Foxtons Group’s (LON:FOXT) FY24 trading update confirmed revenue and adjusted operating profit growth of c 11% and c 33%, respectively, reflecting the developing success of the company’s strategic vision. This suggests that the medium-term targets, particularly the adjusted annualized operating profit target of £25–30m, are increasingly coming into focus. We believe market share is being gained across all divisions, likely to be further boosted by the under-offer pipeline in Sales, which is the strongest since 2016. We have modestly raised our FY24e forecasts but maintained estimates further out at this stage, given the increase in Stamp Duty from April. Our valuation remains 134p per share, though risks appear to be skewed to the upside if market momentum continues, which could be further supported by a potential easing of interest rates.

FY24 Results Exceed Market Expectations

Foxtons’ FY24 trading update confirmed that total revenue increased by 11% to £163m, with adjusted operating profit for the 12 months rising by c 33% to £19m. Both figures were ahead of market expectations and Edison’s forecasts of £160.2m and £17.9m, respectively. Despite investing £13.0m in acquisitions, including Haslams Estate Agents and Imagine Property Group in October, Foxtons ended the year with net debt of £12.8m (FY23: £6.8m), which was modestly better than anticipated.

Lettings Provides Platform, Sales Drove Growth

Lettings revenue, which accounts for c 65% of Foxtons’ revenue, increased by c 5% for the year and was up 11% in Q4. Q4 growth was partly driven by like-for-like growth of c 5%, with the remainder generated by acquired businesses, which are performing as expected and are steadily being integrated into the group. Sales performed strongly in a recovering London market, increasing market share by c 20% (source: TwentyCi). Sales revenue increased by c 30%, despite broadly flat average sales prices, which contributed to a significant reduction in sector losses. Financial Services revenue grew by 6% in the year with growth accelerating to 15% in Q4, reflecting operational upgrades and an improving underlying market.

Valuation: Unchanged Despite Strong End to FY24

We have increased our FY24 expectations given the outperformance in the period but have retained our FY25 and FY26 figures, as the market is being temporarily boosted by the government’s decision to increase Stamp Duty. FY25 has started well, with the under-offer pipeline at its highest level in nearly 10 years, suggesting forecast risks are skewed to the upside. We also maintain our 134p per share valuation.

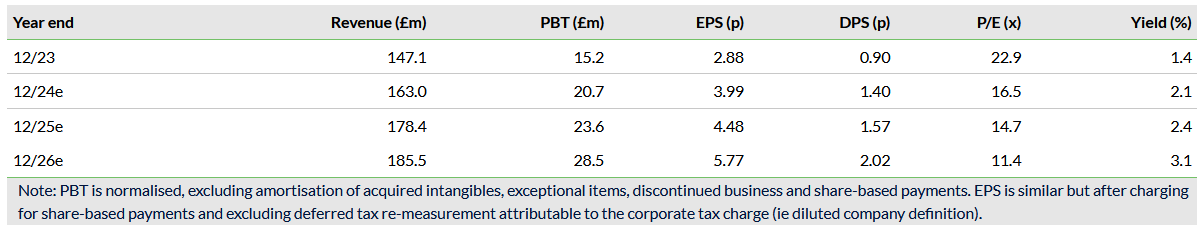

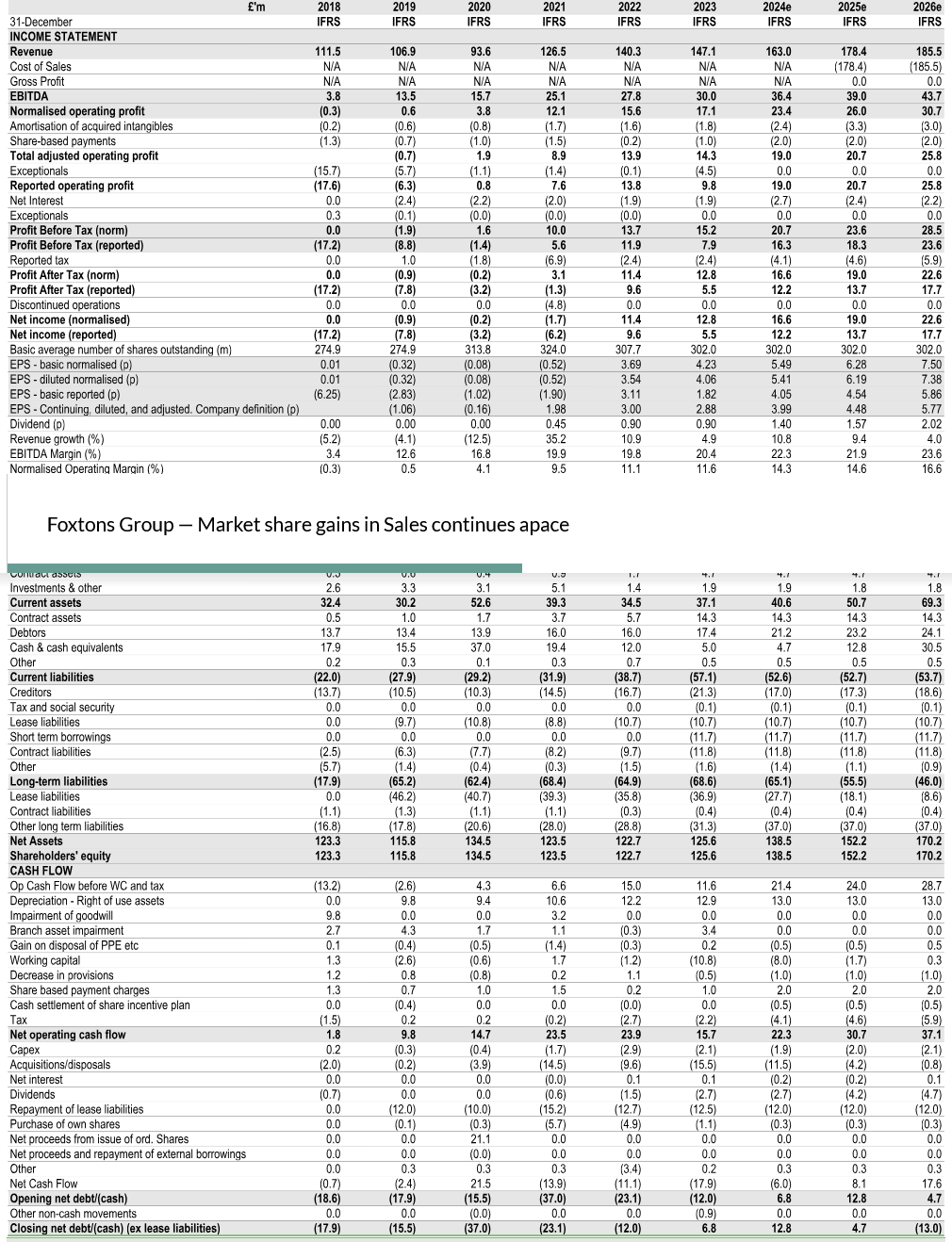

Exhibit 1: Financial Summary

Source: Foxtons Group, Edison Investment Research