Games Workshop's (LON:GAW) FY21 results were at record levels from the perspective of revenue, profitability, cash flow generation and cash returns to shareholders, driven by the launch of the ninth edition of 40K as well as products from prior year releases. The phasing and scale of future new product releases in FY22 and FY23 may produce lower rates of growth than FY21. Management’s focus on product innovation, customer engagement and geographic expansion has tended to provide positive surprises. Our DCF-based valuation increases by c 8% to £129 per share.

Share price performance

FY21: An exceptional year

The extent of GAW’s FY21 success is highlighted by the fact that its FY21 operating profit pre-royalty income of £135.4m was greater than those of FY18 (£64.7m) and FY19 (£69.8m) combined, prior to the disruption caused by COVID-19 in FY20. Constant currency revenue growth of c 34% and limited underlying cost inflation produced significant operational gearing, operating profit pre-royalty income increased by 85% and the margin increased by over 11pp to 38.3%. The higher absolute profits and stable free cash generation, relative to revenue, enabled a strong improvement in cash returns to shareholders, up 62% y-o-y to 235p per share, and an improvement in the year-end net cash position to £85.2m (FY20 £52.9m).

Forecasts: Lower growth due to phasing of releases

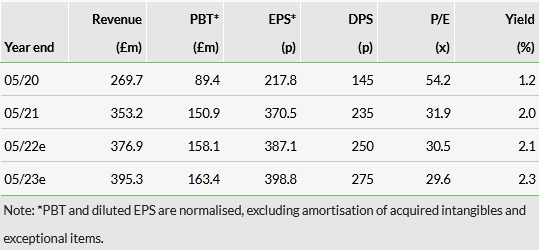

Following the publication of FY21 results our forecasts for FY22 are broadly unchanged and we introduce estimates for FY23. In FY22, we forecast y-o-y revenue growth of c 7%, operating profit before royalties of c 5%, and a modest increase in royalty income to £17m from £16.3m. In FY23, we assume c 5% revenue growth to £395.3m and c 4% growth in operating profit before royalty income. With stable royalty income, this translates to growth in PBT of c 3% to £164.1m. Our DPS forecasts of 250p in FY22 and 275p in FY23 represent cash costs of £82.1m and £90.6m, versus our estimates of free cash flow post interest of £121.6m in FY22 and £127.9m in FY23.

Valuation: DCF-based valuation increased to £129

To reflect the rolling forward of results and our revised estimates, we have increased our DCF-based valuation by c 8% to c £129 per share (from £120 per share). The prospective P/E multiples for FY22 and FY23 of 30.5x and 29.6x respectively compare with the recent peak of 32.2x in FY21.

FY21 results: Exceptional growth and operational gearing

Games Workshop’s FY21 results demonstrated exceptional growth despite the disruption to offline channels due to the COVID-19 pandemic and operational challenges around Brexit. The July 2020 launch of the ninth edition of Warhammer 40K, Indomitus, was an important driver to revenue growth, as was ongoing demand for existing products of prior years’ editions. Limited underlying operating cost inflation led to significant operational gearing.

Revenue grew by 31% to £353.2m, c 34% on a constant currency basis, operating profit pre-royalties increased by 85% to £135.4m, and PBT by c 69% to £150.9m. These compare with the pre-close trading update in May 2021 for revenue of ‘not less than £350m’ and PBT of ‘not less than £150m’.

Click on the PDF below to read the full report: