1.5269, 1.5163 and 1.5026

- Above: 1.5485, 1.5590 and 1.5660

OANDA’s Open Positions Ratio

GBP/USD ratio is unchanged on Wednesday, which has a small majority of positions (53%). This points to slight trader bias in favor of GBP/USD moving lower.