Games Workshop Group’s (LON:GAW) H125 trading update suggests the company enjoyed a strong Q225 in both its core business (due to the launch of the fourth edition of Age of Sigmar midway through Q125) and licensing (due to the success of the Space Marine 2 video game). These are impressive in the context of the tough comparative from the prior year’s launch of the new edition of Warhammer 40K (40K) and the currency headwinds in the early part of H125. We upgrade our profit estimates for FY25 (by 7%) and FY26 (by 3%) to reflect the outperformance versus our prior expectations.

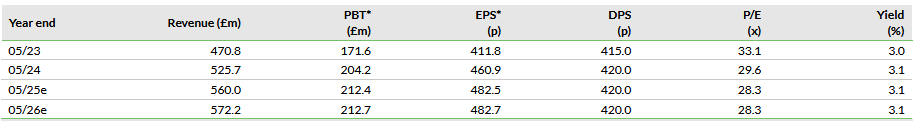

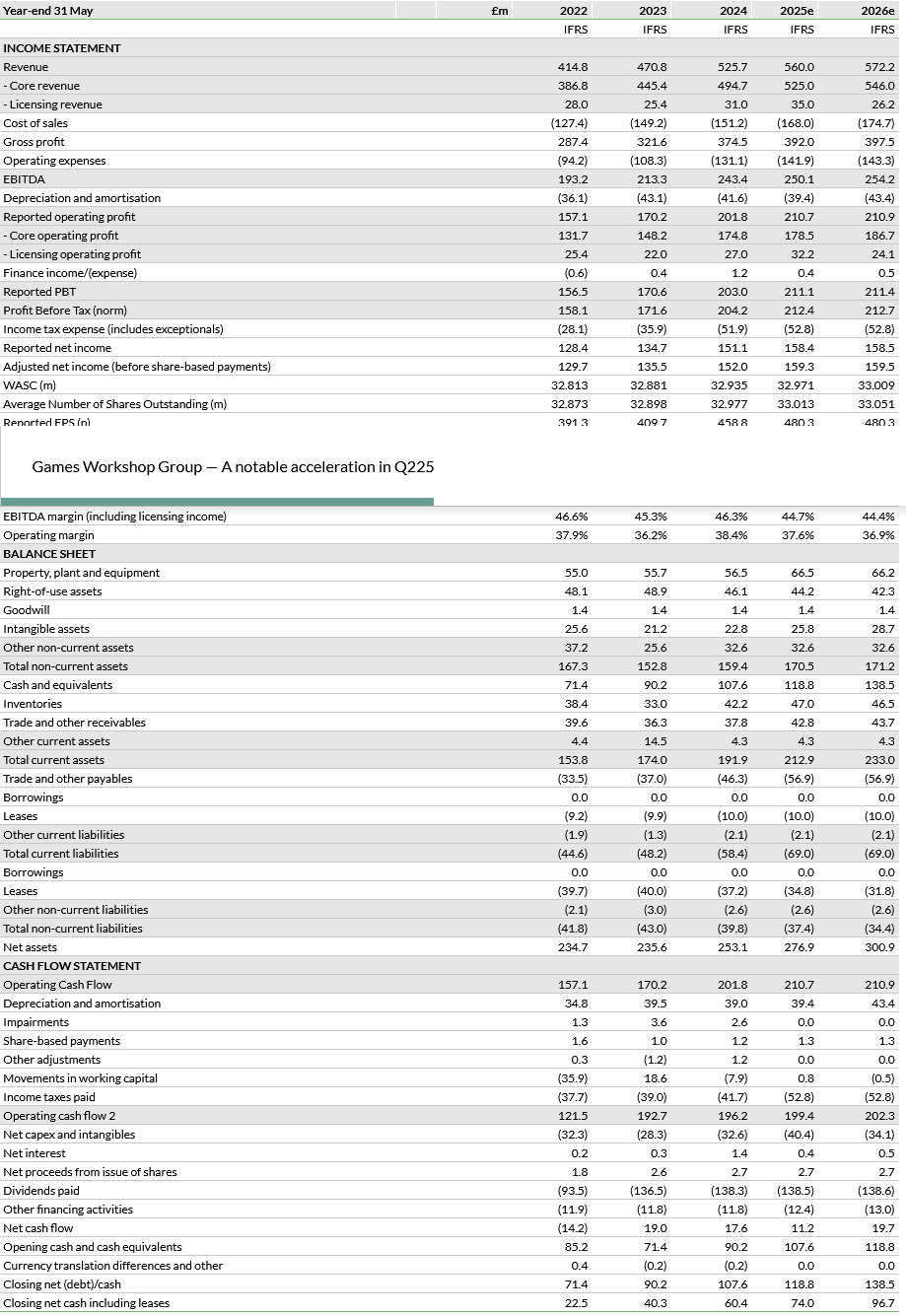

Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

A strong Q225 following an in-line Q125

GAW has reported H125 core revenue is not less than £260m, licensing revenue of not less than £30m and PBT of not less than £120m. These correspond to year-on-year growth rates of not less than 10%, 148% and 41%, respectively. The core business’s revenue growth is consistent with trends seen throughout FY24, which is impressive given the success of 40K last year and the currency headwinds. Licensing revenue is higher than in any prior six-month period. This implies a much better Q225, following Q125 when management indicated trading was in line with its expectations. With a relatively fixed cost base, licensing revenue is likely to be the main driver to the growth in H125’s profit margin.

Upgrades to FY25 and FY25 estimates

We increase our FY25 PBT estimate by 7%, reflecting that GAW has already exceeded our prior FY25 licensing revenue estimate in H125 and that the core business has exceeded management’s expectations in H125. For FY26, we keep our prior year-on-year growth estimate for core revenue, which leads to an upgrade due to the higher FY25 base, while retaining our prior absolute licensing revenue estimate. These adjustments lead to a 3% increase in our FY26 PBT estimate. The projected limited year-on-year growth in FY26’s PBT reflects our c £9m expected year-on-year drop in licensing revenue, while core revenue continues to grow. FY26 will also not benefit from any major releases of new editions of GAW’s two main intellectual properties, 40K and Age of Sigmar.

Valuation: P/E multiple above recent peaks

The strong positive share price reaction to the trading update moves the prospective FY25 P/E multiple to 28.3x, which is above its highest multiple in FY24 (25.4x) but below multiples over 30x in FY20–22 when valuations and trading were influenced by the outbreak of and recovery following COVID-19.

Exhibit 1: Financial Summary

Source: Games Workshop Group accounts, Edison Investment Research