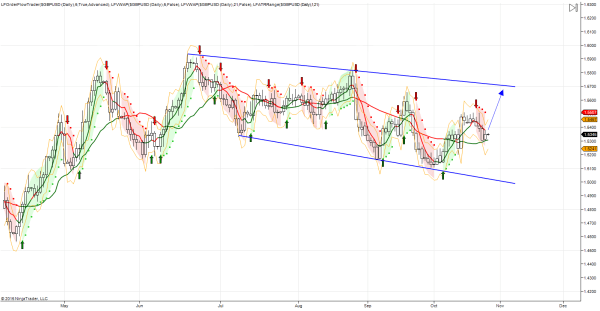

GBP/USD – holding at key support

GBP posted a limited intraday advance and retreated at the end of the day from a daily high of 1.5381. Data from UK was disappointing, as manufacturing production declined for the first time in the last two years according to the CBI Quarterly Industrial Trends Survey, while Mortgage Approvals also fell to 44,489 in Sept from 46,567 in Aug according to British Bankers’ Association. Attention turns to today’s GDP release.

While 1.5300 supports downside reactions, expect a grind higher to test 1.56 symmetry objective. A breach of 1.53 targets a retest of pivotal 1.52 support

Trade Idea

- I am looking to enter long positions on a breach of yesterday's highs, looking for a push towards the pivotal resistance at 1.56. Once again using a fairly tight stop leaning on the 1.53 support level.

- NOTE: I will not enter this trade in advance of the GDP release, looking for it to be triggered post release.