In the end of last week, the GBP/USD pair started correcting up after a fall of the beginning of the week.

The pair was pressured by strong USD positions that was in high demand after the expected Fed decision on interest rates in the US. In addition, the pair was pressured by poor macroeconomic statistics from the UK. The GDP data for the third quarter of the year that came out on Wednesday showed that the economy growth slowed from 0.5% to 0.4% against the previous quarter. On a year-to-year basis, the growth slowed from 2.3% to 2.1%.

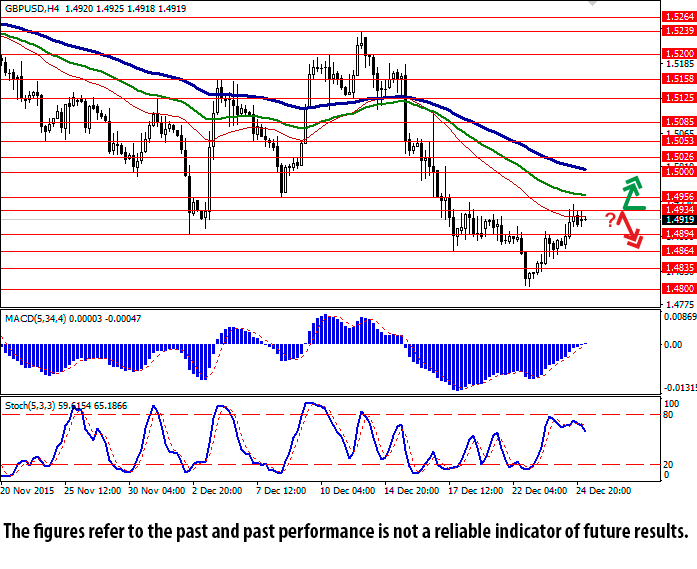

Bollinger Bands® on the daily chart is turning horizontally while the price range remains very wide. At the same time, the indicator has formed a signal for correctional growth. MACD is growing and giving a buy signal. Stochastic is also moving up and approaching the overbought zone.

The indicators recommend long positions.

Support levels: 1.4894 (2 December lows), 1.4864, 1.4835, 1.4800 (22 December lows), 1.4765.

Resistance levels: 1.4934 (local high), 1.4956 (18 December highs), 1.5000 (psychologically important level), 1.5026, 1.5053, 1.5085, 1.5125.