The British pound recently suffered heavy losses against the US dollar, as the GBP/USD pair traded lower to test the 1.5400 level. However, buyers appeared around the stated level to prevent the downside and pushed it back higher.

On the economic front, there were a few releases in the US and UK recently. The US data failed to impress the investors and on the other hand, the UK data managed to help the British pound. So, in short there was some relief for the British pound buyers as the GBP/USD pair traded higher.

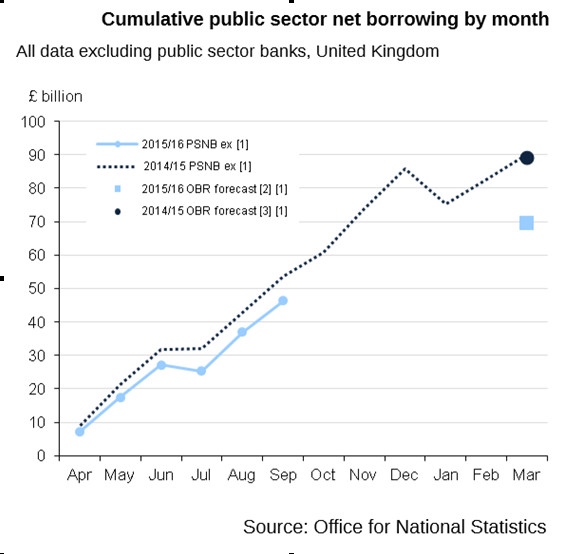

UK Net Borrowing

Earlier during the UK saw a major release, as the Net Borrowing (the financial deficit in the UK national accounts) report, which presents the amount of new debt held by the U.K. governments was published by the National Statistics. The market was expecting a decline in September to £9.400B, compared with the preceding month.

However, the result was above the forecast, as the UK Net Borrowing declined and posted a reading of £8.628B in September 2015. Considering the year-over-year change, the Net Borrowing (in September 2015, compared with the same month a year ago) in the Public sector excluding public sector banks lowered by £7.5 billion to £46.3 billion.

The report highlighted that “General Government Gross Debt at the end of September 2015 was £1,638.2 billion, equivalent to 86.3% of Gross Domestic Product; an increase of £78.8 billion compared with September 2014”. Adding further there was a mention that the “Central government net cash requirement decreased by £11.3 billion to £43.8 billion in the current financial year-to-date (April 2015 to September 2015) compared to the same period in 2014“.

Overall, the data was on the positive side, and helped the GBP/USD pair. There was an upside reaction after the release.

Technically, the GBP/USD pair traded higher, but there are many hurdles on the way up for buyers and it won’t be easy to clear them. There is a monster confluence area forming around the 100 moving average on the hourly chart, which is at 1.5460. The mentioned level acted as a pivot area earlier so, there is a chance of it acting as a resistance in the near term.