Yesterday the pair grew and recovered losses from the beginning of the week.

The reason for the growth was weakening across the market US Dollar, which is declining prior to the Fed meeting that is due next week.

Today the Bank of England will hold its meeting and will make a decision on interest rates. The regulator is expected to leave the rate unchanged at its record low 0.5%, and to restate that monetary policy is going to be kept easy for quite a long time.

At the same time, according to the latest forecasts, the GDP growth in the UK for 2015 and 2016 can be revised down, from 2.6% to 2.4% and from 2.7% to 2.5% accordingly.

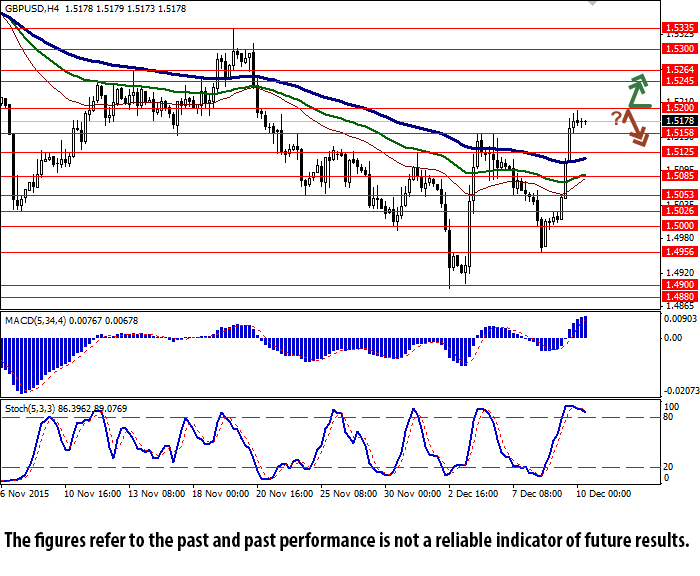

Bollinger Bands® on the daily chart is turning horizontally while the price range is widening. MACD is growing and giving a quite strong buy signal. Stochastic is moving up and approaching the overbought zone.

The indicators recommend waiting for clearer trading signals.

Support levels: 1.5158 (3 December high), 1.5125, 1.5085, 1.5053, 1.5026, 1.5000, 1.4956 (8 December low), 1.4900, 1.4880.

Resistance levels: 1.5200 (local high), 1.5245, 1.5264, 1.5300, 1.5335 (19 November high).