- Expect another on-hold decision from the Bank of England

- "Higher for longer" set to remain the key message

- We expect rate cuts from next summer

- Gilt and sterling implications

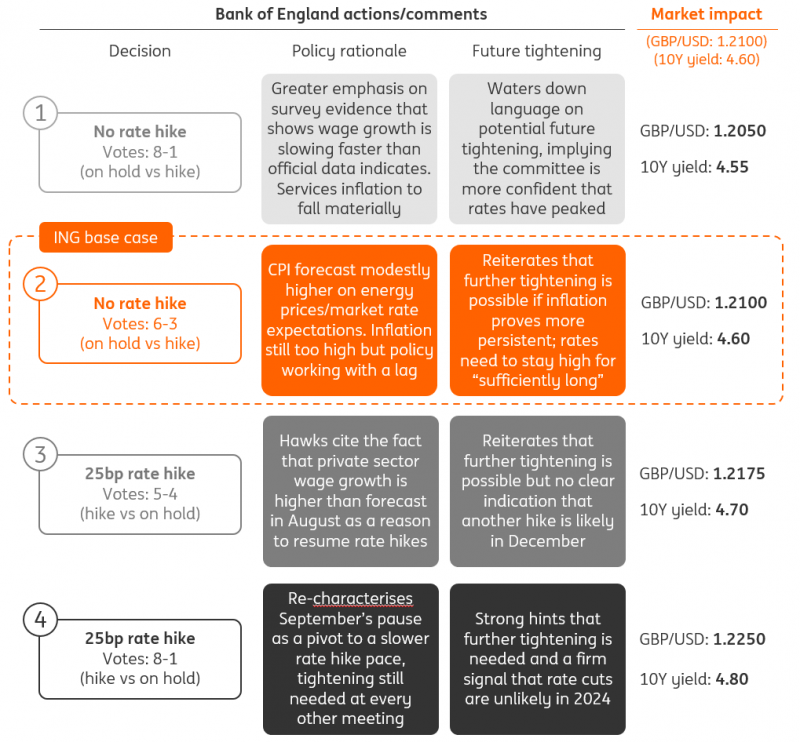

Four scenarios for the November Bank of England meeting

Expect another on-hold decision from the Bank of England

Famous last words, but next week’s Bank of England meeting looks set to be among the least unpredictable since the current tightening cycle began in late 2021. The last decision taken in September ended up on a knife-edge, and ultimately the committee opted to keep rates on hold in an unusually tight 5-4 vote. It’s tempting to conclude from that level of division that the risk of a November hike is relatively high. After all, it would only take one committee member to change their mind to tip the balance in favour of more tightening – but we’re doubtful.

First and foremost, we’ve had very little data since that September meeting, and what we have had is unlikely to have moved the needle. The Bank has made it clear it’s watching three data points as the primary guide for policy: private-sector wage growth, services inflation and the vacancy-to-unemployment ratio (a gauge of labour market tightness). The first two of those, while still uncomfortably high, didn’t materially surprise on the upside in the most recent releases. Services inflation is tracking slightly below the Bank’s August forecasts, and wage growth a bit above.

As for the jobs numbers, the reliability of this data is under question and policymakers will be reluctant to put much – if any – emphasis on the latest unemployment figures. The jobs market is clearly cooling, but by how much and how rapidly is less apparent. Interestingly, the committee is also showing caution about the latest wage figures, which show private-sector pay packets growing at 8% year-on-year and is increasingly at odds with other data that suggests it is falling away more rapidly.

In short, if you are a committee member who voted for a hike in September, you’re likely to do so again, and vice versa. Add in the fact that one of those voting for a hike last time – Jon Cunliffe – has since left the committee, and the general sense is that his successor Sarah Breeden is less likely to go against the consensus (and Governor) in her first meeting. A 6-3 vote in favour of keeping rates on hold is the base case next week.

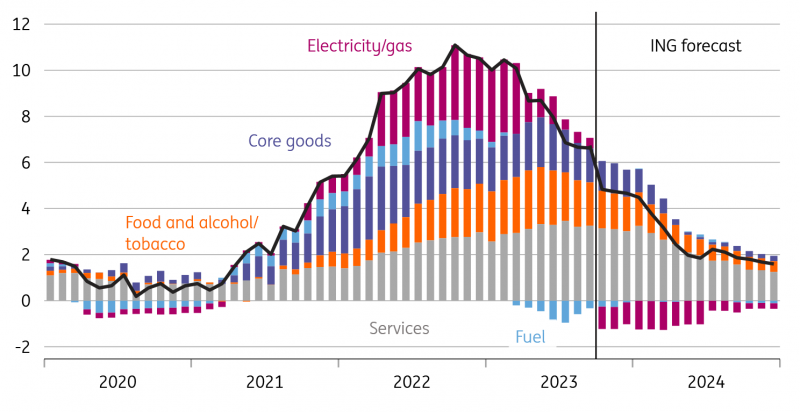

Contributions to UK headline inflation (and our forecasts)

"Higher for longer" set to remain the key message

Still, it’s unlikely the committee will want to close the door to further tightening, and we’d expect policymakers to hammer home the Bank’s central message that rates need to stay at these levels for quite some time. Expect repeated references to rates needing to stay “sufficiently high” for “sufficiently long”.

That message is likely to be reinforced by the new forecasts. Oil and gas futures are higher than they were in August, but more importantly as far as the Bank’s models are concerned, market rate expectations for the UK are noticeably low. While global yields have been rising, the story of the summer in the UK was the substantial repricing lower of BoE expectations. Market pricing for Bank Rate in two years has fallen by roughly 40bp since August. Inflation forecasts could be a little higher and we’d imagine that the Bank’s CPI forecast for mid-2025 will be roughly at the 2% target, especially once a so-called “upside skew” is applied to the model-based forecasts, which have typically been coming in below 2%.

We shouldn’t read too much into what that tells us, given that policymakers are visibly less trusting of their models these days. But a medium-term inflation forecast at target, premised on a yield curve which bakes in very little easing over the next couple of years, will be cited as another reason to keep rates higher for longer.

We expect rate cuts from next summer

That said, we think the Bank will be in a position by next summer to begin the process of taking rates back towards a more neutral setting. Core inflation should be back below 3% by that point, albeit probably still above target. But more importantly, as the Bank itself acknowledges, much of the impact of past tightening is still coming through.

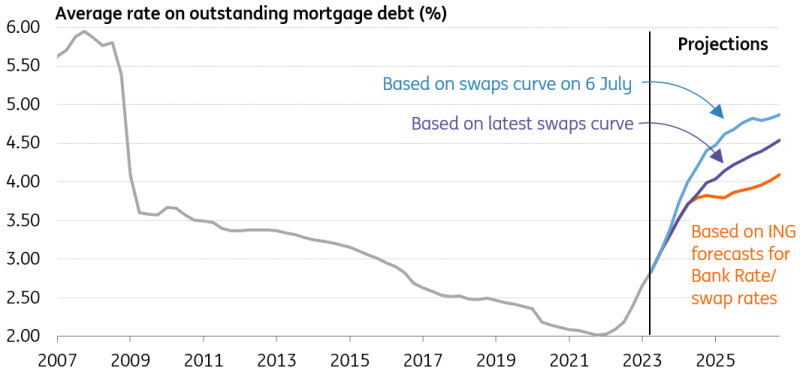

Our favoured gauge of how much tightening is still to play out is the average rate of outstanding mortgages. That has gone from a low of 2% to 3.1%, despite quoted rates on new mortgages being well above 5%. The vast majority of UK home lending is on fixed rates, but almost all of it is fixed for five years or less. If markets are right about future Bank of England policy, then we estimate that this average mortgage rate will reach 4% by the end of 2024, given that 4-5% of mortgages refinance each quarter.

Even under our own base case, which includes Federal Reserve rate cuts in the spring, along with a corresponding fall in global yields and BoE cuts from the summer, the average rate still rises to 3.8% by the end of next year.

In that environment, we think 5%+ rates are unlikely to be sustainable beyond next summer, and we expect a gradual cutting cycle that takes back to the 3% area later in 2025.

Average mortgage rate set to keep climbing in almost any scenario

Gilt and sterling implications

Money markets are already embracing the high-for-longer message going into the BoE meeting. Markets are widely anticipating the bank rate to remain unchanged this time around but do still see some chances that the central bank will hike rates one more time in the coming months. Roughly a 30% chance is attached to this outcome. Beyond that, markets are fully discounting a first rate cut only by September next year.

Longer end rates such as the 10Y Gilt yield do have a close correlation to the front end, but are also seeing the spill-over effects of rising US yields becoming more relevant, especially over the past month. That said, the 10Y Gilt yield has moved in a sideways range since July. While sitting closer to the top of that range, it will probably need a larger surprise from the BoE such as a hike to push yields materially higher to say 4.8%, as central bank holding patterns are unfolding more globally.

Given the other key events next week, it will be difficult to disentangle the BoE’s impact on the long end from other factors. But on medium-term models based on the money market curve, the 10Y Gilt yield has still shown a beta of 0.5 with 1Y1M forwards, which currently roughly reflect the forward horizon that markets discount the first cut.

In FX markets, the BoE's sterling trade-weighted index has stayed on the soft side of narrow ranges during October. We doubt a hawkish hold on Thursday will have much impact on sterling, but outline its path under alternative scenarios above. We still have a year-end EUR/GBP forecast at 0.87 and a view that it could trade up to 0.90 next summer as the market shifts to pricing a more traditional Bank of England easing cycle.

One further point is that GBP/USD is showing a reasonably high positive correlation with US equities, and warns that sterling can underperform a little more if the equity sell-off picks up steam. Our baseline assumes GBP/USD ends the year at 1.22, but an intra-month drop to 1.1750 is possible if conditions in global equity markets were to deteriorate further.

First published on Think.ing.com.