By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

In the 24 hours before the October Federal Reserve meeting we saw the dollar consolidate against the euro and fall against the Japanese yen. This lack of consistency reflects the market’s doubt over Fed policy and the oversold nature of the EUR/USD. A month ago, U.S. policymakers passed on the opportunity to raise interest rates but confidently said that liftoff could begin soon. They even stressed that October would be a 'live' meeting, an option nobody believes at this point. No one expects the Federal Reserve to hike on Wednesday and we would not be surprised if it refrained from providing any clear signal about its intention to raise interest rates before the end of the year.

There’s no press conference scheduled after this meeting and updated economic forecasts won’t be released – which means the FOMC statement is the Fed’s only opportunity to convey its views and no where in the statement does the central bank reference a day/time/year where a rate hike would be appropriate. Instead, it said,

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

If that line remains unchanged -- and it probably will -- dollar bulls will be encouraged that a rate hike is still in play while dollar bears will find comfort in knowing that the central bank is still in wait-and-see mode because it did not feel that it was necessary to reaffirm a hawkish bias. How the dollar trades will be driven by any changes in the Fed’s economic assessment.

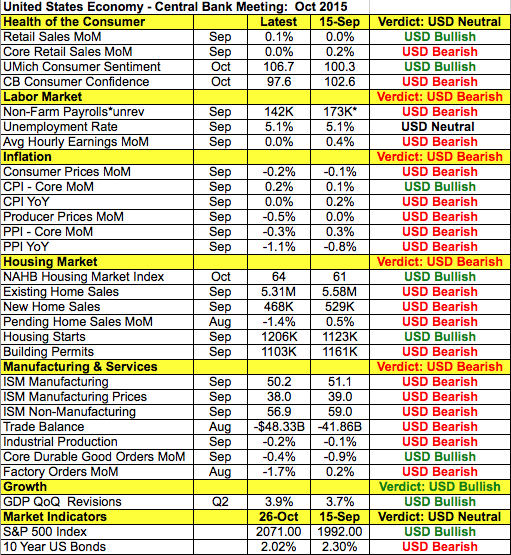

Taking a look at the table below, the Fed has a lot more to be worried about in October than September. The “sea of red” reflects more deterioration than improvement in the U.S. economy since the last Fed meeting. Job growth slowed, wages stagnated, inflation declined, housing-, service- and manufacturing-sector activities weakened, the trade deficit ballooned, while retail sales and consumer confidence were mixed. oil prices also dipped giving U.S. policymakers very little to be excited about in October. Easing by China and the prospect of more stimulus from the ECB is a double-edged sword for the Fed. One of the Federal Reserve’s greatest concerns last month was the strong dollar and easier monetary policy abroad will drive the buck higher. This is a problem for Janet Yellen because a strong currency hampers inflation and trade activity. Also, China and the ECB are taking steps to stimulate their economy to counter slowdown -- global uncertainty was also one of the Fed’s main concerns. So while it can be argued that stimulus abroad is good for U.S. markets making it easier for the Fed to raise interest rates in December, the reasons why these central banks are easing and the consequences for the dollar could also deter them from tightening. The best option would be for the Fed to wait and see and take this opportunity to leave most of the policy statement unchanged. More U.S. dollar traders are positioned for a nonevent than a disappointment.

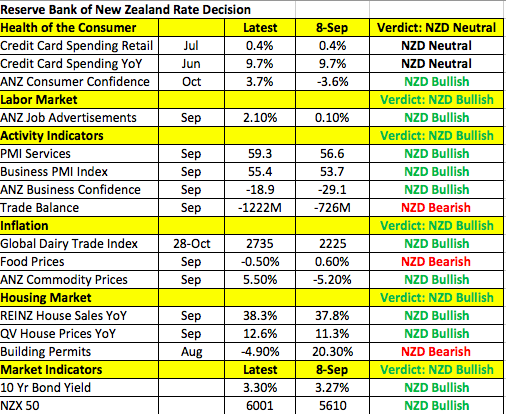

New Zealand dollar traders, on the other hand, are positioned for optimism from the Reserve Bank. Taking a look at the table below, there’s been widespread improvement in New Zealand’s economy since the September monetary-policy meeting. Manufacturing- and service-sector activity increased, business confidence improved, dairy prices rebounded, housing activity remains strong and consumers turned positive on the economy in October. The RBNZ has many reasons to be encouraged by these recent developments but the slowdown in China and the rapid appreciation in the currency is a big problem that could threaten their recovery. In the past month, NZD/USD has risen from a low of 0.6250 to 69 cents while AUD/NZD has fallen from a high of 1.1350 to a low of 1.0575. If the RBNZ only talked of the improvements in the economy, it risks sending NZD even higher. After lowering rates 3 meetings in a row in September, Governor Wheeler warned that, “some further easing in the official cash rate seems likely.” While there is no need to cut again in October, the rise in the New Zealand dollar should encourage the central bank to repeat this guidance.

Tuesday's best-performing currency pair was USD/CAD, which broke through its 50-day SMA to trade above 1.32 on the back of lower oil prices. The price of crude dropped for the third day in a row to its lowest level in 7 weeks. USD/CAD looks poised for a move above 1.33 but with no major economic reports this week (only a monthly GDP), how far USD/CAD rises will hinge upon the performance of the U.S. dollar and its impact on oil prices. AUD/USD traded slightly lower ahead of its Q3 CPI report. Lower commodity prices could drive inflationary pressures lower.

Sterling traded lower on the back of mixed GDP numbers. The U.K. economy expanded by 0.5% in the third quarter compared to the 0.6% forecast and 0.7% growth experienced in Q2. This left the annualized pace of growth at 2.3% vs. 2.4%. However as reported by our colleague Boris Schlossberg, shortly after the data, sterling recovered its losses because “the first reading of UK GDP only covered 50% of the data which mainly focused on the output component of the economy. With two more revisions of the GDP still to come, the prospect of the an upward revision is high, especially given the fact that UK Retail Sales have proven to be much stronger than anticipated adding to the overall growth in demand.”

Meanwhile the lack of Eurozone economic reports left EUR/USD virtually unchanged. The currency pair continues to consolidate after last week’s sharp slide but the path of least resistance is still lower, especially after comments from ECB member Praet who outlined all of the options the central bank is considering. He said there is “no taboo on possible ECB steps because the risk of weak growth and inflation are real.”